PEARL RIVER, N.Y. — Strides Pharma Inc. has signed a 57,197-square-foot industrial lease in Pearl River, located along the New York-New Jersey-border. The Indian pharmaceutical manufacturer will occupy the entirety of two buildings within Hudson Valley iCampus, a 207-acre development. James Schroeder of JLL represented Strides Pharma in the lease negotiations. Robert Lella, Sheena Gohil and Charles Hatfield of Colliers, along with internal agent Jamie Schwartz, represented ownership.

Property Type

PATERSON, N.J. — Locally based brokerage firm Gebroe-Hammer Associates has negotiated the $3.7 million sale of two apartment buildings totaling 18 units in the Northern New Jersey community of Paterson. The buildings are located in the Wrigley Park area and include commercial uses. Debbie Pomerantz of Gebroe-Hammer represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

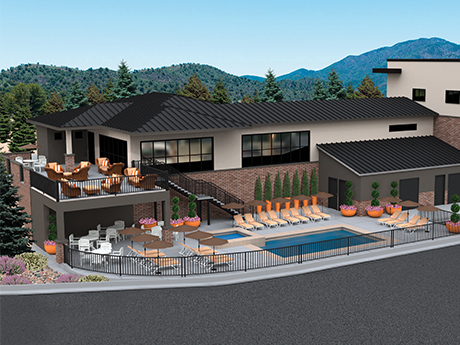

PRESCOTT, ARIZ. — Montezuma Heights Investors has unveiled plans for Montezuma Heights, a $41 million luxury multifamily development in Prescott. The groundbreaking ceremony will be held July 13. The development, located at 609 Bagby Drive, will feature 144 apartment units with one- to three-bedroom floor plans. Amenities will include a state-of-the-art gym, lounge, outdoor grotto with grilling area, dog parks, multiple fire pits and electric car charging stations. The community will also have a trail connection to Granite Creek Park and the Depot shopping center. The developer expects the construction process to take 20 months. MEB Management will serve as the community’s manager and leasing agent.

Ryan Cos. Begins Construction of 101,136 SF Medical Office Building in Scottsdale, Arizona

by Jeff Shaw

SCOTTSDALE, ARIZ. — Ryan Cos. has begun construction on a multi-tenant medical office building in Scottsdale. The two-story, 101,136-rentable-square-foot building is called One Scottsdale Medical. It is 80 percent preleased, with the City of Hope and Exalt Health serving as anchor tenants. They will occupy about 30,000 and 50,000 square feet, respectively. The building will provide additional space for lease to medical tenants. One Scottsdale Medical is scheduled for completion by third-quarter 2024. Mari Lederman and Katie McIntyre from JLL’s Phoenix office are the project’s exclusive leasing brokers.

ST. PAUL, MINN. — Kraus-Anderson has completed Phase II construction of Lexington Landing, a $24 million seniors housing development in St. Paul’s Highland Park neighborhood. Designed by Pope Design Group, the four-story building features 92 independent living units. Amenities include a pickleball court, golf simulator, club lounge, community room, library, community garden, dog park, rooftop patio, fitness room and guest suite. Lexington Landing also offers event and activity programming, spiritual care and scheduled transportation. J.A. Wedum Foundation is the owner and PHS Management LLC is the property manager.

PHOENIX — Topp Corp. has purchased The Marlowe, a 53-unit apartment complex in Phoenix, for $8.4 million. Built in 1968, the majority of the apartment interiors have been renovated with new cabinets, countertops, appliances, flooring and lighting. The average unit size is 552 square feet. The Marlowe offers new ownership an opportunity to implement a comprehensive value-add strategy by renovating the remaining 20 percent of apartment interiors and adding custom touches to enhance the community. The community enjoys a central location near Tempe, Scottsdale and Phoenix Sky Harbor International Airport. It features a central garden courtyard, swimming pool, laundry facility and assigned parking. Paul Bay and Darrell Moffitt of Marcus & Millichap, in conjunction with Cliff David and Steve Gebing of IPA, represented the seller, Living Well Homes, and procured the buyer.

HIGHLAND, IND. — Mid-America Real Estate Corp. has negotiated the sale of Highland Grove in Highland, a northwest suburb of Indianapolis. The sales price was undisclosed. The 312,406-square-foot shopping center is fully leased. Tenants include Kohl’s, Burlington, Macy’s, Michaels, Petco, Ulta, Five Below, Famous Footwear, Potbelly, Torrid and Olive Garden. Target, Best Buy and Ashley Furniture shadow anchor the property. Ben Wineman, Joe Girardi and Rick Drogosz of Mid-America represented the undisclosed seller. Bridge33 Capital was the buyer.

Saunders, NavPoint Complete Construction of Two Industrial Buildings in Castle Rock, Colorado

by Jeff Shaw

CASTLE ROCK, COLO. — Saunders Development and NavPoint Real Estate Group have completed construction on two 80,000 square-foot industrial buildings in Castle Rock. The buildings, designed for distribution tenants, feature a ceiling height of 24 feet. Lakewood Electric and Colorado Powerline are the first tenants to operate from one of the buildings. Jeff Brandon and Charlie Davis of NavPoint Real Estate Group are handling the leasing of these two buildings.

ELMHURST, ILL. — Focus Healthcare Partners LLC, a Chicago-based real estate investment and asset management firm, has acquired a senior living community in Elmhurst for an undisclosed price. The buyer will rebrand the property as The Roosevelt at Salt Creek and convert it from an entrance-fee model to a rental community offering both independent living and assisted living. Life Care Services will manage the community and help facilitate its multi-year renovation. The transformation will include building out common areas with a new design and broadening programming options for residents. Amenities will include an indoor pool, cinema, art studio, game room and sports lounge. The property was formerly named Lexington Square Senior Living.

TACOMA, WASH. — Colliers has brokered the sale of a self-storage property located at 8233 S. Hosmer in Tacoma. Hosmer Self Storage LLC sold the property, spanning 46,265 square feet and consisting of 454 storage units, to Merit Hill Capital. The price was not disclosed. The facility offers a range of storage unit sizes, including drive-up units and options for indoor vehicle storage. The Colliers de Jong | Becher Self Storage Team represented the seller in the negotiation process.