NEW YORK CITY — New Jersey-based investment firm Cedarbridge Management has purchased a 54-unit multifamily building located at 4300 Broadway in Manhattan’s Washington Heights neighborhood for $12 million. The six-story building was originally constructed in 1955 and houses five commercial spaces. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of local brokerage firm Rosewood Realty Group represented Cedarbridge and the undisclosed seller in the transaction. The deal traded at a cap rate of 7 percent.

Property Type

LONG BRANCH, N.J. — Locally based firm Inspired by Somerset Development has broken ground on a 22-unit multifamily project at the site of the former Inkwell Coffee House in the coastal New Jersey community of Long Branch. The three-story building will house one- and two-bedroom units, 800 square feet of street-level retail space, an indoor parking garage and a private rooftop deck. Construction is slated for a summer 2024 completion.

NEW YORK CITY — Locally based real estate giant SL Green Realty Corp. (NYSE: SLG) has received $500 million in funds to refinance debt on 919 Third Avenue, a 1.5 million-square-foot office building in Midtown Manhattan. Designed by international architecture firm Skidmore, Owings & Merrill, the 47-story building was originally completed in 1970. It was designed to accommodate an existing New York City landmark, famed restaurant and saloon P.J. Clarke’s. SL Green owns the building in partnership with an institutional investor advised by J.P. Morgan Global Alternatives. The property is 80 percent leased to tenants such as Bloomberg, which expanded by an additional five floors last winter, as well as law firm Shulte Roth & Zabel LLP. Another law firm, Cohen Clair Lans Greifer & Simpson LLP, became the building’s newest tenant when it inked a 17,862-square-foot deal last month. A consortium of lenders led by New York City-based Aareal Capital Corp. and French lender Credit Agricole Corporate & Investment Bank provided the financing. James Millon, Tom Traynor and Mark Finan of CBRE arranged the debt. The loan bears interest at a rate of 250 basis points above the Secured Overnight Financing Rate (SOFR), which closed at 4.81 percent on Friday, …

Retail is not dead. In fact, coming out of COVID-19, retail is arguably the strongest that it’s been in many years. According to S&P Global Market Intelligence data, in 2022 we saw a 13-year low in retail companies filing for bankruptcy. Here in Baltimore, we’re seeing extremely low vacancy rates and steady demand, which in turn, is cultivating a competitive environment. However, despite the challenges that retail has faced over the past several years, its resilience is where we continue to find plenty of reasons to be optimistic. A look back In March 2020, the phones stopped ringing and businesses shuttered for what was anticipated to be a few short weeks. We soon came to find that was not the case. Retail did struggle, significantly in some cases. Restaurants, service-based businesses, soft goods, fitness, entertainment and experiential concepts amongst many others, whether large corporate-owned or mom-and-pop users, struggled to stay afloat. And many did fail. Space came back on the market and concepts dwindled at an uncanny pace. But the so-called “retail apocalypse” — a common phrase that was originally coined because of the increased popularity of e-commerce — was, again, proved to be hyperbole. Retailers sought ways to enhance …

SAVANNAH, GA. — Olympus Property has acquired Capital Crest at Godley Station, a 203-unit apartment community located in Savannah. Built in 2017 along Benton Boulevard, the property offers 14 floor plans in one-, two- and three-bedroom layouts. Amenities at the community include a 2,500-square-foot sports club, saltwater swimming pool, poolside cabanas and fireplace, a theater, car care center, dog park, pet spa and attached and detached garage parking. The seller and purchase price were not disclosed.

KeyBank Arranges $33M Acquisition Financing for Meadow Creek Apartments in Bridgeport, West Virginia

by John Nelson

BRIDGEPORT, W.VA. — KeyBank Real Estate Capital (KBREC) has arranged a $33 million loan for the acquisition of Meadow Creek Apartments, a multifamily community located in Bridgeport. Built in 2017 on 31.5 acres, the property comprises 29 buildings ranging from two to four stories. Alan Isenstadt, Pranav Sarda and John Ward of KBREC structured the fixed-rate Fannie Mae loan. Moshe Feiner of Sevenstone Capital arranged the financing on behalf of the undisclosed borrower.

MIAMI — Forman Capital, a South Florida-based lender owned by Brett Forman and Ben Jacobson, has acquired a $24.1 million loan secured by a development site in Miami. Charles Foschini of Berkadia arranged the transaction. Located at 2301 N.W. 3rd Avenue, the site was acquired in September of last year by an affiliate of Neology Life Development Group for $32.1 million, with plans for a mixed-use development. The property is zoned for up to 1,800 residential units. Hermitage Palmer Land LLC provided the acquisition loan.

DELRAY BEACH, FLA. — PEBB Enterprises has signed new retail leases totaling 27,099 square feet at Delray Landing, a shopping center the company is currently redeveloping in Delray Beach. Retro Fitness will occupy 17,299 square feet at the property, and Crown Wine will lease 4,100 square feet. Keke’s Breakfast Café and a dentist office will also open at the center, leasing 4,200 and 1,500 square feet, respectively. Sprouts Farmers Market anchors the property, which is also leased to Burger King and Taco Bell. PEBB acquired the shopping center, which is located at 5024-5070 W. Atlantic Ave., in June 2021 in a joint venture with Topvalco Inc. A grand reopening is scheduled for this summer.

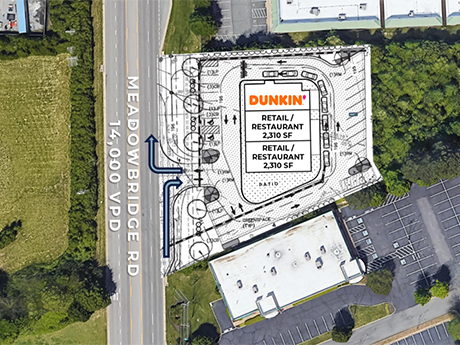

MECHANICSVILLE, VA. — WEDGE Acquisitions LLC has purchased a 1.7-acre parcel in Mechanicsville for $690,000 for the development of a retail strip center. Upon completion, the property, located at 8527 Meadowbridge Road, will comprise 6,500 square feet. Dunkin’ will anchor the center. Nathan Shor of S.L. Nusbaum represented WEDG in the transaction, and Douglas Tice III, also with S.L. Nusbaum, represented the seller, Lisa G. Waitman.

MESQUITE, TEXAS — CBRE has brokered the sale of two industrial buildings totaling 918,213 square feet in the eastern Dallas suburb of Mesquite. Buildings B and D at Alcott Station, a 160-acre development by Urban Logistics Realty, total 325,218 and 592,995 square feet, respectively. At the time of sale, Building B was vacant, and Building D was fully leased to third-party provider RJW Logistics Group. Randy Baird, Jonathan Bryan, Ryan Thornton, Nathan Wynne and Eliza Bachhuber of CBRE represented Urban Logistics Realty in the transaction. Institutional investment firm BentallGreenOak purchased the buildings for an undisclosed price.