OKLAHOMA CITY — LSC Development has acquired a 161,190-square-foot retail building formerly occupied by Sears in Oklahoma City with plans to redevelop the property into a mixed-use facility with retail self-storage uses. The site is adjacent to a Walmart Neighborhood Market and across the street from the 31-acre INTEGRIS Southwest Medical Center. Michael Brewster, Drew Quinn, Brad Peterson, El Warner and Charley Simpson of Colliers represented the undisclosed seller in the transaction.

Property Type

HOUSTON — Baker Katz has arranged three retail leases totaling 19,050 square feet for Pet Supplies Plus in metro Houston. The pet care brand will occupy 6,000 square feet in the northern suburb of Conroe beginning in the fourth quarter. Additionally, Pet Supplies Plus will open a 5,550-square-foot store in Cypress and a 7,500-square-foot space in north Katy in the second quarter of 2024. Brett Levinson of Main Street Commercial Partners represented the landlords in the Conroe and Katy deals. Brad Kilbride of Retail Leasing represented the landlord in the Cypress deal.

DALLAS — Law firm Simon Greenstone Panatier has signed a 28,366-square-foot office lease at Bank of America Plaza in downtown Dallas. The 72-story, 1.8 million-square-foot complex offers a fitness center, conference facilities, tenant lounge, car wash services and multiple onsite dining options. Ryan Hoopes, Tom Sutherland and Dean Dahlsten of Cushman & Wakefield represented the tenant in the lease negotiations. Russ Johnson and Joel Pustmueller of JLL represented the landlord, Metropolis Investment Holdings Inc.

IRVING, TEXAS — Daikin Applied, a provider of commercial HVAC systems and services, has renewed its lease for 13,000 square feet of industrial space at Las Colinas Distribution Center in Irving. Brian Pafford of Bradford Commercial Real Estate Services represented the landlord, an entity doing business as Las Colinas AAA Investment LLC, in the lease negotiations. Michael Paine of Cushman & Wakefield represented the tenant.

NEWARK, N.J. — JLL has arranged a $64.3 million construction loan for Bridge Point 15E, a 211,388-square-foot speculative industrial project in Newark. The site is located less than three miles from the city’s airport and seaport facilities. Michael Klein, Jon Mikula and Michael Lachs of JLL arranged the three-year loan through global investment management firm Heitman LLC on behalf of the borrower, Bridge Industrial. A tentative completion date was not disclosed.

BALA CYNWYD, PA. — LCB Senior Living has completed The Residence at Bala Cynwyd, an adaptive reuse project located northwest of Philadelphia. The number of units was not disclosed. Built in the 1850s as Benjamin Schofield’s West Manayunk Woolen Mills, the property eventually became known as Lee’s Shoddy Mill, named after the heavy fabric created from recycled wool and cotton. The Residence at Bala Cynwyd offers independent living, personal care and memory care accommodations. Units are available in studio, one-bedroom and two-bedroom floor plans.

LOWELL, MASS. — Regional brokerage firm Northeast Private Client Group (NEPCG) has negotiated the $12.8 million sale of Willard Street Apartments, a 72-unit multifamily complex in Lowell, a northern suburb of Boston. The three-building property houses three studios, 24 one-bedroom units and 45 two-bedroom apartments. Francis Saenz, Drew Kirkland, Jim Casey, Brad Carlson and Brett Curtis represented the seller and procured the buyer, both of which requested anonymity, in the transaction. The new ownership plans to implement a value-add program.

NEW YORK CITY — West Publishing Corp. has signed a five-year, 46,105-square-foot office lease extension at 3 Times Square in Midtown Manhattan. The company will occupy the entire 17th floor and a portion of the 18th floor at the 885,000-square-foot building, which was originally constructed in 2001 as the headquarters for Reuters and recently underwent a capital improvement program. Mitchell Konsker, Dan Turkewitz and Christine Tong of JLL represented the tenant in the lease negotiations. Tom Keating represented the landlord, locally based investment firm Rudin, on an internal basis.

EVERETT, MASS. — A partnership between two locally based developers, RISE and btcRE, will build a 46-unit multifamily project at 52 School St. in Everett, a northern suburb of Boston. The four-story building will feature a mix of studio, one- and two-bedroom units, and seven residences will be reserved for renters earning 80 percent or less of the area median income. Needham Bank provided financing for the construction of the project, which is scheduled to begin in the third quarter.

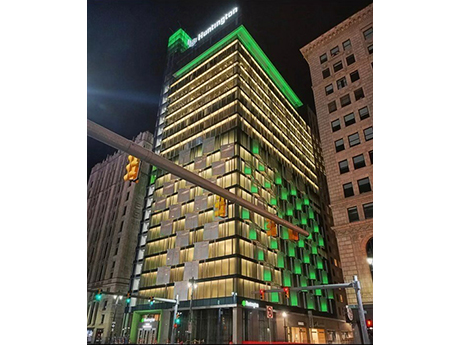

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …