BOSSIER CITY, LA. — An affiliate of Cordish Cos. doing business as LRGC Gaming Investors LLC has broken ground on Live! Casino & Hotel Louisiana, a $270 million development in Bossier City. The development represents the first land-based casino in the Bossier City-Shreveport metropolitan area, according to Cordish. The project is expected to create 750 new construction jobs and 750 permanent jobs upon completion. The site was formerly home to the vacant Diamond Jacks Casino & Hotel, which Cordish acquired earlier this year. Scheduled to open in 2025, the Live! Casino & Hotel Louisiana will feature more than 47,000 square feet of gaming space; a sportsbook for live betting on sporting events; an upscale 550-room hotel with a resort-style pool and fitness center; 25,000-square-foot events center; structured and surface parking; and 30,000 square feet of dining and entertainment venues, including Cordish brands Sports & Social, PBR Cowboy Bar and Luk Fu.

Property Type

ALEXANDRIA, VA. — Bell Partners has purchased The Thornton, a 439-unit apartment community located in historic Old Town Alexandria, a neighborhood in metropolitan Washington, D.C. Built in 2018 along the Potomac River, the property features studio, one- and two-bedroom apartments. Amenities include a dog grooming spa, 24-hour fitness center, clubroom, game room and a courtyard with a bocce ball court, fireplace and grilling area. Bell Partners purchased the community via its Value Add Fund VIII and will rebrand it as Bell Old Town. With this acquisition, the Greensboro, N.C.-based buyer now owns and/or manages 22 apartment communities containing more than 7,300 apartment homes in the Mid-Atlantic region. The seller and sales price were not disclosed, but Triad Business Journal reports that the City of Alexandria appraised the property at $161.1 million in January. The news outlet also reported that Starwood Capital Group purchased the community in 2019 for $180.2 million.

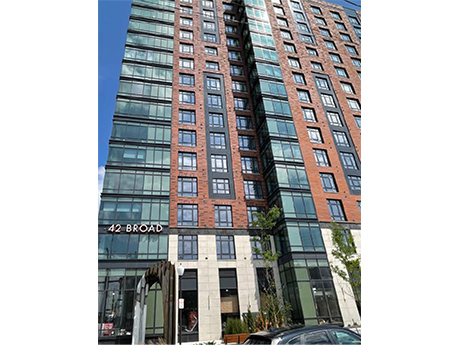

MOUNT VERNON, N.Y. — Canadian institutional investment firm Otera Capital has provided a $93 million loan for the refinancing of a 249-unit multifamily property in Mount Vernon, about 20 miles north of Manhattan. The 16-story building at 42 W. Broad St. houses studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, game room, entertainment kitchen, outdoor dining areas, coworking spaces, library and a courtyard garden. Kellogg Gaines and Geoff Goldstein of JLL arranged the financing. The borrower is a joint venture between two New York City-based firms, Alexander Development Group and The Bluestone Organization, and institutional investors advised by JP Morgan Asset Management.

ATLANTA — Cushman & Wakefield has brokered the sale of Alexan Summerhill, a new 315-unit apartment community located at 720 Hank Aaron Drive SE in Atlanta’s Summerhill submarket. Weinstein Properties purchased the property from the developers, Trammell Crow Residential and PGIM Real Estate. The sales price was not disclosed, but Atlanta Business Chronicle reported the property traded for $94 million. Robert Stickel, Alex Brown, Ashlyn Warren, Michael Kay and Sim Patrick of Cushman & Wakefield represented the sellers in the transaction. Situated near Georgia State University’s Center Parc Stadium and Convocation Center, as well as a new Publix grocery store, Alexan Summerhill features studio, one- and two-bedroom apartments. Amenities include a clubhouse, fitness center, swimming pool with a tanning ledge and poolside lounge, gaming lounge, event room, indoor/outdoor work from home spaces, podcasting studios, makers space, computer lab with wireless printing, grilling stations, bike storage and repair, EV charging stations, dog park and a pet spa.

Brookwood Financial Acquires 211,006 SF Publix-Anchored Retail Center in Melbourne, Florida

by John Nelson

MELBOURNE, FLA. — Brookwood Financial Partners has acquired Melbourne Shopping Center, a 211,006-square-foot retail center located at 1301-1441 S. Babcock St. in Melbourne. Built in 1959 and renovated in 2022, the property was 92.4 percent leased at the time of sale to tenants including Publix, Big Lots, Beall’s Outlet, Conn’s, Club 4 Fitness, Dollar Tree, Pet Supermarket, CATO, Pizza Hut and Firestone Complete Auto Care. Danny Finkle, Jorge Portela and Eric Williams of JLL represented the seller in the transaction. Andrew Gray and Ryan Parker of JLL secured acquisition financing on behalf of the buyer. The seller, sales price and loan amount were not disclosed.

ASHBURN, VA. — SRS Real Estate Partners has arranged the $8.5 million sale of a single-tenant, 12,580-square-foot medical office building located at 20041 Riverside Commons Plaza in Ashburn, about 30 miles northwest of Washington, D.C. Built in 2022, the property was fully leased to OrthoVirginia, an orthopedics practice with 35 locations, at the time of sale. The medical office facility is an outparcel for Riverside Square, a 90,000-square-foot shopping center, and is within one mile of Inova Loudon Hospital. Andrew Fallon and Philip Wellde Jr. of SRS represented the buyer, a Virginia-based private investor who was in a 1031 exchange and paid all-cash for the asset. Danny Booker, Rich Sillery and Douglas Olson of Monument Retail represented the seller, which was also the developer, in the transaction.

ITHACA, N.Y. — Largo Capital, a financial intermediary based in the Buffalo area, has arranged a $40.5 million loan for the refinancing of a 64,500-square-foot medical office building in downtown Ithaca. The newly developed building is located on the Cayuga Park healthcare campus and houses a walk-in clinic, specialized care for complex illnesses, diagnostic imaging facility, outpatient clinic and a comprehensive women’s health center. Ned Perlman of Largo Capital arranged the debt. The borrower and direct lender were not disclosed.

DERBY, CONN. — CBRE has brokered the $33 million sale of Hilltop Commons, a 198,910-square-foot shopping center in Derby, located west of New Haven. Big Y, CVS, Dollar Tree and American Freight anchor the newly redeveloped property. Other tenants include Verizon, AT&T, McDonald’s, Wendy’s and Sherwin-Williams. Jeffrey Dunne, David Gavin and Travis Langer of CBRE represented the seller, a partnership between DLC and Hutensky Capital Partners, in the transaction. Kempner Properties and Lee & Associates NYC acquired the property in partnership via a 1031 exchange.

SCHAUMBURG, ILL. — Colliers has arranged the sale of a 178,000-square-foot office building in the Chicago suburb of Schaumburg for an undisclosed price. The vacant building at 955 American Lane formerly served as Experian’s regional headquarters. Experian vacated the property in August of this year. Built in 1999, the four-story property features a shared parking deck, conference center, training room, cafeteria, fitness center, outdoor volleyball court and walking path around Woodfield Lake. The building is situated just west of Woodfield Mall and is divisible for up to seven tenants. Alissa Adler and John Homsher of Colliers represented the seller, Orion Schaumburg LLC. A private investor purchased the asset. Jon Connor and Steve Kling of Colliers also assisted with the transaction.

CHICAGO — Specialty insurance provider Argo Group has signed a new long-term lease at 24 E. Washington St., also known as the Marshall Field & Co. building, in Chicago. Argo’s lease is for roughly 20,500 square feet on the ninth floor. The company plans to begin operating out of its new office in early 2024. In 2021, owner Brookfield Properties completed a major restoration of the historic building, which has been listed on the National Register of Historic Places since 1978. Built in the early 1900s, the building served as the flagship location of the Marshall Field department store. The property rises seven stories and totals 636,000 square feet. This year, Ferraro North America, Olam International and Spot Logistics also signed leases at the property. Jeff Miller and Corey Siegrist of JLL represented Argo in its lease, while Jack O’Brien and JD Parcheta of The Telos Group represented Brookfield.