CHESHIRE, CONN. — Locally based brokerage firm O,R&L Commercial has negotiated the $1.6 million sale of a 25,320-square-foot industrial building in Cheshire, located roughly midway between Hartford and New Haven. The building is situated on a 2.3-acre site at 1187 Highland Ave. and was 88 percent leased at the time of sale. Richard Lee and Will Braun of O,R&L Commercial represented both the seller, Marshall Enterprises, in the transaction and procured the buyer, Dattco Inc.

Property Type

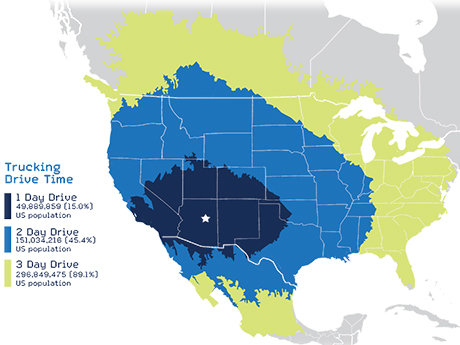

WINSLOW, ARIZ. — Atlas Global Development Group has released plans for I-40 TradePort Winslow, a 3,000-acre manufacturing and logistics park in Winslow, approximately 57 miles southeast of Flagstaff, Arizona. The project will kick off the development of the I-40 TradePort Corridor, a planned 805-mile network of clean-energy logistics hubs. According to Atlas Global, the project aims to circumvent the increasingly slow supply chain performance of the Inland Empire in Southern California, and to address future negative impacts to the national supply chain. The park will seek tenants in industries such as advanced manufacturing, heavy manufacturing, logistics, transportation, manufactured wood products, renewable energy production and storage, semiconductor suppliers and aerospace. The site sits at the nexus of a BNSF Railroad line, the Winslow-Lindberg Regional Airport and Interstate 40. The U.S. Department of Transportation has awarded a $974,000 grant to the project. Atlas Global plans to use the funds to support planning, studies and analysis for the project’s development, as well as primary engineering and design work. “These rural Arizona communities have long been overlooked, despite their incredible potential as central and essential pieces to the supply chain logistics puzzle,” says Daniel Lupien, managing director of Atlas Global Development Group. “The RIA grant …

— By Aiman Noursoultanova, Senior Vice President, CBRE’s Reno Investment Properties Group — Reno’s multifamily sector has performed exceptionally well over the past decade due, in part, to strong, sustained job growth. Nevada continues to lead the nation in employment growth at 3.8 percent over the past year, according to July data from the Bureau of Labor Statistics. While Reno’s job growth over the past decade has focused more on diversification, recent growth can best be characterized by higher-wage industries like healthcare, technology, manufacturing and aerospace/aviation. As a result, the market has seen an influx of new Class A, well-amenitized construction that appeals to this new tenant demographic. Notable company relocations and expansions thus far in 2023 include OMEC Medical, a life sciences instrument manufacturer; Edgecore, a wholesale data center developer, owner and operator; Generac, a leading global designer, manufacturer and provider of energy technology solutions; and Stellar Aviation, a fixed-base private airplane operator catering to private planes and jets. Companies investing in Reno most commonly appreciate the region’s attractive regulatory environment, low cost of doing business, access to regional transportation corridors and a high quality of life for its employees. Regarding rent growth over the past decade, several submarkets have performed …

NORCROSS, GA. — Locally based FIDES Development has delivered The Perry, a 160-unit, garden-style apartment community in the Atlanta suburb of Norcross. The gated development is situated at the intersection of Jimmy Carter and Peachtree Industrial boulevards. Ware Malcomb provided interior architecture and design services for the amenity spaces, which include a hospitality zone and lounge that comprises the pool and a lobby featuring custom specialty millwork, TVs, sofas and games. Other amenity spaces include a bike room, coworking space, office work rooms, mail room, pet spa area and a gym. Fortune-Johnson was the general contractor for The Perry, which commands rents beginning at $1,500 per month, according to Apartments.com.

JUPITER, FLA. — Woodmont Industrial Partners and Butters Construction & Development have delivered Corporate Logistics Center, a 252,848-square-foot industrial facility located at 15791 Corporate Circle in Jupiter. The property is situated within the 1,300-acre Palm Beach Park of Commerce in South Florida’s Palm Beach County. The building is available for immediate occupancy and features 3,800 square feet of office space, 36-foot clear heights, 48 dock doors, two drive-in doors, 60 trailer parking spaces and ample automobile parking spaces and outdoor storage facilities. Christopher Thomson and Chris Metzger of Cushman & Wakefield are handling the leasing assignment at Corporate Logistics Center, which represents the fifth development between Woodmont and Butters. Separately, the firms teamed up with PCCP LLC to acquire land within Palm Beach Park of Commerce with plans to develop 2 million square feet of industrial space.

Cushman & Wakefield Arranges Sale of 358-Unit Ansley at Town Center Apartments Near Augusta

by John Nelson

EVANS, GA. — Cushman & Wakefield has arranged the sale of Ansley at Town Center, a 358-unit apartment community in the Augusta suburb of Evans. The Shoptaw Group purchased the property from Spyglass Capital Partners for an undisclosed price. Taylor Bird, Nelson Abels, Laura Aylor and Jaime Slocumb of Cushman & Wakefield represented the seller in the transaction. Built in 2009 and 2012, Ansley at Town Center features a clubhouse with billiards and a coffee bar, business center, fitness center, saltwater pool and sundeck, pet play area, Luxer package locker room and grilling stations.

Marcus & Millichap Brokers Sale of 200-Unit Olde Salem Village Apartments in Shreveport, Louisiana

by John Nelson

SHREVEPORT, LA. — Marcus & Millichap has brokered the sale of Olde Salem Village, a 200-unit apartment community located at 6725 Buncombe Road in Shreveport. John Hamilton, Bryan Sisk and David Dorris of Marcus & Millichap represented the seller, Continental Foundation Inc., in the transaction. An entity doing business as Thara Properties LLC purchased the community for an undisclosed price. Built in 1984 on 14.5 acres, Olde Salem Village features a clubhouse, pool and a basketball/tennis court.

STERLING, VA. — The Laramar Group has acquired Sterling Medical Plaza, a 35,406-square-foot medical office building located at 46440 Benedict Drive in Sterling, a suburb of Washington, D.C. The investment firm purchased the two-story property via Laramar Medical Properties Fund I for an undisclosed price. The seller was also not disclosed. Built in 1986 and renovated in 2021, Sterling Medical Plaza was 85 percent leased at the time of sale to tenants including Loudoun Medical Group, INOVA Health and Concentra.

Rosewood Property Receives $31.9M Acquisition Loan for Self-Storage Portfolio in the West

by Amy Works

VISTA, CALIF.; TEMPE, ARIZ.; AND LAS VEGAS — Talonvest Capital has arranged a $31.9 million loan for the acquisition of a three-property self-storage portfolio in Vista, Tempe and Las Vegas. The borrower is Rosewood Property CO. The portfolio offers 2,010 units, including 238 climate-controlled units, 1,772 non-climate-controlled units and 90 parking spaces. Kim Bishop, Tom Sherlock, Philippe Castillo and Lauren Maehler of Talonvest secured the 10-year loan that provides seven years of interest-only payments with the ability for full-term interest-only payments.

Fountainhead Development Sells Retail Pad at Monterey Crossing in Palm Desert, California for $6.3M

by Amy Works

PALM DESERT, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the sale of a newly built, multi-tenant retail pad at Monterey Crossing, a shopping center in the Coachella Valley city of Palm Desert. Newport Beach-based Fountainhead Development sold the asset to a Los Angeles-based private investor for $6.3 million. Situated on 1.2 acres at 3120 Dinah Shore Drive, the 8,370-square-foot property was fully leased to Jersey Mike’s Subs, Nekter Juice Bar, Roll-Em-Up Taquitos, Keith Alexander DDS and Mathnasium. The building was built in 2022. Bill Asher and Jeff Lefko of Hanley Investment represented the seller, while Yoram Katz of Woodland Hills-based Peak Commercial represented the buyer in the deal. This transaction marks the fifth retail pad building Hanley Investment Group has sold at Monterey Crossing, totaling a combined 25,430 square feet and approximately $27 million.