CHICAGO — Interra Realty has negotiated the $7.5 million sale of a two-building multifamily portfolio on Chicago’s South Side. The properties on South Paxton Avenue total 79 units and consist of three studios, 21 one-bedrooms, 33 two-bedrooms, 13 three-bedrooms and nine four-bedroom units. As part of the transaction, the buyers assumed the existing long-term Fannie Mae loan from the seller. Lucas Fryman of Interra represented the sellers, Mendy Raskin and Jon Kranzler. Brad Feldman of Interra represented the buyer, a local private investor. The portfolio was 94 percent occupied at the time of sale.

Property Type

LAKE ZURICH, ILL. — Principle Construction Corp. has completed a 13,500-square-foot apartment and retail building in downtown Lake Zurich, a far northwest suburb of Chicago. The brownfield redevelopment project at 17 S. Old Rand Road was made possible by the consolidation of several vacant lots from previously demolished, outdated retail buildings. The new development includes 6,750 square feet of first-floor commercial space and four luxury apartment units. The anchor tenant is Lake Zurich Florist, which is doubling its retail footprint. All four apartment units are occupied. Muran Architects designed the building.

LINDEN, N.J. — SRS Real Estate Partners has brokered the sale of a ground lease for a 185,682-square-foot retail building in the Northern New Jersey community of Linden that is occupied by Walmart. The building was constructed on 14 acres in 2019, and there are 17 years remaining on the corporate-guaranteed lease. Matthew Mousavi, Patrick Luther, Britt Raymond and Kyle Fant of SRS represented the sellers, Dallas-based developer Cypress Equities and San Francisco-based investment firm Stockbridge Capital Group, in the deal. David Chasin of Pegasus Investments Real Estate Advisory represented the buyer.

LAWRENCE, MASS. — MassDevelopment and Reading Cooperative Bank have provided a $6.6 million loan for a project that will convert two vacant buildings in Lawrence, located near the Massachusetts-New Hampshire border, into a 24-unit affordable housing complex. The buildings previously housed a mix of office and retail uses, and the residential complex will include a food hall in the remaining retail space. MassDevelopment and Reading Cooperative Bank were equal participants in the loan, and MassDevelopment also enhanced the loan with a guarantee. Construction will begin in July and last about a year. The borrower is The Jowamar Cos.

SIHI, Graycor Construction Break Ground on 516,320 SF Camelback 303 Industrial Park in Goodyear, Arizona

by Jeff Shaw

GOODYEAR, ARIZ. — Sunbelt Investment Holdings and Graycor Construction Company have begun construction on Phase I of Camelback 303, a Class A industrial park in Goodyear. The first phase consists of a 516,320-square-foot building within the Loop 303 Corridor. It is designed for use by a single tenant, or it can be divisible to three tenants. The Camelback 303 project aims to provide warehouse, distribution and manufacturing space. At completion, Camelback 303 is slated for up to 16 buildings ranging from 32,400 square feet to 1.2 million square feet. The development is part of the even larger PV|303 master-planned business park, which totals 1,600 acres and offers 20 million square feet of industrial, office and retail space. Construction on Camelback 303 Phase I is underway now, with completion scheduled for first-quarter 2024. The architect for Camelback 303 is Butler Design Group. Graycor Construction serves as the general contractor. Andy Markham, Mike Haenel and Phil Haenel of Cushman and Wakefield are the project’s exclusive leasing brokers.

Lee & Associates-Ontario Negotiates $19.5M Sale of Riverside Business Park in Jurupa Valley, California

by Jeff Shaw

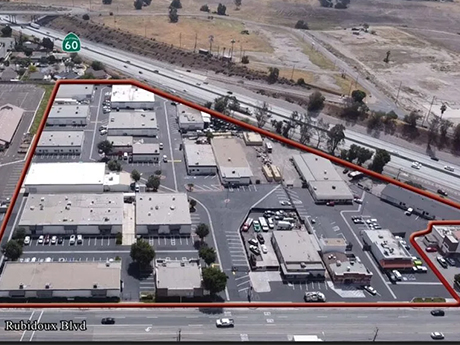

JURUPA VALLEY, CALIF. — Lee & Associates-Ontario has facilitated the sale of Riverside Business Park, a fully occupied, multi-tenant business park in Jurupa Valley. Intersection Equities LLC acquired the asset, consisting of 37 units across 22 buildings, for $19.5 million. The park features ground-level and dock-high door loading, private yards, and clear heights of up to 16 feet. The sellers were Bravo Whiskey Properties LLC and Transition Properties LLC. The selling agent, Barret Woods of Lee & Associates-Ontario, represented himself as a principal in the transaction. Brad Yates and Stefan Pastor of Stream Realty represented the buyer.

Bayview Provides $19.8M C-PACE Financing for Hotel Development Near Yosemite National Park

by Jeff Shaw

OAKHURST, CALIF. — Bayview PACE has provided a $19.8 million financing agreement for the construction of a new 125-room hotel in Oakhurst, about 16 miles south of Yosemite National Park. The financing will enable the start of construction on the resort, which aims to attract adventure and lifestyle travelers. The project will feature luxury accommodations, a full restaurant and bar, meeting spaces and other amenities. Waterton and equity partner Argosy Real Estate are the developers.

PHOENIX — Jamie Godwin, president of Stevens-Leinweber Construction (SLC), has purchased a two-story office building in Phoenix’s Camelback Corridor area for $3.8 million. The building will undergo a multi-million-dollar renovation to serve as the company’s new, expanded headquarters. The renovation plans include modernizing the building’s interior, creating employee-centric amenities and improving common areas. Other planned improvements include renovations to the building’s shared courtyard and common areas, new HVAC systems and the addition of a fire sprinkler system. Chris Krewson of Newmark represented SLC in the purchase of the 5045 building. Wally Hale and Drew Sampson of Avison Young represented the building’s seller, 5045 Associates LLC. Renovations are underway, with the project slated for completion by the end of this year.

SALT LAKE CITY — Workbox, a member-driven coworking company, is set to open its first location outside of the Midwest in Salt Lake City. The new coworking space will be in the historic Orpheum Theater, which formerly served as a CommonGrounds Workplace location. Workbox offers shared kitchen spaces, private conference rooms and programming events.

DEBARY, FLA. — Mosaic Development LLC has purchased 13.1 acres of land in Debary, roughly 23 miles north of Orlando, for the development of the first phase of a mixed-use project to be located immediately north of the city’s SunRail station. Upon completion, the “Main Street-style” development will feature 500 apartment units, 40,000 square feet of retail space and a central park and community plaza. Construction on the project is scheduled to begin early next year. Mosaic purchased the land parcels, which are zoned as a transit-oriented development (TOD) district, from private landowners as well as the City of DeBary for a total $4.2 million. Mosaic is currently under contract to purchase an additional 5.7 acres within three years for the second phase of the development. Colliers worked to bring the private owners into a joint marketing agreement with the city. Ken Krasnow, Brooke Mosier and David Calcanis of Colliers represented the sellers, which included Miller Land Trust, Ray Sands/Frank Slabodnik, Empire Cattle and DeBary Central LLC, in addition to the city. Casey Babb of Colliers represented Mosaic in the transaction. “I envision a main street that serves as the vibrant heart of our community — a place where neighbors …