WASHINGTON, D.C. — Altus Realty plans to convert an 11-story office building located at 1010 Vermont Ave. NW into Mint House Downtown Washington, D.C. Set to open in early 2025, the property will encompass 85 apartment-style flexible rental units that Mint House will operate. The spaces will be designed for guests who need accommodations ranging from two days to two months. The rooms will range from studios to two-bedroom units that will include a kitchen with a stove and dishwasher, as well as washers/dryers and work spaces. Amenities will include an onsite fitness facility, meeting space and a café. Altus Realty plans to begin repositioning the former office building this fall. The property is situated near a Metro station, McPherson Square Park, The White House and DuPont Circle. This will be the first location in downtown D.C. for Mint House, which operates 25 flexible rental destinations in 16 states. Mint House recently opened locations in Dallas; Birmingham, Ala., and St. Petersburg, Fla.

Property Type

Redline Completes Renovations at Port 26 Creative Office Building in North Charleston, Signs First Tenant

by John Nelson

NORTH CHARLESTON, S.C. — Redline Property Partners has completed renovations at Port 26, an 85,000-square-foot creative office/flex building located at 2155 Eagle Drive in North Charleston. The firm purchased the former industrial facility in December 2021. Building renovations included transforming the building’s exterior, common areas and restrooms; redesigning entrances and lobbies; and creating tenant lounges, outdoor patios and a dog park. Redline also fully upgraded most of the building’s systems. Situated along I-26, Port 26 will soon be home to its first tenant, RXO, a transportation and logistics provider. Nick Tanana and Brady Dashiell of Cushman & Wakefield provide leasing services for Port 26 on behalf of Redline.

GREENVILLE AND TAYLORS, S.C. — Matthews Real Estate Investment Services has brokered the sale of a portfolio of Heroes Car Wash locations in Upstate South Carolina’s Greenville County. The properties are located at 1405 Woodruff Road and 3107 N. Pleasantburg Drive in Greenville and 6050 Wade Hampton Blvd. and 2900 Wade Hampton Blvd. in Taylors. The sale includes both the car wash facilities and the underlying real estate. Jagr Larson, Tyler Spain, Ethan Miller and Simon Assaf of Matthews represented the seller, a North Carolina-based investor that is looking to exit the Greenville market. The buyer, PassiveInvesting.com, acquired the portfolio with plans to continue its expansion in the express car wash business. The sales price was not disclosed, but Matthews disclosed it was 99 percent of the list price.

Trinity Partners Arranges Sale of 58,064 SF Office Building in Charlotte’s SouthPark Submarket

by John Nelson

CHARLOTTE, N.C. — Trinity Partners has arranged the sale of a 58,064-square-foot office building located at 6201 Fairview Road in Charlotte’s SouthPark office submarket. An affiliate of Charlotte-based Big V Property Group purchased the office building from an affiliate of The Daniels Co., an investment firm based in Bluefield, W.Va. Roger Cobb of Selwyn Property Group represented the buyer in the transaction. Dunn Mileham, David Morris and Eric Jennings of Trinity Partners represented the seller. The sales price was not disclosed. The office building was 59 percent leased at the time to sale, and Big V plans to relocate its Charlotte office to the fourth floor.

GRAND PRAIRIE, TEXAS — Locally based developer JPI has broken ground on Phase I of Jefferson Loyd Park, a multifamily project in the central metroplex city of Grand Prairie that will add 450 units to the local supply. The development will consist of eight three-story buildings on a 25-acre site. Units will come in one-, two- and three-bedroom floor plans, and amenities will include a pool and a fitness center. Completion of Phase I is slated for early 2025. Construction of Phase II of Jefferson Loyd Park, which will feature 352 units, is set to commence later this year. Other project partners include Demarest (architect), Kimley-Horn (civil engineer) and Happy State Bank (construction lender).

MELISSA, TEXAS — Dallas-based Welker Properties will develop a 343-unit build-to-rent residential project in Melissa, located north of Dallas in Collin County. The project, known as Wolf Creek Farms Melissa BTR, has a total price tag of $95 million. Homes will come in one-, two- and three-bedroom floor plans and will be situated on a 32-acre site. Residents will have access to amenities such as a pool, fitness center, dog park, courtyards and lounges. Construction is scheduled to begin in the fall and to be complete by the end of 2025.

INDIANAPOLIS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Marwood Plaza in Indianapolis for an undisclosed price. The Kroger-anchored shopping center totals 107,080 square feet. The property was originally developed in 1972 and completely refurbished in 2021. Kroger occupies 42 percent of the property’s gross leasable area. Bill Rose, Erin Patton, Scott Wiles and Craig Fuller of IPA represented the seller, Citivest Commercial, and procured the buyer, Core Marwood Plaza LLC. The shopping center was 93.5 percent occupied at the time of sale. Tenants include Buyer’s Market, Laundry & Tan Connection, Chase Bank, Los Patios Mexican restaurant, China One restaurant and H&R Block.

ELGIN, ILL. — Seefried Properties has broken ground on a two-building speculative industrial development in Elgin. The 465,360-square-foot project is slated for completion in the third quarter of 2024. The buildings will feature clear heights ranging from 32 to 36 feet, 185-foot-deep truck courts and 236 trailer parking spaces. The project team includes Harris Architects, FCL Builders and Spaceco as civil engineer. Jason West and Doug Pilcher of Cushman & Wakefield are marketing the project for lease.

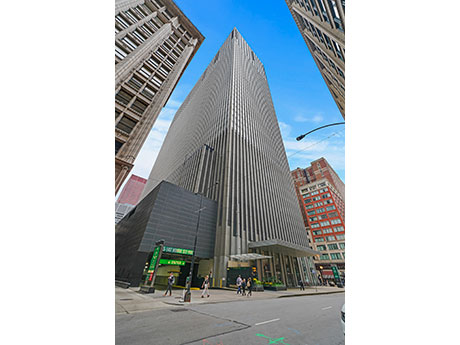

CHICAGO — Analytics8, a consulting firm that specializes in data strategy implementation, has signed a 13,355-square-foot office lease at 55 East Monroe in Chicago for its new U.S. headquarters. The firm is more than doubling its current 6,000-square-foot space at 150 N. Michigan. Victor Sanmiguel of Bespoke Commercial Real Estate represented Analytics8. Michael Lirtzman, Marina Zelenkova and Michelle Levy of Colliers represented the landlord, PGIM Real Estate. Rising 49 stories and totaling 1.2 million square feet, 55 East Monroe is situated in the city’s East Loop submarket. Amenities include a 3,400-square-foot conference center, 10,000-square-foot fitness center and the 10,000-square-foot Forum 55 food hall. More than 90,000 square feet of leases have been signed at the property within the last seven months. PGIM has unveiled plans to upgrade the building’s common areas, including the lobby, conference center and other amenity spaces in 2024.

FOREST PARK, ILL. — Interra Realty has brokered the $1.8 million sale of a 15-unit apartment building in the Chicago suburb of Forest Park. Located at 102 Rockford Ave., the three-story property was constructed in 1979. There are five studios and 10 one-bedroom units, all of which were fully occupied at the time of sale. Patrick Kennelly and Paul Waterloo of Interra represented both parties in the transaction. The buyer completed a 1031 exchange.