CROWN POINT, IND. — Greystone has provided a $40.3 million Freddie Mac loan for the refinancing of Hidden Creek Apartments in Crown Point, a city in Northwest Indiana. Eric Rosenstock and Dan Sacks of Greystone originated the nonrecourse loan, which features a 10-year term and a fixed interest rate. Originally constructed in 1976, the 432-unit property features one- and two-bedroom units spread across 12 buildings. Amenities include a pool, fitness room, playground, disc golf course and clubhouse. The borrower, Bayshore Properties, purchased the community in 2021 with bridge financing and completed $725,000 in capital improvements to more than 25 percent of the units as well as exterior renovations totaling $659,000.

Property Type

CHASKA, MINN. — Continental Properties has opened Springs at McKnight Lake, a 280-unit apartment community in Chaska, a southwest suburb of Minneapolis. The property is located at 3 Oakridge Drive near a new Costco store. Springs at McKnight Lake offers studio, one-, two- and three-bedroom units. Amenities include a pool, clubhouse, outdoor grill area, fitness center, car care area and two dog parks. Situated on the slopes overlooking McKnight Lake, the property provides residents with a direct path to trails and water activities. Springs at McKnight Lake marks the ninth community in Continental’s Minnesota portfolio.

CINCINNATI — Brennan Investment Group has acquired a 263,000-square-foot industrial building located at 10045 International Blvd. in Cincinnati. The purchase price was undisclosed. The property was acquired from Intelligrated under a consolidation plan to dispose of the building by the end of 2023. The property is situated on a 17.5-acre site in the World Park industrial park in Cincinnati’s northwest submarket. Upon closing, Brennan secured a new lease for the building with Trew, a provider of automated material handling solutions. Trew will use the facility for manufacturing and distribution of material handling equipment throughout the United States and Canada. Constructed in 1986, the property was expanded and renovated in 2000. The building features 390 auto parking stalls, a 130-foot-deep truck court with trailer parking stalls, a clear height of 25 feet, three five-ton cranes and an outdoor storage area. Byline Bank’s Commercial Real Estate Group provided a $10.4 million loan for the acquisition.

CHICAGO — AmTrust RE has secured two lease renewals totaling more than 20,000 square feet at its 33 North Dearborn office property in Chicago. The building totals 330,000 square feet. Regional law firm Heyl, Royster, Voelker & Allen PC renewed its lease for 13,383 square feet. KIPP Foundation, a nonprofit that trains and develops educators to lead KIPP schools, signed a lease for its 6,617-square-foot office. David Knight, Ethan Braham and Luke Wuchenich of Advocate Commercial Real Estate Advisors represented both tenants. In September 2023, AmTrust unveiled plans for a $50 million capital improvements programs at two of its Chicago properties, including 33 North Dearborn. Construction is underway, and the initiative marks the initial stage of the company’s $100 million commitment to upgrading its Chicago portfolio.

OVERLAND PARK, KAN. — The Heartland Soccer Association, a nonprofit that supports the development of youth soccer players in metro Kansas City, has moved its corporate office to the Aspiria campus in Overland Park. The move took place in November. Heartland Soccer hosts more than 3,450 league teams annually and 14 tournaments each year that attract more than 3,700 teams from 16 states. Established in 1977, the organization has 74,000 youth soccer players, 4,000 coaches and 2,000 referees. Wichita-based Occidental Management owns and manages Aspiria, which is the redevelopment of the former Sprint campus.

Related Midwest Breaks Ground on 72-Story Multifamily Development in Chicago’s Streeterville Neighborhood

by Katie Sloan

CHICAGO — Related Midwest has broken ground on 400 Lake Shore, a two-tower multifamily development located along the Chicago River in the city’s Streeterville neighborhood. Related is building the project on a site left vacant after plans to build the Chicago Spire skyscraper were abandoned nearly two decades ago. Phase I of the project will include the construction of the development’s 72-story North Tower. The 1.1 million-square-foot North Tower will offer 635 multifamily units, 20 percent of which will be affordable housing. The development will also include 4.5 acres of open and green space, including the construction of DuSable Park in partnership with the Chicago Park District. The development will also include an expansion of the Chicago Riverwalk Founder’s Way walking path. Construction on Phase One is scheduled for completion in early 2027. The Chicago Office of Skidmore, Owings & Merrill designed both towers, which include nods to the city’s architectural history and geography. March and White designed the building interiors, with locally based Stantec serving as the architect of record for the project. The development team for Phase I includes LR Contracting and BOWA Construction. A collaboration between The Illinois Housing Development Authority, Wells Fargo and other undisclosed financial institutions …

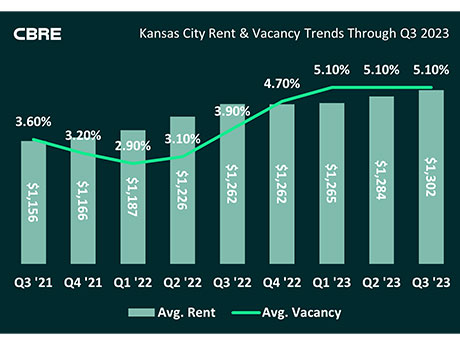

By Max Helgeson, CBRE As the national real estate landscape undergoes transformative shifts, Kansas City has emerged as one of the region’s most attractive multifamily markets. There are a myriad of attributes making Kansas City an unrivaled destination to deploy capital in the heart of the Midwest. Here are six key areas that propel the market to the forefront of real estate investors’ considerations. Economic anchors, diversification Kansas City has one of the nation’s most diverse economies with no sector comprising more than 15 percent of overall employment. A national leader of several durable industries provides unmatched economic stability and significant risk mitigation for investors. Moreover, the metro’s strategic location in the heart of the U.S. and strong transportation infrastructure make it a favored logistical hub for corporations across the world. Finally, the market is a base for startups and entrepreneurs drawn to the area’s abundant talent pool and competitive office space rates. Strategic infrastructure, connectivity Infrastructure is a cornerstone of Kansas City’s rise to prominence. The city’s strategic network of highways, interstates, railways, fiber networks and a major airport not only facilitates connectivity but positions it as a hub for commerce. This strategic infrastructure acts as a magnet, pulling …

Gencom Retakes Majority Ownership of Ritz-Carlton Key Biscayne Hotel in Miami, Plans $100M Overhaul

by John Nelson

MIAMI — Gencom has retaken the majority ownership of Ritz-Carlton Key Biscayne, a 291-room hotel located at 455 Grand Bay Drive in Miami’s barrier island of Key Biscayne. The locally based company developed the 17-acre resort in 2000 and later sold the majority stake to a privately held REIT in a three-property portfolio deal valued at $750 million. Ritz-Carlton Key Biscayne includes several swimming pools; 1,000 feet of beach frontage; six restaurants, bars and cafes; 37,000 square feet of meeting space; health and wellness amenities including a fitness center, tennis center and spa; and 188 condo-hotel units, which were not part of the acquisition. Citigroup and affiliates of KSL Capital Partners LLC provided financing for Gencom’s purchase, the terms of which were not disclosed. Gencom is planning a $100 million overhaul of the 13-story hotel that is slated to start in 2025. The renovation will include major upgrades to the guestrooms, food-and-beverage offerings, public spaces and guest amenities.

SARASOTA, FLA. — Colliers has arranged the $30.5 million sale of Glengary Shoppes, a 95,489-square-foot shopping center located along South Tamiami Trail in Sarasota. University Park, Fla.-based Benderson Development purchased the property from Jacksonville-based REIT Regency Centers. Brad Peterson and Whitaker Leonhardt of Colliers represented the seller in the transaction. Built in 1995, Glengary Shoppes was 97 percent leased at the time of sale to tenants such as Best Buy and Barnes & Noble. Regions Bank and IHOP occupy outparcels at the shopping center.

Equitas Management Completes Renovation of 57,000 SF Office Building in Chattanooga, Tennessee

by John Nelson

CHATTANOOGA, TENN. — Equitas Management Group has completed renovations for One Park Place, a 57,000-square-foot office building located at 6148 Lee Highway in Chattanooga. The property is fully leased to tenants including Equitas Management and EMJ, a general contractor that oversaw the renovations as well as constructed the building originally in 1984. Other tenants include medical, legal and financial services tenants, among others. Designed by HK Architects, the renovations include a new sleek black exterior, updated atrium, modernized offices and conference spaces and a grand balcony.