ASHBURN, VA. — A partnership between American Real Estate Partners, GreenBarn Investment Group and Rithm Capital has begun the next wave of leasing at CityHouse Ashburn Station, a 200-unit build-to-rent luxury townhome development underway in metropolitan Washington, D.C. Bozzuto Management Co. is the property manager of the development, which is being delivered in phases. The latest phase adds 12 townhomes to the development, which is expected to fully deliver in early 2025. CityHouse Ashburn Station is situated near the Ashburn Metro Station and features three-bedroom, three-bathroom townhomes ranging in size from 1,544 to 2,486 square feet. All units feature dens, attached garages and oversized windows, and select units include 15-foot kitchen islands and rooftop terraces with outdoor fireplaces. Amenities include a sports court for pickleball or basketball, private playground, pavilion and outdoor kitchen with grills and dining areas, green space for yard games and a pet park. Dream Finders Homes is the general contractor for the project. Rental rates range from $3,495 to $5,590 per month, according to the CityHouse Ashburn Station website.

Property Type

CARY, N.C. — A partnership between an affiliate of New York City-based Mack Real Estate Group (MREG) and Soundwater Properties has purchased Maynard Crossing, a grocery-anchored shopping center in Cary, a suburb of Raleigh. Built in 1996, the 122,901-square-foot property is located at the intersection of High House and N.W. Maynard roads. Maynard Crossing was 88 percent leased at the time of sale to tenants including Harris Teeter, Workout Anytime, Doctors Express, Riccobene Family Dentistry, Brigs Restaurant, Kathmandu Kitchen and All American Swim Supply, as well as a newly built outparcel gas station. Tom Kolarczyk, Danny Finkle, Jim Hamilton and Steele Burkett of JLL represented the undisclosed seller in the transaction. The sales price was not disclosed. MREG and Soundwater Properties will pursue their grocery-anchored retail acquisition strategy in markets throughout the East Coast.

DORAL, FLA. — Codina Partners will add 25,000 square feet of retail space to Downtown Doral, the developer’s 250-acre mixed-use community in Miami-Dade County. The new plans for Downtown Doral include the addition of 13 customizable retail units with a rooftop deck featuring amenities including pickleball courts. Plans also include 929 additional parking spaces. Established in 2005, the development features more than 40 existing restaurants and retailers, a cultural arts center, two charter schools, a library, government center and clinics operated by Baptist Health South Florida. Existing tenants include AT&T, Bulla Gastrobar, First American Bank, Hand and Stone Massage & Facial Spa, Mega Wine & Spirits, Publix, Sage Dental, Sweat 440 and The UPS Store, among others.

AURORA, ILL. — Developers Atlantic Residential and Focus have completed Lumen Fox Valley, a 304-unit luxury apartment complex that repositioned a portion of the Fox Valley Mall in Aurora. Evanston-based Morgante Wilson Architects (MWA) completed the interiors of the property. MWA will also complete the interiors of Lucca Fox Valley, which will replace a former department store with 323 luxury apartment units as part of the second phase of the mall’s redevelopment. Lumen Fox Valley repurposed a vacant Sears store at the mall. MWA designed all common spaces and amenities, including a two-story lobby and lounge, private dining room, clubroom, game room, fitness and yoga studio, and pet spa. MWA also selected the unit finishes for kitchens, baths and flooring, and designed and furnished the model units. Torti Gallas + Partners and HKM Architects + Planners were the project architects. Focus was the general contractor, and USAA Real Estate provided financing. Monthly rents at Lumen Fox Valley start around $1,717. Residents can now earn a free month of rent on select one- and two-bedroom units if they move in by the end of February, according to the property’s website.

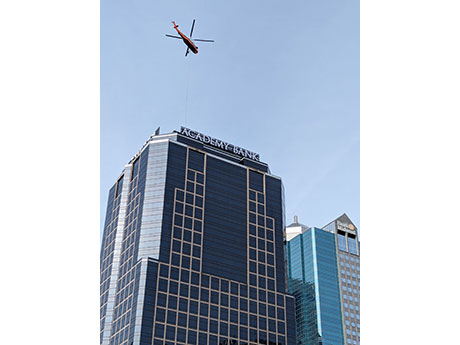

KANSAS CITY, MO. — Academy Bank, a full-service community bank and family-owned subsidiary of Dickinson Financial Corp., has opened a new retail branch within the lobby of 1201 Walnut, a 29-story office tower owned by Copaken Brooks in downtown Kansas City. The bank also moved its corporate headquarters to three contiguous floors of the building totaling roughly 50,000 square feet. Additionally, the property now features Academy Bank signage. Of Academy Bank’s 71 branches, 23 are located throughout metro Kansas City. Sister bank Armed Forces Bank will maintain its headquarters in Fort Leavenworth, Kan.

DEARBORN, MICH. — Syndicated Equities has acquired Carhartt’s corporate headquarters and global design facility in Dearborn for an undisclosed price. The property, which is located at 5750 Mercury Drive, rises two stories and totals 58,722 square feet. The building is situated across the street from Ford’s global headquarters. Carhartt uses the facility for selecting fabrics and designs for new apparel. Syndicated acquired the property in a Delaware Statutory Trust ownership structure to accommodate investors completing 1031 exchanges along with accredited individual investors.

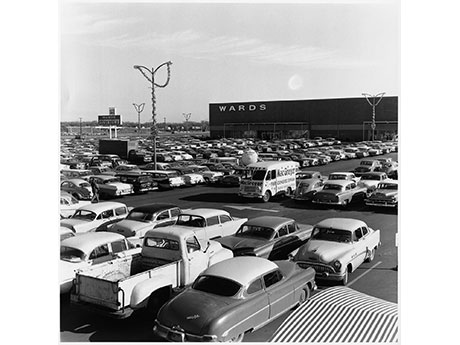

BLOOMINGTON, MINN. — Kraus-Anderson Realty & Development has begun to demolish the former Toys ‘R’ Us and Herberger’s buildings at Southtown Shopping Center in the Minneapolis suburb of Bloomington. Located at the corner of I-494 and Penn Avenue South, the shopping center opened in November 1960 and included a two-story, 150,000-square-foot Montgomery Wards, the largest in the retailer’s chain of 550 stores nationwide. The center also opened with 44 other shops, including Musicland, Red Owl, Walgreens and Texaco. The property has undergone numerous additions and renovations since then. Kraus-Anderson is demolishing the large vacant space on the northeast side of the center, often referred to as the old Herberger’s (originally Montgomery Wards) and Toys ‘R’ Us space. The demolition phase is expected to take approximately 12 weeks and is slated for completion at the end of March. The rest of the shopping center will remain open. Future plans regarding tenants or new uses were not released.

HILLIARD, OHIO — Colliers has brokered the sale of Northwest Corporate Plaza, a 221,736-square-foot light industrial portfolio in Hilliard, a northwest suburb of Columbus. The two-building portfolio is situated on 18 acres along Leap Road directly west of I-270 and near I-70. The buildings are home to seven tenants, including Micro Center, Yokowo Manufacturing of America, E-Cycle and Mectron North America. Alex Cantu, Alex Davenport and Shane Woloshan of Colliers represented the seller, Transwestern Investment Group. Diamond Properties was the buyer.

SALT LAKE CITY — Jones Lang LaSalle Securities (JLLS), a member of JLL Capital Markets, has structured and placed a $112 million credit tenant lease and equipment financing for a newly completed industrial facility located at 6320 W. 300 South in Salt Lake City. JLLS served as placement agent for the developer, Riverbend Management. The lease financing and tenant improvements loan was structured to mature with the initial lease term and provide the borrower a single source of financing at a competitive, long-term, fixed rate. The loan allowed Riverbend Management to refinance an existing construction loan in addition to funding more than $80 million of equipment manufacturing improvements. Following tenant improvements, Riverbend will convert the 309,489-square-foot industrial property into a manufacturing facility. Bill Cavagnaro and Austin Johnson of JLLS represented the borrower in the financing. Additionally, JLL Work Dynamics represented the tenant on selection of the manufacturing site, and JLL Project and Development Services served as construction monitor.

INGLEWOOD, CALIF. — JPI has broken ground on Jefferson Inglewood, a market-rate and affordable housing apartment project in Inglewood, just southwest of Los Angeles. Move-ins are scheduled to begin in early 2026. The eight-story, transit-oriented property will feature 222 studio, one- and two-bedroom apartments. Units will offer stainless steel appliances and full-size washers and dryers. Community amenities will include a pool, cabana, clubroom, fitness center and rooftop deck. Jefferson Inglewood is located three metro stops from El Segundo and one stop from Los Angeles’ The Automated People Mover, including an electric train system on a 2.25-mile elevated guideway with six stations. The project recently received $1 billion in federal funding and construction is scheduled to begin this year. The Jefferson Inglewood project team includes TCA Architects, Englekirk Engineering and Kimley Horn Associates Engineering.