SAN ANTONIO — Dallas-based Rosewood Property Co. has begun leasing Phase II of Tobin Estates, a 311-unit multifamily project located on the north side of San Antonio. In addition to the 304 apartments that are housed in four buildings, Phase II features a building with seven townhomes and additional amenities, including a 4,500-square-foot fitness center. Units come in one-, two- and three-bedroom floor plans, with rents starting at roughly $1,400 per month for a one-bedroom apartment. Project partners included Oden Hughes Taylor Construction (general contractor), WDG Architecture, Westwood (civil engineer), B2 Architecture + Design (interior designer) and LandDesign (landscape architect). Full completion is slated for early 2024.

Property Type

Tidal Delivers First Southeast Mass Timber Residential Project With 389-Unit Ann Street Lofts in Savannah

by John Nelson

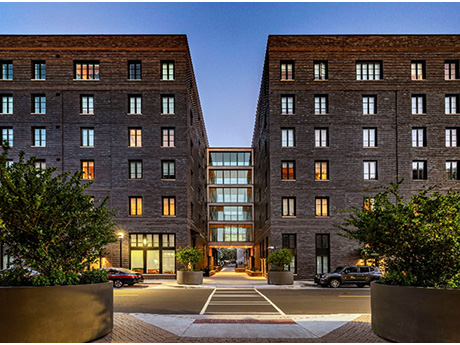

SAVANNAH, GA. — Tidal Real Estate Partners, on behalf of investment vehicle Flank GP Fund I, has delivered Ann Street Lofts, a two-building residential development located at 110 Ann St. in downtown Savannah. The 389-unit property represents the first mass timber residential project in the Southeastern United States, according to Tidal. The developer and project architectural firm, LS3P, are targeting LEED Gold certification for Ann Street Lofts, which features a rooftop solar array and electric vehicle charging stations, as well as exposed timber columns, beams and ceilings throughout. Greystar manages the property, whose rental rates range from $1,712 to $3,902 per month, according to Apartments.com. Floor plans range from studios to four-bedroom apartments. Amenities include a pool, fitness center, clubhouse, movie theater, grilling areas, business center, onsite property management and maintenance, bicycle storage, pet play area and a pet washing station.

ATLANTA — Crescent Communities has opened Novel West Midtown, a 340-unit apartment community located at 1330 Fairmont Ave. in Atlanta. Situated in the city’s West Midtown district, the property features walking trails that connect to various hiking trails and a future connection to the Atlanta BeltLine; a dog park; saltwater pool with cabanas, hammocks and spa; outdoor kitchen; and a private courtyard with an elevated terrace view. Indoor amenities include a fitness center, coworking lounge, club room and a game room. The unit mix at Novel West Midtown includes studio, one-, two-, and three-bedroom residences, with 10 percent of homes designated as affordable housing. Rental rates range from $1,699 to $3,515 per month, according to Apartments.com.

CHARLOTTE, N.C. — Northmarq has arranged the $107 million sale of Alta Filament, a 352-unit luxury apartment community located at 525 E. 21st St. in Charlotte. The newly built property is situated in the city’s Mill District neighborhood near Optimist Hall food hall and the Lynx Blue Line Light Rail. Allan Lynch, Caylor Mark, Andrea Howard, John Currin, Jeff Glenn and Austin Jackson of Northmarq represented the seller, Wood Partners, in the transaction. The buyer was Mid-America Apartment Communities. Amenities at Alta Filament include a community clubhouse, conference room, grilling areas and fire pits, a 24/7 fitness club with a rollup door to an outdoor lawn, swimming pool, sundeck trellis, pet spa and wash and a package delivery service. The community also features two oversized courtyards, a podcast/content creator studio and 10 private offices rentable by the month.

Capstone Real Estate Sells Former Student Housing Community in Murfreesboro, Tennessee

by John Nelson

MURFREESBORO, TENN. — Capstone Real Estate Investment has sold Landmark Apartments, a 264-unit community located near the Middle Tennessee State University campus in Murfreesboro. The property was acquired as a student housing project by the company in 2020 and underwent significant renovations, including the transformation of the community into traditional multifamily. Landmark Apartments offers one-, two- and three-bedroom units. The buyer in the transaction was not disclosed.

FREDERICK, MD. — Power Solutions LLC, a commercial electrical contractor based in Bowie, Md., has signed a 93,800-square-foot lease at Arcadia Business Park in Frederick. The tenant signed the lease with Baltimore-based St. John Properties Inc., which represents the fourth lease transaction between the two firms. Danny Foit of St. John Properties represented the landlord internally in the deal, and Jon Casella of CBRE represented the tenant. Power Solutions plans to house 90 full-time employees at its new warehouse space at 4754 Arcadia Drive, which is about 43 miles northwest of Washington, D.C.

DALLAS — Locally based commercial real estate services firm Morrow Hill has signed a 17,501-square-foot office lease expansion in North Dallas. According to LoopNet Inc., the five-story building at 14800 Quorum Drive was constructed in 1980 and totals 106,600 square feet. Chris Morrow of Morrow Hill internally represented the tenant in the lease negotiations. Adam Toth represented the landlord, Boxer Property Group, also on an internal basis.

FORT WORTH, TEXAS — Greysteel has arranged the sale of University Village, a 16-unit apartment complex that is located less than a block from Texas Christian University in Fort Worth. According to Apartments.com, the property was built in 1959 and offers one- and two-bedroom units. Andrew Mueller of Greysteel represented the buyer and seller, both of which requested anonymity, in the transaction.

KATY, TEXAS — Dallas-based brokerage firm STRIVE has negotiated the sale of a 10,299-square-foot retail building in Katy, a western suburb of Houston, that is leased to Mexican restaurant chain Uncle Julio’s. The building was originally constructed in 2015. Jackson Brewer and Jake Dutson of STRIVE represented the seller and procured the buyer, both of which were Houston-area investors that requested anonymity, in the transaction.

FLOWER MOUND, TEXAS — Los Caminos Modern Cocina will open a 5,680-square-foot Mexican restaurant at Lakeside, a 160-acre mixed-use development in Flower Mound, a northern suburb of Fort Worth. The site spans 1.3 acres, and the space will include an 1,810-square-foot, climate-controlled patio. The opening is slated for fall 2024. Dallas-based Realty Capital Management owns Lakeside.