SAN JOSE, CALIF. — Marcus & Millichap has arranged the sale of Atrium Garden, an apartment property in San Jose. The property traded for $18.5 million, or $115,531 per unit. The names of the seller and buyer were not released. Mitchell Zurich, Kirk Trammell and Joshua Johnson of Marcus & Millichap represented the seller and procured the buyer in the deal. Constructed in 2000, the four-story Atrium Garden features 159 studios and a one-bedroom manager’s apartment. Studios are furnished with a bed, bedside table and lamp, lounge chair, built-in desk and chair, TV, microwave, mini-fridge and a stove or hotplate. Community amenities include a leasing office, fitness center, media rooms, resident lounges, community kitchens, laundry facilities and an outdoor barbecue and lounge area.

Property Type

LOS ANGELES — Lee & Associates LA North/Ventura has arranged the acquisition of a three-story office building located at 5550 Topanga Canyon Blvd. in the Warner Center/Woodland Hills submarket of Los Angeles. S&G Properties Management LLC acquired the property from an undisclosed seller for $10.1 million. S&G Property Management plans to occupy a portion of the 62,241-square-foot building for its company, Citiguard, a security guard company in California. Additionally, the new owner will invest capital into the building to renovate the interior and exterior, as well as create onsite amenities to attract tenants. Darren Casamassima, Scott Romick and Jay Rubin of Lee & Associates LA North/Ventura represented the buyer. The team will also oversee leasing of the property moving forward.

SACRAMENTO, CALIF. — Newmark has arranged the sale of Rivergate Apartments, a 126-unit property at 900 Simon Terrace in West Sacramento. Will Blucher and Wills Vlasek of Newmark represented the seller, McCarty Sacramento Property LLC, in the disposition to a private buyer, IMG II, LLC. The acquisition price was not released. Rivergate is approximately three miles from Sacramento’s central business district and offers 72 one- and 54 two-bedroom floor plans across 10 two-story buildings on a 3.6-acre parcel. Amenities include a gated pool, standalone leasing office, common area laundry facilities and interior courtyards.

PORT WASHINGTON, WIS. — Vantage Data Centers and the Wisconsin Building Trades Council have partnered to build the previously announced Lighthouse data center campus in Port Washington, a northern Milwaukee suburb located along Lake Michigan. The $15 billion-plus, privately funded investment will require a workforce of more than 4,000 skilled construction workers over a three-year period and will rely on local union labor to the fullest extent possible. The new campus, part of OpenAI and Oracle’s Stargate expansion, will feature four data centers. Completion is slated for 2028. Once complete, Vantage and Oracle will create more than 1,000 long-term jobs and thousands more indirect jobs. Lighthouse is designed to preserve local resources, support new clean energy resources and advance environmental stewardship.

CEDAR FALLS, IOWA AND SOUTHERN PINES, N.C. — BWE has arranged $49.5 million for the refinancing of East Viking Plaza in Cedar Falls and Morganton Park South in Southern Pines. Dan Rosenberg, Logan Petersmeyer and Isabella Barrios of BWE arranged the financing on behalf of Cincinnati-based Midland Atlantic Properties. Both nonrecourse loans feature multiple years of interest-only payments. East Viking Plaza totals 147,659 square feet and is leased to tenants such as Target, Scheels, Michaels, Old Navy and Ulta. Morganton Park South totals 267,021 square feet and is nearly fully leased. Constructed in 2024, the shopping center is anchored by Target, Dick’s Sporting Goods and HomeGoods.

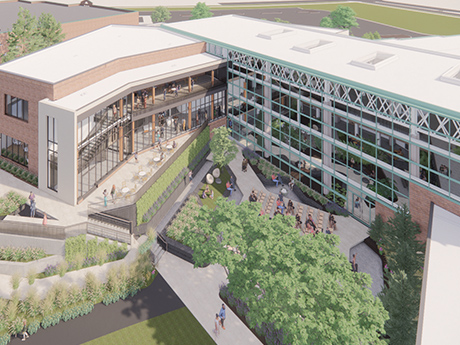

WOODBURY, MINN. — Kraus-Anderson has completed a $42.3 million revitalization of Woodbury Central Park, which is located at 8595 Central Park Place in Woodbury. Designed by HGA Architects, the three-story, 62,708-square-foot project included enclosing the existing amphitheater, a new multipurpose space addition, expanded public gathering areas and an updated Lookout Ridge indoor playground. Improvements also increased parking and pedestrian access, added art installations and space for public art and enhanced accessibility with ADA updates. Sustainability was a core focus of the project, including the integration of a Darcy Geothermal Well system, solar energy and other energy-efficiency initiatives to reduce environmental impact and operating costs. Construction began in April 2024.

CHICAGO — Kiser Group has brokered two multifamily sales in Chicago for a total of $31.5 million. The first transaction, brokered by Lee Kiser, Aaron Sklar and Noah Birk, involved a portfolio of three multifamily properties in Hyde Park: Campus Court Apartments (58 units), The Victorian (64 units) and Woodlawn House (85 units). At closing, the portfolio was more than 95 percent occupied. The second transaction, brokered by Lee Kiser, Andy Friedman and Jake Parker, was the sale of The Annabelle, a property in the Lakeview neighborhood with an occupancy of 93.6 percent. The asset sold for $7.8 million. The value-add property is located within walking distance of Wrigley Field.

SHELBY TOWNSHIP, MICH. — Sport Clips will open at the Kroger-anchored shopping center at the southeast corner of 25 Mile and Dequindre roads in Shelby Township, a northern suburb of Detroit. Bill McLeod and Tjader Gerdom of Gerdom Realty & Investment represented the tenant in the lease for the 1,200-square-foot space, which was formerly home to Supercuts. Adams Commercial Real Estate Group manages the property.

MIAMI — SCALE Lending, the debt financing arm of New York City-based Slate Property Group, has provided a $460 million cross-collateralized facility on behalf of the Namdar Group for two adjacent apartment towers under development in downtown Miami. The facility will comprise a $230 million bridge loan for the completion and lease-up of 55 N.E. 2nd Street (Phase I), which contains 680 multifamily units across 358,000 square feet; and a $230 million loan for the ground-up construction of 50 N.E. 3rd Street (Phase II), which comprises 714 apartment units across 395,000 square feet. The two 43-story towers will be connected from the first through eighth floors upon completion. Phase I is slated for completion in the first quarter of 2026. Construction of Phase II commenced in September 2025, with completion estimated for spring 2028. Units range in size from studios to two-bedroom layouts. A connected garage on the second through sixth floors will include 269 parking spaces, and the ground floor will feature 7,100 square feet of retail space. Combined, the buildings will include 62,000 square feet of amenity spaces on the seventh and eighth floors to be shared by tenants of both towers. Both buildings will offer gyms, golf …

— By Sam Meredith of Colliers — After a slow and uncertain start to 2025, the retail market in Reno and Sparks is finally finding its stride. The first half of the year saw many tenants hit pause on leasing decisions as economic jitters made retailers cautious. By the third quarter, however, the mood had shifted. Leasing activity picked up noticeably, and tenants are now back in the market, actively looking for space. That momentum is expected to carry through the fourth quarter and into 2026, with healthy absorption on the horizon. This turnaround is backed by solid market indicators. Net absorption turned positive in the second quarter, while asking rents rose quarter over quarter. Vacancies nudged upward due to big-box closures, including three Big Lots and a Joann store early in the year, but the overall retail vacancy still sits at a manageable 5.4 percent. In fact, several submarkets, including North Valleys, Northwest Reno, South Reno and Southwest Reno, are reporting vacancy rates below 2 percent, showing strong demand in key areas. Retailers are clearly taking notice. Trader Joe’s, which once considered Northern Nevada a one-store market, has now opened two additional locations in Spanish Springs and South Reno. …