Life sciences-anchored innovation districts are becoming increasingly popular as hubs for research and development in the biotech and pharmaceutical industries. These districts, also known as “innovation districts,” are characterized by clusters of companies, research institutions, supporting organizations, living areas, amenities and offices all located in close proximity. This grouping requires detailed planning and design strategies to maximize their potential for scientific exploration and success on an enormous, ambitious scale. Master planning and engaging site civil engineering partners early on in the process can save time and money once a project reaches the design stage. This article is the first installment in a two-part series on life sciences innovation districts to discuss, first, the planning, and, then, the design elements required by these districts. Read about design in Part 2, here. Fostering innovation, collaboration and productivity is at the heart of planning for life sciences innovation districts. The successes of famous examples such as North Carolina’s Research Triangle Park, Kendall Square in Cambridge, Mass. and Mission Bay in San Francisco indicate how beneficial a melting-pot mix of residential, commercial and research spaces can be when they concentrate talent from research institutions, life sciences innovators, universities and the surrounding community. “Many life …

Property Type

TUSKEGEE, ALA. — Farpoint Development, along with general contractor Doster Construction Co., has delivered Building 100 at Regional East Alabama Logistics (REAL) Park in Tuskegee. Situated within the 638-acre site in Macon County, the 169,000-square-foot speculative facility is the first building within the 6.2 million-square-foot, multi-phase REAL Park. Situated off exit 42 on I-85 roughly 10 miles south of Auburn University, the building represents the only Class A manufacturing or distribution facility within a 40-mile radius, according to Farpoint. Project partners include construction lender Regions Bank and government entities Opportunity Alabama and Macon County Economic Development Authority. Once complete, REAL Park is expected to create $450 million of total economic output in the east Alabama region. Farpoint is currently marketing Building 100 for lease. The developer is based in Chicago and has a regional office in Asheville, N.C.

Gantry Secures $40M Acquisition Financing for Four Self-Storage Properties in Tennessee, Florida

by John Nelson

IRVINE, CALIF. — Irvine-based Gantry has secured $40 million in acquisition financing for four separate purchases of self-storage properties in Tennessee and Florida. Totaling 286,000 rentable square feet, the properties include three Storelocal Self Storage properties in Franklin and Spring Hill, Tenn., and a U.S. Storage Center facility in Tampa. Andy Bratt and Amit Tyagi of Gantry arranged the fixed-rate loans through separate life insurance companies on behalf of the borrower, a multi-generational private family that is buying the properties in a 1031 exchange. Two of the loans were bridge loans and two were permanent loans.

LOUISVILLE, KY. — Dermody Properties has signed an unknown tenant to a full-building industrial lease at LogistiCenter SM at Louisville Airport Building 2. Built in 2022, the 203,840-square-foot facility is located at 3195 S. Park Road in Louisville, about eight miles south of Louisville Muhammad Ali International Airport. Bruce Isaac of NAI Isaac, Mark Wardlaw and Clay Manley of NAI Fortis and Bill Kampton and Phil Garrett of Colliers NAPA represented the tenant in the lease transaction. Alex Grove and Kevin Grove of CBRE represented the landlord.

Stirling, Level Homes to Develop Build-to-Rent Residential Project in Geismar, Louisiana

by John Nelson

GEISMAR, LA. — A joint venture between Stirling and Level Homes plans to develop Arabella at Dutchtown Townhomes, a build-to-rent (BTR) residential development in Geismar. The companies recently acquired a 7.5-acre parcel for the project, which will comprise 48 three-bedroom single-family townhomes, as well as a leasing office and clubhouse. The design-build team includes architect Architectural Studio and general contractor/homebuilder Level Homes. Stirling will be responsible for development, horizontal land improvements and amenities, in addition to asset management and accounting oversight of the project. BH Management will handle daily onsite management and leasing. Construction will begin on the first townhomes later this month, and the development is expected to be complete by the end of 2024.

Kennedy Wilson Properties Brokers $19.6M Sale of Office Building in Clearwater, Florida

by John Nelson

CLEARWATER, FLA. — Kennedy Wilson Brokerage, a division of Kennedy-Wilson Properties Ltd., has brokered the $19.6 million sale of an eight-story office building in Clearwater. Gary Goodgame, Jeremy Dee and Max Browne of Kennedy Wilson Brokerage represented the seller, Mercury Casualty Co. (i.e. Mercury Insurance), in the transaction. Convergent Capital Partners, a Tampa-based investment group, is the buyer and is planning to make renovations to the property. Located at 1901 Ulmerton Road, the 157,000-square-foot building is located on a 7.3-acre site in Clearwater’s Feather Sound area and features a gym, café and five-story parking garage. The building was delivered in 1999 and currently has approximately 100,000 square feet available for lease. K.C. Tenukas, Kristin Kenney and Nick Baldwin of CBRE will be marketing the building for lease on behalf of Convergent Capital.

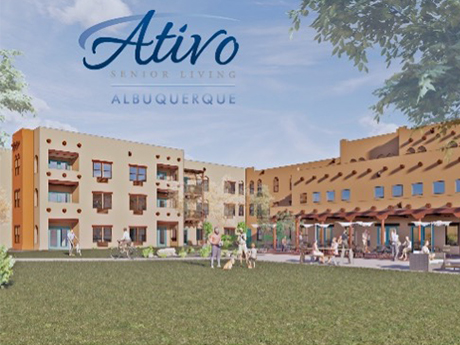

Insight Senior Living Breaks Ground on 144-Unit Ativo of Albuquerque Seniors Housing Community

by Jeff Shaw

ALBUQUERQUE, N.M. — Insight Senior Living has broken ground on Ativo of Albuquerque, a three-story independent living, assisted living and memory care community in Albuquerque. Situated on 6.5 acres, Insight Senior Living will be the operator and Link Senior Development arranged financing. Ativo of Albuquerque will offer 144 apartments. The community is scheduled to open in winter 2024.

TEMPE, ARIZ. — Institutional Property Advisors (IPA) has arranged the sale of and financing for The Gallery, an 88-unit apartment community in Tempe. Living Well Homes sold the property to RSN Property Group for $20.3 million. The Gallery is a two-story, 13-building property built in 1972 on approximately four acres. Amenities include a pool, fitness center and laundry facility. Apartment features include private patios or balconies. The two- and three-bedroom floor plans average 1,013 square feet in size. Cliff David and Steve Gebing, both executive managing directors with IPA, along with Marcus & Millichap’s Paul Bay and Darrell Moffitt, represented the seller and procured the buyer. Brian Eisendrath, Cameron Chalfant, Jake Vitta and Tyler Johnson led the IPA capital markets team.

FLAGSTAFF, ARIZ. — Faris Lee Investments has arranged the $23.5 million sale of The Marketplace, a 268,000-square-foot shopping center in Flagstaff. Tenants at the property include Petco, Best Buy, World Market, Marshall’s, Old Navy and Bealls Outlet. Don MacLellan, Jeff Conover and Scott DeYoung of Faris Lee represented the seller, Macerich, in the all-cash transaction. A California-based 1031 investor purchased the property.

Clarion Partners Provides Financing for 600,000 SF Industrial Property in Riverside, California

by Jeff Shaw

RIVERSIDE, CALIF. — Clarion Partners has provided a has provided a mezzanine loan that’s part of the acquisition financing package collateralized by an industrial building in Riverside. An affiliate of Societe Generale arranged the $10 million mezzanine loan subordinate to a $70 million senior loan. The Class A, 600,000-square-foot facility is fully leased and serves as the headquarters for a third-party logistics provider.