BROWNSTOWN, MICH. — Friedman Real Estate has brokered the $25.7 million sale of a 180-unit multifamily property in Brownstown, a southwest suburb of Detroit. The community is located at 21901 Stratford Place Blvd. Peter Jankowski and Rich Deptula of Friedman represented the undisclosed seller and the buyer, Four Corners Development Group.

Property Type

PALATINE, ILL. — Marcus & Millichap has arranged the $5 million sale of Palatine Center, a 46,095-square-foot office property in the Chicago suburb of Palatine. Located at 865-909 E. Wilmette Road, the three-building property was fully leased at the time of sale to five tenants. Roughly 85 percent of the tenants have occupied the building for 17 to 27 years. A specialized school occupies 69.6 percent of the space. Tammy Saia and Tami Andrew of Marcus & Millichap represented the seller, a private investor. The duo also secured the buyer, a Texas-based limited liability company.

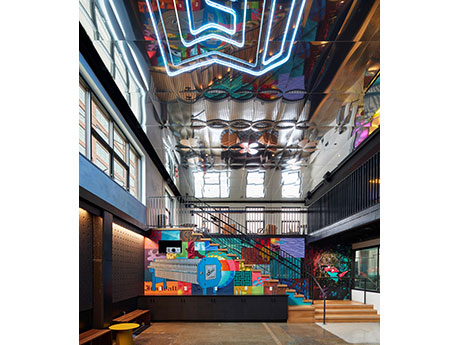

MINNEAPOLIS — Kraus-Anderson has completed a $2 million renovation of the 7,000-square-foot headquarters and taproom for Modist Brewing Co. in Minneapolis. The project included new event space, a quality control lab and employee workplaces. The Minneapolis studio of Perkins & Will designed a two-story event space, mezzanine and catwalk that can accommodate 120 people for corporate and private events. The design aesthetic is “punk rock chic” and includes bold colors, neon sculpture lights, dichroic glass that changes colors, glitter concrete epoxy flooring and mirrored ceilings.

BURLINGTON, N.J. — United Fulfillment Solutions Inc. has signed a 217,986-square-foot industrial lease in the Southern New Jersey community of Burlington. The e-commerce company will occupy the entirety of Building 1 at Rancocas 5 Industrial Park, which features a clear height of 36 feet, 42 loading docks, 183 car parking spaces and 28 trailer drops. Nate Demetsky, Dean Torosian and Matt Kemery of JLL represented the landlord, regional developer Endurance Real Estate Group, in the lease negotiations. Allen Ding of Visionaire Real Estate represented the tenant.

DEER PARK, N.Y. — CBRE has brokered the sale of Sutton Landing at Deer Park, a 200-unit active adult complex on Long Island. The age-restricted property was built in 2021 and offers amenities such as a pool, fitness center, game room, outdoor grilling and dining stations and a leasing office. Aron Will, John Sweeny and Scott Bray of CBRE represented the seller, a partnership between local developer B2K Development and Chicago-based investment firm Harrison Street, in the transaction. Shawn Rosenthal, Jason Gaccione, Jake Salkovitz, Aron Will, Matthew Kuronen and Michael Cregan of CBRE originated Freddie Mac acquisition financing on behalf of the buyer, Fairfield Properties.

YONKERS, N.Y. — Rockabill and BWE have provided a $16.9 million Fannie Mae loan for the refinancing of Monastery Manor, a 147-unit affordable seniors housing property located just north of New York City in Yonkers. Units are designated for persons 62 years and older who earn no more than 50 percent of the area median income (AMI). The borrower, nonprofit owner-operator Finian Sullivan Corp., will use a portion of the proceeds to fund renovations and extend the property’s affordability status. Jim Gillespie and Ilya Weinstein of BWE originated the loan.

FLEMINGTON, N.J. — Locally based financial intermediary G.S. Wilcox Co. has arranged a $16 million loan for the refinancing of a 170,000-square-foot shopping center in the Northern New Jersey community of Flemington. Grocer ShopRite anchors the center, which was fully leased at the time of the loan closing. Wesley Wilcox and Al Raymond of G.S. Wilcox arranged the loan, which carried a 10-year term, 30-year amortization schedule and flexible prepayment options, through an undisclosed life insurance company. The borrower was also not disclosed.

By Taylor Williams Architects and general contractors are shaking up the ways in which they design and construct industrial projects in response to financial pressures faced by their clients, an elevated emphasis on sustainability and shifts in how tenants utilize spaces. The nuts and bolts of designing and developing commercial properties are fickle by nature, as they are beholden to consumer preferences, which are in a perpetual state of flux. Yet the current shifts in industrial design and construction practices should not be viewed as indicators of the sector’s waning popularity among investors. “Despite a difficult rate environment that is causing challenges for all sectors of the economy, we have deep optimism about the near- and long-term future for the industrial market in New Jersey and Pennsylvania,” says David Greek, managing partner at regional firm Greek Real Estate Partners. “This region sits amid the most densely populated area in the nation and continues to grow. At the same time, the consumer shift to e-commerce is not nearly complete, creating a dramatic long-term need for logistics facilities to accommodate this historic change.” In other words, industrial is still hot. And the most visible and basic change occurring within the property type — …

Hard Rock, Steinhaur to Co-Develop 31-Story Hard Rock Hotel Long Beach in Southern California

by John Nelson

LONG BEACH, CALIF. — Global hotelier Hard Rock International has partnered with development firm Steinhauer Properties to develop Hard Rock Hotel Long Beach, a 31-story hotel in downtown Long Beach. The hotel will be situated adjacent to the Long Beach Convention & Entertainment Center along East Ocean Boulevard. Hard Rock Hotel Long Beach will include approximately 427 rooms and suites, including a Rock Star Suite. The hotel will also feature the tallest open rooftop bar on the Southern California coast, as well as an outdoor swimming pool with an amenities deck. The co-developers plan to break ground on the hotel in summer 2024 with plans to open the property in spring 2027. The new development is expected to create approximately 3,100 construction jobs and approximately 500 permanent positions once operations begin in 2027. The hotel represents the first new full-service hotel to be built in Long Beach in 30 years and the first new Hard Rock hotel in Southern California in almost a decade, according to Hard Rock. Amenities will also include Body Rock Fitness Studio, two onsite restaurant options and a Rock Shop that will sell Hard Rock merchandise and other items. The new property will also feature a …

Rockpoint to Develop 1.5 MSF Industrial Property Within $2B Pomp Project in Pompano Beach, Florida

by John Nelson

POMPANO BEACH, FLA. — Boston-based firm Rockpoint plans to develop a 1.5 million-square-foot industrial property in Pompano Beach in partnership with The Cordish Cos. and Caesars Entertainment. Situated on an 87.8-acre site, the project will be part of the 223-acre, $2 billion mixed-use development —The Pomp —currently underway by Cordish and Caesars. Site work for the industrial park is scheduled to begin in May 2024, with the first of three phases of development. Rockhill Management, Rockpoint’s property services affiliate, will lead the development and management of the project.