SAN MATEO, CALIF. — Cushman & Wakefield has arranged the sale of 1840 Gateway, a Class A office property in San Mateo. Monday Properties sold the asset to SC Properties for $16.2 million. Gary Boitano, Ryan Venezia, Steve Herman, Jack Depuy, Seth Siegel, Scott Prosser and Courtney Trunnell of Cushman & Wakefield represented the seller and the buyer in partnership with Clarke Funkhouser of JLL. The four-story property offers 70,098 square feet of office space, as well as a recently renovated gym facility with showers. Approximately 75 percent of the building’s square footage is finished as high-end creative space, including renovated restrooms and polished concrete floors. The property also offers a multi-story glass-enclosed lobby and flexible zoning that allows for potential redevelopment to residential use.

Property Type

MISSOULA, MONT. — Trident Development is underway on plans for a new senior living community in Missoula. Situated within the Old Sawmill District, the property will feature independent living, assisted living and memory care residences. Trident’s partner, Lifespark Senior Living, will manage the community. Trident plans to break ground on the development in 2026.

FRENSO, CALIF. — Columbia, Md.-based pickleball concept Dill Dinkers has signed a franchise agreement to open 10 new venues in the Central Valley region of California. Entrepreneurs Bill Revilla and Georgia Revilla will own and operate the locations, which will offer several indoor pickleball courts separated by fences, as well as event space, a ball machine and a reservation system for guests. Founded in 2022, Dill Dinkers currently has nine operating locations in the United States and more than 380 locations under development across Texas, Washington, D.C., North Carolina, Connecticut, South Carolina, Arizona, Maryland, Delaware, Virginia, Georgia, Florida, New York, New Jersey, Pennsylvania and California.

Hanley Investment Group Arranges $7.2M Sale of Shake Shack-Occupied Retail Property in Oxnard, California

by Amy Works

OXNARD, CALIF. — Hanley Investment Group Real Estate Advisors has brokered the sale of a single-tenant restaurant property at 711 Town Center Drive in Oxnard. A Texas-based developer sold the asset to a Northern California-based private 1031 exchange investor for $7.2 million. Sean Cox, Jeff Lefko and Bill Asher of Hanley Investment Group represented the seller, while Judson Kauffman of New York-based Surmount represented the buyer in the deal. Shake Shack occupies the 3,286-square-foot property, which was built in 2025, under a new 15-year corporate-guaranteed absolute triple-net ground lease. The building features Shake Shack’s latest prototype with a double-lane drive-thru. Shake Shack operates more than 570 locations across 34 states and over 200 international markets as of third-quarter 2025. The company opened 43 company-operated stores in fiscal-year 2024, marking its highest annual expansion to date.

MISHAWAKA, IND. — Eastern Union has secured $15.9 million in financing toward the condo conversion of River Rock Apartments, an 82-unit property in Mishawaka. The five-story asset is located at 116 W. Mishawaka Ave., six miles east of South Bend. Built in 2015 and 2016, the property features eight commercial units spanning 4,385 square feet that will remain after conversion. The site also includes a 31,027-square-foot parking garage. Joe Siegfried of Eastern Union arranged the three-year loan, which features an 8 percent interest rate, a 75 percent loan-to-value ratio and interest-only payments. Republic Bank provided the loan on behalf of the undisclosed borrower.

ROCHESTER, MICH. — Bernard Financial Group (BFG) has arranged an $11.5 million loan for the refinancing of a 134,600-square-foot retail property in Rochester, a northern suburb of Detroit. Joshua Bernard of BFG arranged the loan on behalf of the borrower, Eagle Creek Master LLC. A life insurance company provided the loan.

WAUKESHA, WIS. — CBRE has arranged the sale of Ridgeview Industrial Center IV in Waukesha for $10 million. Bentley Smith, Joe Horrigan, Ryan Bain, Zach Graham, Judd Welliver and Mike Caprile of CBRE represented the seller, Mohr Capital. Billy Mork, Mike Vannelli and Joel Torborg of CBRE arranged a five-year, fixed-rate acquisition loan on behalf of the buyer, Capital Partners. Located near the I-94 and Redford Boulevard intersection and minutes from Waukesha County Airport, the 89,405-square-foot facility was built in 2001 and renovated in 2021 and 2023. The building features a clear height of 22 feet, one drive-in door, 14 dock doors and a 316-stall parking lot. The asset was fully occupied at the time of sale with a 7.9-year weighted average lease term.

WEST CHICAGO AND BRIDGEVIEW, ILL. — Zenith Industrial Outdoor Storage (IOS) has acquired two facilities in metro Chicago: 1400 Powis Road in West Chicago and 9809 Industrial Drive in Bridgeview. Ikey Betesh of Meridian Capital Group as well as Frank Melchert, Matt Garland, Stevan Arandjelovic and Simon Porras of Cawley Commercial Real Estate sourced the two acquisitions for Zenith. The Cawley team has been retained as the leasing agent for the West Chicago property, which features a 67,500-square-foot warehouse with 5 acres of outdoor storage space.

MIAMI — A partnership between The Easton Group, Lennar and MPKA LLC has proposed City Park at West Kendall, a $2 billion, 990-acre master-planned community in Miami. The development team has filed its application with Miami-Dade County. Plans call for 7,800 new homes in a variety of price points, including townhomes, multifamily units, single-family homes and workforce housing, as well as 1.4 million square feet of retail space and 500,000 square feet of office space. At the heart of the proposed project is Village Core, a walkable town center with shops, restaurants, entertainment, plazas and a boardwalk. With the development application filed, the next step involves collaborating with local neighbors, government officials and community stakeholders to fine-tune the plan, according to Bill Albers, partner with MPKA, which is a consultant to the homebuilding industry. City Park is expected to generate $2.4 billion in annual economic output for the county. The project is also estimated to create more than 19,000 construction jobs during build-out followed by more than 13,000 permanent jobs. By reducing the need for daily commutes to job centers like downtown, Brickell, Doral and Coral Gables, City Park will also help reverse traffic patterns and ease congestion that has …

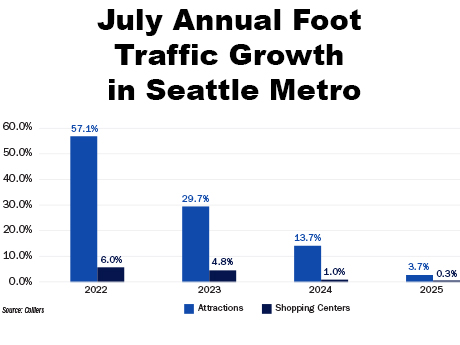

— By Jacob Pavlik of Colliers — As big-box retailers scale back or exit the market, a new class of tenants is reshaping the retail landscape across the Puget Sound region. Experiential retail is taking their space and providing destinations for consumers and the experiences they crave. This umbrella term includes concepts that prioritize interaction, entertainment and social connection. This is emerging as a compelling solution for landlords looking to drive foot traffic and re-energize shopping centers. The shift is not accidental. The pandemic disrupted traditional social experiences and accelerated the decline of large-format retail by getting people more accustomed to buying online, even if they “picked up” the item later in a store. Now, with consumers eager to reconnect in person, experiential concepts have gained traction. These tenants often don’t sell goods or services in the conventional sense. Instead, they offer immersive experiences that encourage group participation and repeat visits. Recent examples include Mirra, a 12,000-square-foot social entertainment venue that opened in Bellevue’s Lincoln Square, a mixed-use shopping center with three hotels, and more than 1.2 million square feet of office space. Adjacent to Cinemark Reserve in the South Tower, Mirra offers immersive virtual reality party games and transitions to …