WALNUT CREEK, CALIF. — CBRE has brokered new office leases at Ygnacio Center in Walnut Creek. The leases, totaling 13,916 square feet, were secured for accounting firm BDO USA and law firm Pennington LLP. Ygnacio Center is a Class A office complex spanning 536,000 square feet and three buildings. The recently enhanced amenities include a state-of-the-art conference center, as well as bike parking and showers for tenants. Phil Damaschino, Jeff Birnbaum and Andy Schmitt from CBRE represented the landlord, Hines. Gabe Chao from Transwestern represented BDO and Mindy Bacharach from Commercial East Bay represented Pennington LLP.

Property Type

PORTLAND, ORE. — BPM Real Estate Group, a locally based and privately owned development and investment company, plans to open the Block 216 mixed-use tower in downtown Portland in August. Located at 900 SW Washington St., the tower will house The Ritz-Carlton, Portland hotel, the brand’s first in the Pacific Northwest. In addition to the 251-room hotel, the high-rise will include The Ritz-Carlton Residences (132 condos and penthouses across 15 floors), shops and 134,000 square feet of office space, as well as a food hall on the ground level known as FLOCK. Development costs for Block 216 are reportedly $600 million. “As one of the tallest towers in Portland, this development is a monumental signifier of the renewal and transformation in store for this city,” says Walter Bowen, founder and CEO of BPM. “We are pleased to contribute to Portland’s continued recovery and resurgence as one of the country’s leading business centers and gateway to the Pacific Northwest travel destination locations.” The Ritz-Carlton hotel’s amenities will include a spa, signature restaurant on the 20th floor, infinity-edge pool and a 4,000-square-foot fitness center, according to the hotel website. FLOCK, which will house nine BIPOC-owned (black, indigenous and people of color) vendors, is …

— By Evan Jurgensen, Senior Vice President, Lee & Associates Los Angeles – Downtown — As the pandemic recedes, the hospitality and food and beverage industries in downtown Los Angeles are rebounding, driven in part by the return of venue entertainment and conferences. The number of visitors to the area has climbed back to within 10 percent of pre-pandemic levels and now sits at 10 million people per month. Consequently, there has been an influx of new restaurants, venues and breweries in the region. However, as overall occupancy levels in the market remain in flux, businesses are becoming mindful of how they utilize their spaces to achieve a triple bottom line impact that benefits not only the asset owner, but also the consumer and community at large for the long run. Increased Investment in Outdoor Space Outdoor dining saved many restaurants during the pandemic and continues to have great appeal in the present day. In addition to being a healthier option for diners, outdoor seating allows restaurants to handle more customers at once and increase profitability. Los Angeles city officials created a streamlined process known as the L.A. Al Fresco program in May 2020, which allowed more than 2,500 restaurants and …

For real estate investors who have an acquisition teed up or who need to refinance, the prospects of finding debt today are arguably the bleakest they have been since the financial crisis 15 years ago. Higher interest rates and concerns over growing distress convinced banks and other lenders to move to the sidelines several months ago, thwarting commercial real estate investment sales. In turn, that is fueling broad uncertainty over what properties are really worth, which only begets more unease among banks. But private debt funds, which typically provide short-term rate bridge loans, are more likely to make deals when banks will not, says Jeff Salladin, a managing director with Dallas-based debt fund Revere Capital. That’s because debt funds like Revere raise capital from sophisticated investors to fund their loans, he says, while banks rely on deposits. That subjects banks to stringent regulatory oversight, which is especially intense in today’s debt climate. “All investors dislike uncertainty, and banks are investors by another definition,” states Salladin, who oversees real estate lending for Revere. “As a result, we could be in the first inning of a golden era for debt funds like ourselves, because we’re more flexible in way banks can’t be.” …

Merritt Properties Begins Construction on 750,000 SF Industrial Project in Metro Baltimore

by John Nelson

WHITE MARSH, MD. — Merritt Properties has begun construction on White Marsh Interchange Park, a 750,000-square-foot industrial project located at 10301 Philadelphia Road in White Marsh, roughly 17 miles outside Baltimore. Upon completion, the development will comprise nine one-story buildings situated on 56 acres. The first phase of the project will include three buildings totaling 235,000 square feet. The buildings will feature 20- to 32-foot clear heights, truck courts with rear-loaded docks and drive-in capabilities and parking with trailer storage. Merritt Construction Services will manage the construction, the first phase of which is scheduled for completion next spring. Merritt acquired the land for the project in 2021.

NEW KENT, VA. — Texas-based Buc-ee’s has purchased 27.7 acres off I-64 in the Richmond suburb of New Kent, with plans to develop the brand’s first location in Virginia. Upon completion, the Buc-ee’s Super Center will comprise 75,000 square feet of retail space, 120 fueling stations, electric vehicle chargers and more than 650 parking spaces. Construction on the project is scheduled for completion within the next 24 months. Nathan Shor of S.L. Nusbaum Realty Co. represented both the seller and Buc-ee’s in the land acquisition.

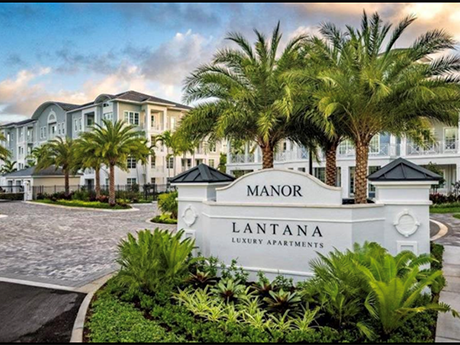

LANTANA, FLA. — The Praedium Group has acquired Manor Lantana, a 348-unit multifamily community located in Lantana, a city in South Florida’s Palm Beach County. Built in 2022, the property comprises four four-story buildings, 18 two-story villas featuring tuck-under garages and a two-story clubhouse. Apartments at the community average 1,164 square feet. Amenities include a spa, golf simulator and a fitness center. The seller and sales price were not disclosed.

Cushman & Wakefield | Thalhimer Brokers $8.2M Sale of Turnberry Crossing Shopping Center in Newport News, Virginia

by John Nelson

NEWPORT NEWS, VA. — Cushman & Wakefield | Thalhimer’s Capital Markets Group has brokered the $8.2 million sale of Turnberry Crossing, a retail center in Newport News. Located at 12638 Jefferson Ave., Goodwill anchors the 53,775-square-foot center, which was 95 percent leased to 17 tenants at the time of sale. Other tenants include Hertz, Papa John’s and DaaBIN Store. Catharine Spangler of Thalhimer arranged the transaction on behalf of the seller, Stavins & Axelrod. Raleigh-based Prudent Growth Partners acquired the property.

CHATTANOOGA, TENN. — Four new retail tenants will join Hamilton Place, a 1.2 million-square-foot enclosed shopping mall in Chattanooga. Crunch Fitness will open a 35,000-square-foot location at the property’s former Sears location, and restaurants Texas Roadhouse, Taco Mamacita and Community Pie have also signed leases. Construction on the Crunch Fitness space is scheduled to begin in August, with the opening planned for later this year. Work is currently underway on Community Pie and Taco Mamacita, which will open in July and next year, respectively. Texas Roadhouse is also scheduled to open next year, with construction anticipated to begin later this month. Chattanooga-based CBL Properties is the landlord and purchased the mall’s former Sears building in 2017.

HOUSTON — MetroNational has completed the $25 million renovation of Memorial City Plazas, a 1 million-square-foot office development in Houston’s Memorial City district. Memorial City Plazas comprises three buildings that rise 12, 14 and 18 stories. The renovation delivered upgraded amenity spaces, including the campus’ fitness center and conference room, and the addition of a new outdoor dining and meeting space. MetroNational also upgraded the touchless technology features, security systems and skywalks that connect the three buildings. Ziegler Cooper served as the project architect. E.E. Reed Construction and O’Donnell/Snider Construction served as the general contractors.