SAN MARCOS, TEXAS — Texas-based Scarborough Lane Development and Partners Real Estate have announced plans for AXIS Logistics Park, a 2,000-acre industrial park in San Marcos. Formerly known as SMART Terminal, the property site is within the Texas Triangle, an urban region consisting of the Dallas-Fort Worth, Houston, San Antonio and Austin metropolitan areas. A development timeline for the park was not disclosed. However, approximately 735 acres of the park are currently zoned for industrial use. The property will include water and wastewater infrastructure, as well as a high-voltage (600 megawatt) electric system with a 356 kilovolt transmission line. The site’s location is near Loop 110, I-35, I-10 and SH-130. Union Pacific Railway, The BNSF Railway and the San Marcos Regional Airport are also adjacent to the property and may provide rail and shipping components to the park. “In addition to being in a strategically ideal location to serve the Texas Triangle, AXIS Logistics Park is the obvious choice for logistics and shipping by national and international manufacturers,” says John Colglazier, a partner at Partners Real Estate. “Mexico is actively working to bring manufacturing back in their country, and they will fully utilize I-35 as their main corridor through Texas …

Property Type

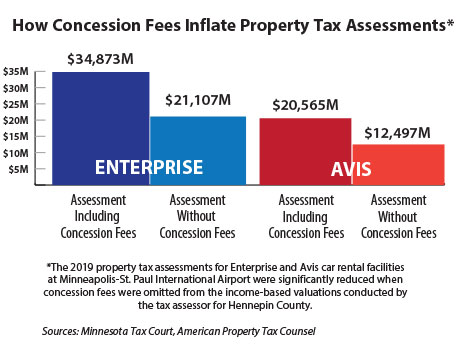

By Timothy Rye, Larkin Hoffman A recent Minnesota Supreme Court ruling requires tax assessors to exclude an airport’s concession fees from rent-based valuations for property tax purposes. The case offers a flight plan to lower taxes at many of the nation’s transportation hubs and underscores the importance for all taxpayers to exclude business value from taxable property value. Every major airfield collects fees from food-and-beverage providers, retailers, banks and other businesses that provide goods or services on airport property. Concessionaires, or those who pay the concession fees to the property owner, commonly pay these charges in addition to rent owed for the real estate where they operate. Many of these businesses are also responsible for property tax that passes through to tenants in a commercial lease. The cases leading up to the March 29 state Supreme Court decision involved two car rental companies that challenged their 2019 tax assessments, claiming the assessor’s office had overstated their property values by including concession fees in its income-based valuation. High-Flying Fees Both Enterprise Leasing Co. of Minnesota and Avis Budget Car Rental pay a concession fee equal to 10 percent of gross revenues in addition to real estate rent for their operations at …

— By Aiman Noursoultanova, Senior Vice President, CBRE — Reno has become an increasingly attractive market over the past decade for multifamily investors due to its continued strong performance, fueled by a desirable business and regulatory climate. Rents have doubled since 2013, while vacancy has continued to remain healthy despite robust construction activity. Multifamily investors took notice once noteworthy companies like Apple, Google, Microsoft and Tesla began to increase their investments in the region. Strong Population, Job Growth Fuel Investment Reno’s population grew by 15.3 percent in the past decade. The area is projected to see 51.6 percent population growth by 2060, the 40th highest of all 384 U.S. metro areas, according to Washington D.C.-based economic and demographic data firm Woods & Poole Economics. As a testament to the area’s growth, the Reno-Tahoe International Airport recently announced a $500 million development and expansion project to accommodate airport traffic. The area’s rise in population is attributed primarily to job growth and a desirable quality of life. This started with Tesla’s initial Gigafactory investment in the region, then continued with Apple’s 1.1-million-square-foot data center campus. Google also purchased 1,210 acres and plans for a future data center development. Meanwhile, Tesla announced a $3.6 …

PHOENIX — A joint venture between Toll Brothers Apartment Living and The Davis Cos. has opened Callia, a 403-unit community in Phoenix’s midtown neighborhood. The developers broke ground on the project in 2021, with resident occupancy beginning in October 2022. Pinnacle Financial Partners and Trustmark provided a construction loan facility for the development. Callia is situated on an 8.2-acre site. Phoenix-based architect Biltform and interior designer Streetsense designed the property. Callia offers studio, one-, two- and three-bedroom apartments, as well as nine live-work units. Community features include surface parking, tuck-under garages, EV charging stations, multiple lounges, a package room with cold storage, a fitness center, coworking spaces, property-wide Wi-Fi, a dog park with a pet wash station, bike storage and a bike service station. The property also offers 1,100 square feet of ground-floor retail space.

Wonderful Real Estate Breaks Ground on 1.1 MSF Spec Industrial Development in Shafter, California

by Jeff Shaw

SHAFTER, CALIF. — Wonderful Real Estate has broken ground on a 1.1 million-square-foot speculative development at the Wonderful Industrial Park (WIP) in Shafter. The facility will be located at 5401 Express Ave. It will be the fifth speculative development delivered by WRE over the past five years. WRE has developed and leased more than 1.3 million square feet at Wonderful Industrial Park in 2022. This includes a 1 million-square-foot spec project that was leased by a Fortune 500 food manufacturer and a 309,000-square-foot building leased by existing tenant GAF, the nation’s largest manufacturer of roofing and waterproofing products. WRE is also in the final stages of design on a 415,000-square-foot speculative building in the park that is scheduled for delivery in the first half of 2024.

Dwight Mortgage Trust Provides $36.3M Refinancing for Villa Annette Apartments in Moreno Valley, California

by Jeff Shaw

MORENO VALLEY, CALIF. — Dwight Mortgage Trust has provided a $36.3 million bridge loan to refinance Villa Annette Apartments in Moreno Valley, a city in the Inland Empire region of California, about 64 miles east of Los Angeles. Latco Enterprises owns the 220-unit property, which is newly built and currently in lease-up. Proceeds from the bridge loan will be used to pay off existing construction debt. Villa Annette sits on 11 acres and comprises 14 two- and three-story buildings that offer a mix of one-, two- and three-bedroom floor plans. Amenities include a clubhouse, pool, spa, business center, fitness center and a picnic and grilling area. The owner plans to obtain a HUD 223(f) loan for permanent financing once the asset is stabilized. Ari Mandelbaum originated the transaction for Dwight.

EL CENTRO, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the $2.4 million sale of a single-tenant retail property located in El Centro, approximately midway between San Diego and Phoenix. 7-Eleven occupies the 2,940-square-foot building on a 15-year, triple-net ground lease. Bill Asher and Jeff Lefko of Hanley represented the seller, Imperial Retail Investments LLC, in the transaction. A self-represented, California-based private investor purchased the property.

COLORADO SPRINGS, COLO. — Warby Parker has opened a 2,298-square-foot store at The Promenade Shops at Briargate, a 236,539-square-foot retail center located in Colorado Springs. The store is situated next to Ted’s Montana Grill. The eyewear brand currently operates more than 200 stores throughout the country.

BEAUMONT AND NEDERLAND, TEXAS — Marcus & Millichap has brokered the sale of a portfolio of seven self-storage facilities totaling 2,627 units in southeast Texas. The properties were constructed in the 1970s and 1980s and total 389,501 net rentable square feet. Two of the properties are located in Beaumont, and two are located in Nederland, with the other facilities located in Groves, Bridge City and Orange. Dave Knobler and Charles LeClaire of Marcus & Millichap represented the seller, a California-based liability company that purchased the portfolio in 2018, in the transaction. The duo also secured the buyer, a North Carolina-based limited liability company.

ARLINGTON, TEXAS — A joint venture between Southern California-based investment firm Magma Equities and a fund backed by Macquarie Asset Management has acquired Bardin Greene, a 285-unit apartment community in Arlington. Built in 2001, the property comprises 18 two-story buildings that house one-, two- and three-bedroom units on a 16-acre site. The amenity package consists of a pool, fitness center, business center, volleyball court, courtyard with a children’s play area, resident clubhouse and onsite laundry facilities. Brian Eisendrath of Institutional Property Advisors (IPA), a division of Marcus & Millichap, arranged acquisition financing for the deal through Los Angeles-based PCCP LLC. Moody National Cos. sold the asset off-market for an undisclosed price. The new ownership plans to implement a value-add program.