INDEPENDENCE, N.J. — New Jersey-based developer Woodmont Properties has reached 75 percent occupancy at the first phase of Woodmont Liberty at Independence, a 120-unit multifamily project that is located on an 11-acre site about 60 miles west of Manhattan. The property offers one- and two-bedroom units that are furnished with custom-designed kitchens, walk-in closets, keyless entry mechanisms, individual washers and dryers and private balconies/patios. Amenities include a pool, outdoor grilling and dining areas, a fitness center, game room, conference center, walking trails and a dog park. Leasing began in April, at which point rents started at $2,440 per month for a one-bedroom apartment.

Property Type

JOLIET, ILL. — PENN Entertainment has broken ground on the $185 million Hollywood Casino Joliet at RockRun Collection in Joliet. The casino will anchor RockRun Collection, a 1 million-square-foot mixed-use development that is under construction. Cullinan Properties is the owner and developer for the 310-acre project. The land-based casino will feature approximately 850 slots and 44 live table games, including a baccarat room, retail sportsbook, bars and restaurants, and an approximately 10,000-square-foot event center with meeting areas. There will also be roughly 1,330 parking spaces. PENN expects to create 450 construction jobs and 515 permanent jobs at Hollywood Casino Joliet. The development will take about 24 months to construct. RockRun Collection is slated to include 570 apartment units, 500 hospitality rooms, 150,000 square feet of office space, 500,000 square feet of retail and restaurant space, an outdoor amenity area and entertainment space.

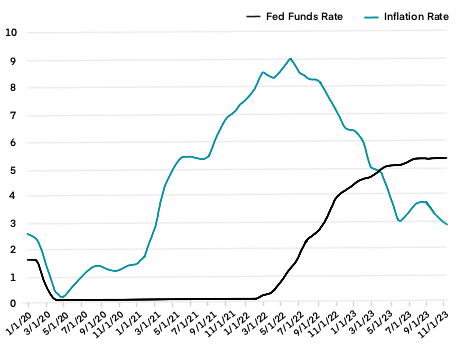

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational opportunity in senior debt and preferred equity investments,” explains David Scherer, co-CEO of Origin. “Despite uncertainties, it remains a mistake to stay out of the multifamily investment market in 2024.” Origin predicts that rent growth will stabilize to historic norms in 2024. The analysis theorizes that the negative rent growth some markets — such as Austin, Texas — experienced in 2023 was likely due to oversupply, and will reverse by January 2025. The report also indicates that long-term demand and absorption of apartments and rental homes is likely to remain strong for several years, as the U.S. is facing a shortage of between 5.5 million and 6.8 million housing units. …

BELLWOOD, ILL. — Evergreen Real Estate Group has completed Bellwood Senior Apartments, an 80-unit affordable seniors housing community in Bellwood, a western suburb of Chicago. The $31.5 million project replaces a former Walgreens store that had been vacant for nearly five years. The four-story development offers 76 one-bedroom and four two-bedroom apartments for seniors age 62 or older with incomes at or below 60 percent of the area median income (AMI). Evergreen says the building is 40 percent leased and will reach full occupancy in the next few months. Weese Langley Weese Architects designed the project. F.H. Paschen served as general contractor on the development. Financial partners for Bellwood Senior Apartments include the Illinois Housing Development Authority as the tax credit issuer (both Low-Income Housing Tax Credits and Illinois Affordable Housing Tax Credits) and subordinate funds provider; the Village of Bellwood, which provided a TIF loan; Bank of America, which is the investor and construction loan lender; Hudson Housing Capital, which syndicated the tax credits; Cook County, which provided HOME funds; and the ComEd Energy Efficiency Program.

NORTH JACKSON, OHIO — Newmark has negotiated a 211,443-square-foot industrial lease at 500 S. Bailey Road in North Jackson, about 60 miles southeast of Cleveland. A large solar manufacturing company signed a long-term lease to occupy the entire building. Terry Coyne of Newmark represented ownership, STAG Industrial Inc., which is renovating the building. The property features 201,476 square feet of manufacturing/warehouse space, 9,967 square feet of office space, a clear height of 35 feet, 19 loading docks, one drive-in door and a 245-car parking lot.

CHICAGO — Interra Realty has brokered the $9.6 million sale of a 28-unit apartment building in Chicago’s Lincoln Park neighborhood. Located at 1900-16 N. Lincoln Ave., the property features a mix of studio, one- and two-bedroom units. The building, constructed in 1906, underwent a capital improvement program for new appliances, countertops, cabinets and floors. Joe Smazal of Interra represented the buyer, Chicago-based ICM Properties. He also represented the local private seller. The property was fully occupied at the time of sale.

NEW YORK CITY — Five tenants have signed leases for office and showroom space at 1 East 33rd Street, a 160,000-square-foot building in Midtown Manhattan. The tenants are apparel company Q4 Designs (26,504 square feet); pet products provider European Home Designs (13,027 square feet), home furnishings firm Franco Manufacturing (6,894 square feet); Regal Jewelry (13,027 square feet); and Jem International (18,624 square feet). Koeppel Rosen LLC owns the building, which was originally constructed in 1913 and is now fully leased.

HARRISBURG, PA. — St. John Properties Inc. has unveiled plans for the redevelopment of Harrisburg Mall, a 1 million-square-foot regional mall located in the Swatara Township section of Dauphin County. The company plans to build Swatara Exchange, a mixed-use development consisting of multi-use commercial space and supporting inline retail and retail pad sites. The mall will undergo an extended demolition program that is expected to conclude in 2025. The existing Bass Pro Shops and Applebee’s Grill + Bar restaurant will remain operational, and the former Toys ‘R’ Us building will be marketed for a new use. At full build-out, Swatara Exchange is expected to support up to 1,000 new jobs in its nearly 550,000 square feet of space and contribute approximately $1 million in additional tax revenue annually. Twelve new buildings, including two retail pad sites, will be constructed in total. “When formulating our long-term strategy for Harrisburg Mall, we factored in trends occurring throughout the retail industry, changing consumer shopping patterns, the local real estate landscape and the greater Harrisburg economic climate,” says Lawrence Maykrantz, president and CEO of St. John Properties. The developer plans to build 13,600 square feet of single-story office space and nearly 200,000 square feet …

By John Bogdasarian, Promanas At a time when the multifamily marketplace is experiencing some turbulence after an extended period of strong growth, some developers, owners and investors are rethinking, repositioning and reworking their approach to a commercial real estate sector that has historically been one of the most reliable investments and dependable asset classes. Current market conditions, however, are not as favorable. A report by The Motley Fool this summer highlighted a 21 percent decline in apartment value. Overbuilding has saturated some markets, contributing to an increase in vacancy rates to around 7 percent and helping push rent growth down to 0.8 percent. In conjunction with persistently high interest rates and increasing delinquency issues with renters, the result is that building a traditional apartment product is a very tricky proposition. Even though the apartment market is somewhat dysfunctional at the moment, there are still plenty of opportunities in multifamily. For thought leaders and forward-thinking commercial real estate investors and professionals, the key is to understand the market, be flexible in your development and investment strategies, and be able to execute an approach that does work in the current marketplace. For those looking to maximize multifamily returns in 2024, there are …

NORTH CHARLESTON, S.C. — The North Charleston City Council has voted to approve Battery Park, a redevelopment of the 50-acre former Charleston Naval Complex. A partnership consisting of Jamestown, Weaver Capital Partners and WECCO Development will assist the city in transforming the waterfront complex into a mixed-use district comprising 1,400 residential units, with 17 percent reserved for workforce housing (households earning less than 120 percent of the area median income). The development will also feature shops, restaurants, offices, entertainment spaces and 23 acres of public spaces, parks and streets. The developers also plan to establish a new pavilion with a market hall, event space and an active lawn fronting the water. The construction timeline for the redevelopment was not disclosed. In addition to Battery Park, Jamestown, Weaver Capital and WECCO are underway on Navy Yard Charleston, an 85-acre redevelopment that will ultimately comprise 3.5 million square feet of commercial and residential space comprising more than 2,600 residential units.