EULESS, TEXAS — Locally based brokerage firm STRIVE has arranged the sale of Euless Town Center, a 239,610-square-foot shopping center located on the eastern outskirts of Dallas. Ross Dress for Less and grocer Aldi anchor the center, which was roughly 86 percent leased at the time of sale. Other tenants include Dirt Cheap, Skechers USA and Sally Beauty. Hudson Lambert and Jennifer Pierson of STRIVE represented the California-based seller and procured the Texas-based buyer, both of which requested anonymity, in the transaction.

Property Type

6919 Fulton St. LLC Nears Completion of 47-Unit Citrino Multifamily Community in San Diego

by Amy Works

SAN DIEGO — Owner 6916 Fulton St. LLC is nearing completion of the development of Citrino, an apartment complex in the Linda Vista neighborhood of San Diego. Located at 6919 Fulton St., the pet-friendly community features 47 studio, one- and two-bedroom apartments ranging from 470 square feet to 941 square feet. Units offer open floorplans with oversized windows, stainless steel appliances, quartz countertops and full-size stackable washers/dryers. The solar-powered property features two electric vehicle charging stations, a community clubhouse, kitchen and courtyard. San Diego-based Sunrise Management is serving as property manager for the asset. Pre-leasing for the community is underway.

Marcus & Millichap Brokers $2.6M Sale of Net-Leased Restaurant Building in Falcon, Colorado

by Amy Works

FALCON, COLO. — Marcus & Millichap has arranged the sale of a restaurant property located at 7575 Falcon Market Place in the Colorado Springs suburb of Falcon. A limited liability company sold the asset to an undisclosed buyer for $2.6 million. Freddy’s Frozen Custard & Steakburgers occupies the 3,030-square-foot property on a net-lease basis. Part of a 20-acre development, the new restaurant is located in front of a King Soopers supermarket that is currently under construction. Drew Isaac and James Rassenfoss of Marcus & Millichap’s Denver represented the seller in the deal.

HOUSTON — Dallas-based Civitas Capital Group has topped out UNITi Montrose, a 238-unit multifamily and coliving project in Houston. The site spans a full acre, and the building rises six stories atop a three-story parking garage. Floor plans consist of 190 studio, one- and two-bedroom units as well as 48 private suites that house a total of 161 private rooms. Amenities will include a pool, coworking space and a courtyard, as well as 4,000 square feet of ground-floor retail space. Meeks + Partners designed the project, and Arch-Con Corp. is serving as the general contractor. Completion is slated for next summer.

CINCINNATI — A joint venture between affiliates of Midland Atlantic Properties and Next Realty has acquired Waterstone Center, a 160,000-square-foot shopping center in Cincinnati. The purchase price and seller were undisclosed. The fully leased property is home to Best Buy, Ross Dress for Less, Michaels, Old Navy, Petco and Verizon. BWE arranged acquisition financing through Goldman Sachs.

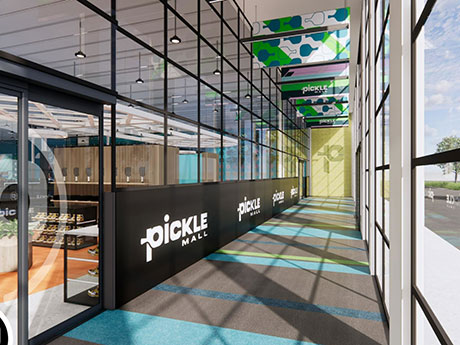

VERNON HILLS, ILL. — Picklemall Inc. has leased 46,000 square feet at 5555 Town Line Road in the Chicago suburb of Vernon Hills. The site will serve as a flagship location for the startup, which aims to establish 50 pickleball facilities nationwide within the next two years. Transwestern’s sports and entertainment group, led by Tim Katt and Larry Serota, is the exclusive real estate provider for Picklemall. Led by CEO West Shaw and backed by billionaire financier and Major League Pickleball founder Steve Kuhn, Picklemall is an indoor pickleball concept that capitalizes on vacant mall space. Picklemall’s Vernon Hills location takes the space formerly occupied by Toys “R” Us. The build-out of the facility is slated for completion in the first quarter of 2024.

CHICAGO — Quantum Real Estate Advisors Inc. has brokered the $3.8 million sale of an 11-unit multifamily building in Chicago’s West Town neighborhood. The property at 835 N. Wolcott Ave. was renovated in 2020. Quantum represented the out-of-state buyer, which completed a 1031 exchange. The seller was undisclosed.

BURBANK, ILL. — Time Equities Inc. (TEI) has purchased Burbank Plaza, a 28,000-square-foot retail strip center in Burbank, a southern suburb of Chicago. The purchase price was $3.1 million. Currently 91 percent leased and anchored by Family Dollar, the property is home to various tenants such as a dry cleaner, nail salon and phone store. One 2,500-square-foot space is available for lease. Ami Ziff, Jonathan Kim, Grant Scott and Eli Smith represented TEI on an internal basis. Adam Foret of CBRE represented the private seller.

NEW YORK CITY — LMXD, an affiliate of New York City-based L&M Development Partners, has topped out the National Black Theatre & Ray Harlem, a 21-story residential and civic project. Designed by Frida Escobedo Architects and Handel Architects, the development will house 222 mixed-income apartments, commercial space along 125th Street and a multi-purpose living room that will be open to the community. In addition, the site will feature a 27,000-square-foot home for National Black Theatre. This space will house offices, classrooms, a 250-seat performance space, a 99-seat flexible studio theater and a set-building shop to support workforce development in theatrical trades. The building is scheduled to open in late 2024, with the theater coming on line in early 2026.

NEW YORK CITY — New York City-based Simone Development Cos. has purchased a retail building in the Morris Park area of The Bronx with plans to convert the property into a 186,298-square-foot industrial facility. The site at 1720 Eastchester Road, which previously housed a 63,000-square-foot Stop & Shop grocery store, liquor store and a Subway restaurant, is adjacent to Hutchinson Metro Center, Simone’s 1.4 million-square-foot mixed-use development. Jonathan Squires and Josh King of Cushman & Wakefield represented the seller, Madison International Realty, in the transaction. Megan Guy, Brian Reardon, Josh Gopan, Dina Gupta and Sean Heneghan represented Simone Development on an internal basis.