NORWALK AND BRIDGEPORT, CONN. — Regional brokerage firm Northeast Private Client Group (NEPCG) has arranged the $3.6 million sale of two multifamily properties in southern coastal Connecticut. The building at 33 Woodbury Ave. in Norwalk totals eight units, and the building at 1421 Fairfield Ave. in Bridgeport totals 25 units. The buyers and sellers in both deals requested anonymity. Brad Balletto Jeff Wright, Rich Edwards, Bob Paterno, Chris Bierezowiec and Pat Hegarty of NEPCG brokered the deals.

Property Type

DENVER AND MILWAUKEE — Two healthcare REITs, Denver-based Healthpeak Properties (NYSE: PEAK) and Milwaukee-based Physicians Realty Trust (NYSE: DOC), have agreed to enter into an all-stock merger agreement that is valued at roughly $21 billion. Under the terms of the agreement, each share of Physicians Realty Trust common stock will be converted into 0.674 of a share of newly issued Healthpeak common stock. The combined entity will feature a portfolio of roughly 52 million square feet of healthcare assets. On a pro-forma basis, Healthpeak and Physicians Realty Trust shareholders will own approximately 77 percent and 23 percent of the combined company, respectively. The deal is expected to close during the first half of next year. Of the combined 52 million square feet, about 40 million would consist of outpatient healthcare facilities in major gateway markets like Nashville, Atlanta, Dallas, Houston, Phoenix and Denver. Healthpeak CEO Scott Brinker will lead the newly formed company in conjunction with a board of directors comprised of eight existing Healthpeak directors and five existing Physicians Realty Trust directors, including current CEO John Thomas. In detailing the reasons behind the merger, executives from both companies noted that Healthpeak Properties and Physicians Realty Trust have overlapping footprints in …

While many cities grapple with a declining population, softening rents and a struggling office market, Miami is riding a wave of population growth and apartment demand. This stems from the usual factors — sun, lifestyle and low taxes — as well as something unprecedented: an influx of large office users. New-to-market office tenants are transforming Miami’s economy and helping offset the challenges of inflation and rising interest rates. Miami multifamily fundamentals remain strong, with plenty of liquidity in the market. Our economy is more diversified than ever, and this has made it one of the most desirable markets in the country. Supply and demand People and businesses fleeing states with higher taxes and longer pandemic restrictions helped fuel Miami’s population surge between 2020 and 2022 and led to record-breaking rent growth during that period. Miami has become a magnet for large financial and tech firms, with well-heeled companies like Starwood Property Trust, Citadel Securities, BlockChain and Blackstone Group taking new office space. All told, a record 57 companies relocated or expanded to Miami-Dade County last year. Between May 2022 and May 2023, Miami added over 83,000 jobs, more than a 4 percent increase. Miami’s unemployment rate as of May 2023 …

CBRE Secures Construction Financing for Whole Foods-Anchored Development in Rogers, Arkansas

by John Nelson

ROGERS, ARK. — CBRE has secured an undisclosed amount of construction financing for the development of Pinnacle Springs, a planned mixed-use development located at 1800 S. Osage Springs Drive in Rogers. The project will comprise 362 apartments and 91,000 square feet of retail space, including a 37,000-square-foot Whole Foods Market grocery store. The borrower is SJC Ventures, a mixed-use development firm based in Atlanta. Richard Henry, Mike Ryan, Brian Linnihan and J.P. Cordeiro of CBRE Capital Markets’ Debt & Structured Finance team in Atlanta arranged the financing. Arvest Bank provided uncrossed construction loans for the project, while Dome Equities provided both common and preferred equity investments in the multifamily component. SJC Ventures plans to break ground on Pinnacle Springs by the end of the year, with an expected delivery date of 2025.

SAVANNAH, GA. — The Opus Group has delivered The Helmsman, a 104-unit, five-story apartment building located at 645 E. Broughton St. in downtown Savannah. Situated near the Savannah College of Art and Design (SCAD), the boutique community features studios, one-, two-, three- and four-bedroom apartments, all with private bathrooms for each bedroom. All units are fully furnished, and select apartments have balconies. Amenities include an art studio, private and group study areas, resident lounge, clubroom, spa with sauna and relaxation room, fitness center, outdoor pool, outdoor dining area with grills, outdoor entertainment area, indoor secure bike storage, bike maintenance room and covered parking. Opus recently completed the lease-up of The Helmsman to both SCAD students and non-student renters. The project team included development partner Atlantic American Partners, construction lender Huntington Bank, architect of record Myefski Architects, general contractor Rabren General Contractors, civil engineer Thomas & Hutton, structural engineer LBYD and interior designer Creative License International.

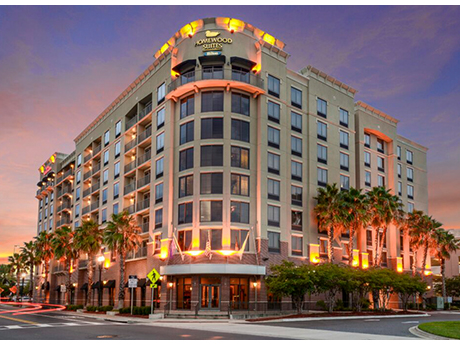

JACKSONVILLE, FLA. — Berkadia has arranged the $26 million refinancing of the leasehold interest in a 221-room dual-branded hotel in Jacksonville’s Southbank neighborhood. Built in 2009 along the St. Johns River, Hilton Garden Inn-Homewood Suites Jacksonville Downtown Southbank is an eight-story hotel located at 1201 Kings Ave. Amenities include an outdoor pool, fitness center, onsite restaurant, room service and meeting rooms. Michael Weinberg, Alec Fox and Lindsey deButts of Berkadia’s Hotels & Hospitality team secured the five-year loan through an undisclosed regional bank on behalf of the borrower, Excel Group.

WOODBRIDGE, VA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $19.9 million sale of a two-building industrial property located at 15111 and 15151 Farm Creek Drive in Woodbridge, about 26 miles south of Washington, D.C. Built in 1986 on an 8-acre site within Featherstone Industrial Park, the 139,818-square-foot property was fully leased at the time of sale to Bekins A1 Storage Inc., a privately held moving and storage company. Robert Filley and Chandler Pace of IPA represented the seller and procured the buyer. Both parties requested anonymity.

RICHMOND, VA. — Matan Cos. has purchased two recently delivered, high-bay industrial facilities within Deepwater Industrial Park in Richmond. Located 2.2 miles from the Richmond Marine Terminal, the assets total 321,000 square feet and feature 36-foot clear heights, 52- by 52-foot bay spacing and visibility from I-95. Hourigan, in collaboration with DSC Partners, delivered the facilities earlier this year. The third building within Deepwater Industrial Park is fully leased to Lowe’s Home Improvement. Matan has tapped Charlie Polk, Gareth Jones and Chris Avellana of JLL to lease the newly acquired assets. Sue Caras, Drake Grier and Evan Parker of JLL arranged acquisition financing through Mesa West Capital. The sales price and loan amount were not disclosed.

SAN ANTONIO — California-based brokerage firm Matthews Real Estate Investment Services has arranged the sale of a 211,000-square-foot warehouse in San Antonio. The building is located on the city’s west side and was originally constructed on 23 acres in 1969 and renovated in 2021. Jeff Miller and Michael Kelleher of Matthews represented the buyer, Evergen Equity, which plans to implement a value-add program. The seller was not disclosed. The building was leased to Flasher Equipment at the time of sale.

DALLAS — California-based investment firm Provender Partners has acquired a 185,569-square-foot cold storage facility in southwest Dallas. According to commercialcafé.com, the property at 5225 Investment Drive was built on 12.3 acres in 1986. Provender Partners, which acquired the facility as part of a $50 million portfolio deal, has also entered into a sale-leaseback agreement with the undisclosed seller. Chris Robinson of Fischer Co. and Scott Delphey with Food Properties Group represented both parties in the portfolio sale.