QUANTICO, VA. — Five new tenants will join Merritt Business Park at Quantico Corporate Center, a light industrial campus located along I-95 in Quantico. Three of the businesses — Full Distance Brewing, The Nova Systems and Two Marines Moving — are veteran-owned companies. Full Distance Brewing and Nova Systems will occupy 8,000 and 7,000 square feet, respectively. Merritt Properties has also signed leases with Top Notch Moving Services and The Continuum Group. Top Notch will take over 15,000 square feet, and Continuum will lease 7,200 square feet at the property, which is comprised of two single-story flex buildings. Both buildings feature 18-foot clear heights, access to a fiber-optic network, loading docks and drive-in capabilities for warehouse users.

Property Type

HOMESTEAD, FLA. — Mast Capital, in partnership with Angelo Gordon, has sold Seascape Pointe, a townhome community located in Homestead, roughly 40 miles southwest of Miami. IMC Equity Group purchased the property for an undisclosed price. Located on 31.7 acres at 1140 S.E. 24th Road, the Seascape Pointe features 54 buildings comprising 306 two-story, direct-access townhomes. Residences range in size from 1,387 square feet to 1,501 square feet in three- and four-bedroom layouts. Amenities include a clubhouse, swimming pool, outdoor fitness area, playground, dog park and 24-hour gated entrance. Mast Capital and Angelo Gordon originally acquired the community as a joint venture in 2020 and instituted capital improvements, as well as the addition of 14 new townhomes.

NEW YORK CITY — Tishman Speyer has inked deals with chef Gabriel Kreuther and his business partners to open two new restaurants at The Spiral, the locally based real estate giant’s 65-story office tower in Manhattan’s Hudson Yards district. One concept will be a 5,700-square-foot full-service restaurant serving lunch and dinner that will be located on the corner of 34th Street and Hudson Boulevard. On the corner of 35th Street and Hudson Boulevard, the team will launch an all-day café serving breakfast and lunch. Both openings are slated for 2024.

HOBOKEN, N.J. — Cushman & Wakefield has negotiated an 18,603-square-foot office lease at Waterfront Corporate Center I in Hoboken. The 14-story, 566,215-square-foot building is located within a larger, 1.5 million-square-foot complex across the Hudson River from Manhattan. David DeMatteis and Mina Shehata of Cushman & Wakefield represented the tenant, industrial investment firm Faropoint, in the lease negotiations. A partnership between New York City-based developer SJP Properties and private investor David Werner owns Waterfront Corporate Center I.

BLOOMINGTON, IND. — Gray Capital has acquired Echo Park Apartments in Bloomington for an undisclosed price. The company says its business plan includes improving onsite management and reducing expenses. Amenities at the property include a bark park, resort-style pool, trash pickup and in-unit washers and dryers. Gray Capital’s property management company, Gray Residential, is now managing Echo Park as well as nearby apartment property Forest Ridge. Echo Park is the fourth property within Gray Capital’s $100 million multifamily investment fund, The Gray Fund. Previous acquisitions include Sycamore Terrace in Terre Haute, Ind.; Club Meridian in Lansing, Mich.; and Stonybrook Commons in Indianapolis. Gray Capital maintains roughly $775 million in assets under management.

NILES, MICH. — Marcus & Millichap has brokered the $4.2 million sale of Village West in Niles, a city in Southwest Michigan. The 54-unit apartment building is located at 746 Colony Court. Renovations made to the property in 2020 and 2021 included a new roof, windows and gutters, as well as upgraded electrical and HVAC systems. Aaron Kuroiwa, Jack Friskney and Austin Meeker of Marcus & Millichap represented the seller, a limited liability company that plans on using proceeds from the sale and a 1031 exchange to buy another multifamily asset in Indiana or Florida. The Marcus & Millichap trio also represented the buyer, a limited liability company that secured agency financing with five years of interest-only payments.

GLEN CARBON, ILL. — The Goodwill store in Glen Carbon, about 14 miles northeast of St. Louis, has reopened following months of renovations. The store at 210 Junction Drive has been reconfigured from 12,500 square feet of retail space and 3,000 square feet of backend space to 10,000 square feet of retail space and 4,850 square feet of backend space. The expanded backend space will help with the increase in donations the store has received. Additional renovations to the exterior will be made this spring. An entirely new donation reception area will be built with the addition of two new docks and enhanced accessibility, as the drop-off area will no longer require the use of stairs.

NEW RICHMOND AND SPARTA, WIS. — Starbucks has signed two new retail leases in Wisconsin. Each lease totals 2,460 square feet. The first property is located at 124 Grant Way in New Richmond, about 45 miles northeast of Minneapolis. The other is at 630 S. Black River St. in Sparta, about 28 miles east of La Crosse. Tony Colvin of Mid-America Real Estate represented Starbucks. The landlords for both properties were Jacques Holdings LLC and OLH II LLC.

OAKLAND TOWNSHIP, MICH. — Meadowbrook Animal Clinic has signed a 2,082-square-foot, five-year lease at Country Creek Commons shopping center in Oakland Township, a northern suburb of Detroit. The veterinary clinic is relocating from Rochester Hills. Barry Landau of Dominion Real Estate Advisors LLC represented both the tenant and landlord.

Morgan Stonehill Breaks Ground on 360-Unit Seasons at Meridian Apartments in Metro Boise

by Amy Works

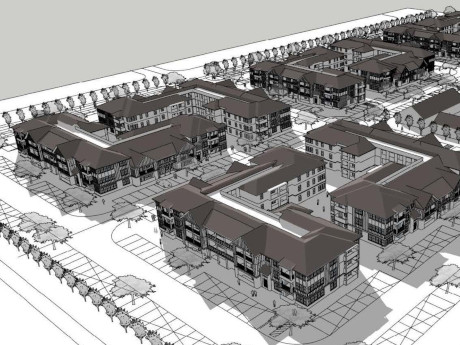

MERIDIAN, IDAHO — Developer Morgan Stonehill, with Los Angeles-based Newman Garrison + Partners as architect, has released plans for Seasons at Meridian, a 360-unit apartment community located at 2700 E. Overland Road in Meridian, a western suburb of Boise. The team broke ground on the development in January. Seasons at Meridian will feature 10 residential buildings arranged around an open-air courtyard space. Each building will offer a mix of studio, one-, two- and three-bedroom units ranging from 488 square feet to 1,328 square feet. The community will offer more than 30,000 square feet of amenity space, including a 10,000-square-foot clubhouse, a pool, park, community garden, fitness facility, bike maintenance room and barbecue areas. Additionally, the project is designed to provide direct pedestrian linkages to the adjacent commercial and retail developments with access to nearby recreational trails, landscaped areas and pocket parks. Completion is slated for second-quarter 2025.