MELBOURNE, FLA. — Red Oak Capital Holdings has provided a $10.2 million acquisition loan for an 80,107-square-foot industrial facility located at 4401 Fortune Place in Melbourne. The borrower, Reich Brothers I LLC, used the bridge loan to acquire the Space Coast property and prepare it for occupancy by its sole tenant, Blue Origin, an aerospace, defense and space exploration company backed by Amazon founder Jeff Bezos. The property traded for $12.5 million. The interest-only loan was underwritten at an interest rate of 8.5 percent and features a 24-month term with two six-month renewal options. The borrower plans to exit the loan via permanent financing upon completion of re-tenanting the building to Blue Origin, according to Red Oak.

Property Type

JOHNS CREEK, GA. — SRS Real Estate Partners’ National Net Lease Group has brokered the $4.3 million sale of Shops at Medlock Corners, a 6,200-square-foot retail strip center located at 5855 State Bridge Road in Johns Creek. The seller, Atlanta-based Willow Capital Partners, delivered the property in March. Situated on less than an acre, the metro Atlanta property was fully leased at the time of sale to Jersey Mike’s, Ideal Dental and ATI Physical Therapy, all of which signed 10-year leases. Michael Berk, Sheree Strome and Scott Campbell of SRS represented the seller in the transaction. The buyer was an unnamed private investment firm based in Atlanta.

DALLAS — Dallas-based Entos Design has begun construction on a multimillion-dollar capital improvement program at Chateau Plaza, a 178,970-square-foot office building in Dallas’ Uptown neighborhood. Capital improvements will include upgrades to the lobby, tenant lounge, public corridors and boardroom, as well as the addition of a fitness center and outdoor patio. Chateau Plaza was originally built in 1985 and last renovated in 2011. A group of institutional investors advised by J.P. Morgan Global Alternatives owns the 18-story building and will rebrand it as 2515 McKinney. Stream Realty Partners manages the property and will market the newly renovated space for lease. Completion is slated for the fall.

AUSTIN, TEXAS — Expansive, a provider of flexible workspace solutions formerly known as Novel Coworking, will open a 48,000-square-foot space in Austin’s Highland neighborhood on Thursday, May 4. The space, which will be the company’s second in the state capital, will be located within a five-story building at 305 E. Huntland Drive and will offer private offices, training and meeting rooms and outdoor amenity areas. Users will also have access to an onsite biergarten and indoor/outdoor lounge areas at the building.

HOUSTON — Partners Real Estate has negotiated a 14,000-square-foot industrial sublease at 4555 Brittmoore Road in northwest Houston. According to LoopNet Inc., the property was originally constructed on 1.8 acres in 2002 and features 20-foot clear heights. Travis Land and Braedon Emde of Partners represented the sublessor, IA Manufacturing LLC, in the lease negotiations. The name and representative of the sublessee were not disclosed.

ALEDO, TEXAS — SHOP Cos. has arranged the sale of a 12,428-square-foot retail strip center located on the western outskirts of Fort Worth. Aledo Retail Center, which was fully leased at the time of sale, is located adjacent to the site of the newly announced, 1,825-acre Dean Ranch master-planned development. Tim Axilrod and Tayler Rose of SHOP Cos. represented the seller, a limited liability company, in the transaction. The buyer was a private investor. Both parties were Texas-based entities that requested anonymity.

LEWISVILLE, TEXAS — Bright Realty has signed three new tenants to leases at The Realm at Castle Hills, the locally based developer’s 324-acre mixed-use campus located north of Dallas in Lewisville. Children’s entertainment concept Cheeky Monkeys is leasing 7,287 square feet, including more than 6,000 square feet of play space, a coffee shop and a limited-service restaurant. Additionally, 206 Luster Grill has opened a 2,257-square-foot restaurant, and Cachet Salons & Spa now occupies 10,692 square feet.

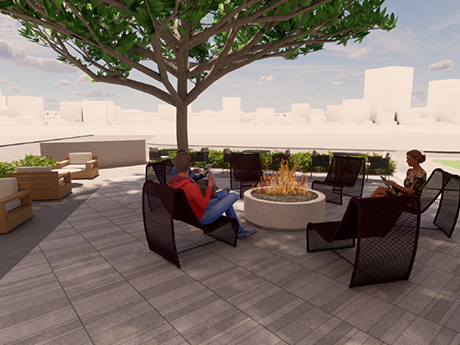

PHOENIX — Phoenix-based developer George Oliver has unveiled plans for Bond, a $52 million renovation that will transform the Biltmore Commerce Center in Phoenix into a hospitality-inspired office experience. Bond is George Oliver’s sixth experiential office project in the Valley. Located at 3200 E. Camelback Road, the property offers prime access to restaurants, retail and executive housing. Bond totals 287,000 square feet in three stories, with office space bordering a corresponding three-story central atrium. Through its renovation, George Oliver plans elevate the space with one of the market’s most extensive amenity packages, including a conference center, co-working space, two-story fitness center, cocktail speakeasy, and a full-service coffee, cocktail and food service bar.

MESA, ARIZ. — Libitzky Property Cos. has purchased Gateway Technology Commerce Center, a two-building, 138,692-square-foot industrial project in Mesa, for $25.4 million. Gateway Technology Commerce Center is located at 7535 E. Ray Road, with immediate adjacency to the Phoenix-Mesa Gateway Airport and freeway frontage exposure to the Loop 202. The Class A asset was built in 2019. It is fully leased to six tenants. Steve Lindley, Alexandra Loye, Eric Wichterman and Mike Coover with Cushman & Wakefield’s capital markets and private capital teams in Phoenix represented the seller, along with Will Strong and Molly Hunt of Cushman & Wakefield’s national industrial advisory group.

CORONA, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the $2.9 million sale of a single-tenant retail property in Corona. A Taco Bell drive-thru operated by Alvarado Restaurant Nation occupies the 2,049-square-foot property on a triple-net-lease basis. Bill Asher and Jeff Lefko of Hanley represented the developer and seller, Evergreen Development, in the transaction. David Aschkenasy of Commercial Asset Group represented the 1031-exchange buyer, a locally based private investor.