MESA, ARIZ. — StarPoint Properties has received a $52 million loan for the construction of Lotus Point, a 245-unit apartment community in Mesa. Jeff Sause, Wyatt Strahan and Elle Miraglia of JLL Capital Markets arranged the construction financing for the project through a debt fund. Lotus Point will rise four stories and offer studio, one- and two-bedroom units. Amenities will include a fitness center, clubhouse, coworking facility and community kitchen. On-site parking will include a mix of tuck-under and grade-level parking. Development is slated for completion by early 2025.

Property Type

SAN DIEGO — High Bluff Capital Partners, a San Diego-based investor, will assume ownership of a portfolio comprising 81 Hardee’s locations following an auction. Located in Montana, Wyoming, Alabama, Florida, Georgia, Kansas, Missouri and South Carolina, the restaurants were previously owned by franchisee Summit Restaurant Group, which filed for Chapter 11 bankruptcy in May of this year. The transaction is expected to close in August. Dave Dixon will oversee operation of the restaurants.

PORTLAND, ORE. — Waterton has acquired The Parker, a 177-unit apartment community in Portland. The Parker rises six stories in the Pearl District, one mile north of downtown Portland. The community offers one- and two-bedroom apartments, as well as amenities such as an outdoor courtyard with grilling stations, a fitness center, a dog wash station, bike storage and a community room with a kitchen and business center. Waterton plans to renovate units with new backsplashes, flooring, lighting, plumbing fixtures, cabinets, shades and mirrors.

JLL Arranges $11.8M Financing for Third Thyme Affordable Housing Community in Los Angeles

by Jeff Shaw

LOS ANGELES — JLL Capital Markets has arranged $11.8 million in permanent financing for Third Thyme, a 104-unit affordable housing community in Los Angeles. Anson Snyder led the team that secured the 15-year, fixed-rate, Freddie Mac loan on behalf of the borrower, West Hollywood Community Housing Corp. JLL Real Estate Capital will service the loan. Third Thyme is located at 1441 W. 3rd St. on a 14,866-square-foot site. The property will utilize 9 percent Low-Income Housing Tax Credits and public funds. Income restrictions were not disclosed.

PHOENIX — ABI Multifamily has brokered the $2.2 million sale of an eight-unit apartment property at 4229 North 17th St. in Phoenix. The buyer and seller are based in Arizona. Mitchell Drake, Dallin Hammond and Carson Griesemer represented the seller in this transaction. The property was originally built in 1982 and renovated in 2020. Interior renovations include contemporary cabinets, stainless-steel appliances, vinyl flooring, floating bathroom vanities and more. Units come in two-bedroom layouts. Exterior renovations include a dog run, community patio grill and picnic area. 4229 North 17th Street is a garden-style community with gated access.

Berkadia Arranges $47M Construction Loan for Apartment Development in Fayetteville, North Carolina

by John Nelson

FAYETTEVILLE, N.C. — Berkadia has arranged a $47 million construction loan for The One at Hope Mills, a 360-unit, garden-style apartment community that will be located at 3680 Elk Road in Fayetteville. Mitch Sinberg, Brad Williamson, Scott Wadler and Matt Robbins of Berkadia’s South Florida office arranged financing on behalf of the Miami-based borrower, One Real Estate Investment (OREI). City National Bank of Florida and Abanca provided the floating-rate loan. Construction will begin in the third quarter, and the property is scheduled for completion in the second half of 2024. The design-build team includes general contractor Berkley Hall Cos., architect BSB Design and civil engineer Site Design Inc. Upon completion, The One at Hope Mills will feature a mix of one-, two- and three-bedroom units, as well as a resort-style pool, outdoor cabana with TVs, a game room with billiards and shuffleboard and a modern fitness center.

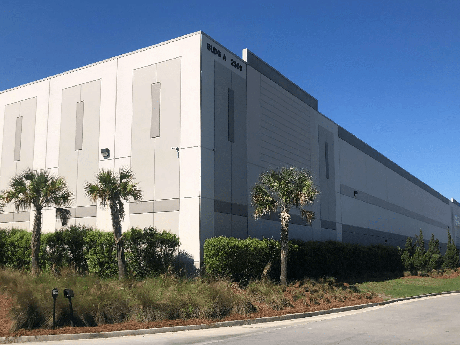

OCALA, FLA. — Stonemont Financial Group and US Capital Development have completed the development of a $28 million speculative industrial facility located in Ocala, about 37 miles south of Gainesville, Fla. Situated on 35 acres, Topline Logistics Facility totals 457,000 square feet and features 36-foot clear heights, 95 dock doors, four drive-in doors and 110 trailer parking spaces. Construction on the project began in March of last year. HDA Architects designed the property, and Frampton Construction served as general contractor.

JACKSONVILLE, FLA. — Olympus Property has acquired Presidium Town Center, a 370-unit multifamily community located in the Deerwood Park neighborhood of Jacksonville. The property was developed in 2021 by Texas-based multifamily developer Presidium. The buyer has rebranded the community as Olympus Preserve at Town Center. The property offers apartments in studio, one-, two- and three-bedroom layouts and amenities including a swimming pool, rooftop lounging deck, fitness center and indoor and outdoor fireplaces. Rents start at $1,611, according to the community website. The sales price was not disclosed.

GARDEN CITY, GA. — Dermody Properties has acquired a 312,000-square-foot logistics facility located at 2509 Dean Forest Road in Garden City, about three miles west of the Port of Savannah’s Garden City Terminal. Yokohama Off-Highway Tires America Inc. and GFA Inc. occupy the property, which features 32-foot clear heights, 89 dock-high doors, three drive-in doors, 74 trailer parking spaces, T-5 lighting and ESFR fire protection. Britton Burdette, Matt Wirth, Jim Freeman, Dennis Mitchell and Mitchell Townsend of JLL arranged the transaction. The seller and sales price were not disclosed.

NASHVILLE, TENN. — Switchyards, a coworking concept based in Atlanta, will open an 8,000-square-foot club at 1101 Chapel Ave. in the Eastwood neighborhood of Nashville. Located within a historic building that formerly housed a church, the space will feature a café, work stations, two libraries, eight soundproof phone booths and three meeting rooms. The landlord is locally based Vintage South Development. Switchyards Eastwood is scheduled to open in September.