HAMMOND, IND. — Marcus & Millichap has arranged the $4.6 million sale of a 14,158-square-foot retail center in Hammond, a city in Northwest Indiana. Built in 2017, the property is located at 1001 5th Ave. and is home to retail and medical tenants, including American Renal Associates. Mitchell Kiven and Nicholas Kanich of Marcus & Millichap represented the seller, a developer based in Hobart, Ind. The property sold to a 1031 exchange investor.

Property Type

HOFFMAN ESTATES, ILL. — Belle Tire Distributors has purchased a 1.7-acre lot in the Chicago suburb of Hoffman Estates for $1 million. Rick Scardino of Lee & Associates represented the seller, Prairie Point Center Development LLC c/o Conor Commercial. Dave Chopp of DRC Realty represented Belle Tire.

ALLEN, TEXAS — JLL has negotiated the sale of Twin Creeks Marketplace, a 43,134-square-foot shopping center located in the northeastern Dallas suburb of Allen. Sprouts Farmers Market anchors the center, which was built in 2016 and was fully leased at the time of sale. Other tenants include Starbucks, Verizon Wireless, ATI Physical Therapy and Advancial. Chris Gerard, Adam Howells, Caroline Binning, Pauli Kerr and Cole Sutter of JLL represented the undisclosed seller in the transaction. The buyer was also not disclosed.

MIDDLETON, MASS. — Nashville-based brokerage firm Matthews Real Estate Investment Services has negotiated the $7.7 million sale of a 14,440-square-foot retail property that is net leased to Walgreens in Middleton, a northern suburb of Boston. Grant Korn and Maxx Bauman of Matthews Real Estate represented the locally based seller, Newport Property Corp., in the transaction. A New York-based private investor acquired the asset via a 1031 exchange.

CARLISLE, PA. — Largo Capital, a commercial intermediary based in upstate New York, has arranged a $6.7 million acquisition loan for a 120-unit multifamily property in Carlisle, a western suburb of Harrisburg. The property consists of 15 buildings that house 88 one-bedroom units with an average size of 598 square feet and 32 two-bedroom units with an average size of 828 square feet. Neal Colligan of Largo Capital originated the financing. The borrower and direct lender were not disclosed.

CLINTON, N.J. — Marcus & Millichap has brokered the $6.2 million sale of Hunterdon Shopping Center, a 26,176-square-foot retail property in Clinton, about 60 miles west of New York City. The property was built on 2.4 acres in 1957 and was fully leased at the time of sale. Walgreens anchors the center and recently signed a 10-year lease extension. Brent Hyldahl and Alan Cafiero of Marcus & Millichap represented the seller, a limited partnership, and procured the buyer, a New Jersey-based private investor, in the deal.

CHICAGO — Kiser Group has negotiated the sale of a 155-unit luxury apartment property in Chicago’s Andersonville neighborhood for $53.5 million. Named Anderson Point, the property located at 5700 N. Ashland Ave. is the adaptive reuse of the Edgewater Medical Center. The seller, MCZ Edgewater Development LLC, transformed the former hospital into a luxury apartment community. Amenities include indoor parking, in-unit laundry, a fitness center, roof deck, golf simulator, tenant lounges and private workspaces. Lee Kiser, Katie LeGrand and Jacob Price of Kiser brokered the transaction. The buyer, Lake Street Lofts LLC, completed a 1031 exchange.

HUDSON, WIS. — Kraus-Anderson Construction has completed a new 250,000-square-foot manufacturing facility for Hunt Electric at 924 Daily Road in Hudson, a city along the Minnesota-Wisconsin border. Hunt Electric is a national electrical design, build and maintenance firm. In 2020, the company moved its 150,000-square-foot prefabrication operations, called “Little Baer,” to Hudson. The firm then purchased 17 acres next to the plant to build “Big Baer,” the new 250,000-square-foot facility. Big Baer will operate alongside the existing Little Baer facility. Pope Design Group designed the property, which features office and storage space in addition to manufacturing space.

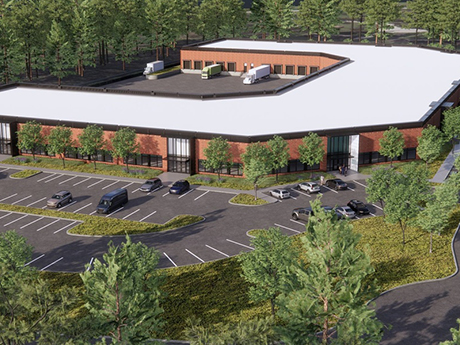

EXTON, PA. — Swiss manufacturer Früh Packaging has signed a 63,480-square-foot, full-building industrial lease in Exton, about 35 miles west of Philadelphia. According to LoopNet Inc., the property was built on 26.5 acres in 2023, totals 113,000 square feet and features a clear height of 16 feet, 40 dock doors and 128-foot truck court depths. Mike Adams and Sarah Finney Miller of NAI Summit represented the tenant in the site selection and lease negotiations. Locally based developer Hankin Group owns the property.

ST. CHARLES, ILL. — Cushman & Wakefield has brokered the sale of River Glen of St. Charles, located within the former Delnor Hospital, which was built in St. Charles in 1939. Located approximately 35 miles west of Chicago, the senior living community features 106 units of independent living, assisted living and memory care. The original hospital building has been converted into a modern, well-amenitized campus. Bridge Investment Group sold the asset to Citrine Senior Communities, a joint venture between affiliates of Citrine Investment Group and Jaybird Capital, for $20 million. Jaybird Senior Living will take over operations. Cushman & Wakefield’s Rick Swartz, Jay Wagner, Aaron Rosenzweig, Tim Hosmer and Jack Griffin arranged the transaction.