RYE BROOK, N.Y. — Kyndryl Inc., a provider of IT infrastructure services, has signed a five-year, 26,212-square-foot office lease at 2 International Drive in Rye Brook, located north of Manhattan in Westchester County. The tenant, which was formerly part of IBM, has moved in to its space on the second floor. Patrick Murphy, Winston Schromm and Kevin McCarthy of Cushman & Wakefield represented Kyndryl Inc. in the lease negotiations. Peter Duncan and Dana Pike internally represented the landlord, George Comfort & Sons.

Property Type

LOS ANGELES — Alliant Strategic Development (ASD) has broken ground on four transit-oriented multifamily communities, totaling 727 income-restricted rental units, in the Los Angeles neighborhoods of Canoga Park, Van Nuys and North Hollywood. Upon completion, which is slated to occur in the fourth quarter of 2024 and first quarter of 2025, the portfolio will offer units geared to households throughout the affordable spectrum — on average earning up to 90 percent of the area median income (AMI), with 144 of the units designated for households making 50 percent or less of AMI. The four projects include: Sync on Canoga, featuring 220 one-bedroom units at 7019 Canoga Ave. in Canoga Park. Pendant on Topanga, totaling 149 studio, one- and two-bedroom apartments at 7322 Topanga Canyon Blvd. in Canoga Park. Vose, offering 332 studio, one- and two-bedroom apartments at 7050 Van Nuys Blvd. in Van Nuys. Candence at Noho, featuring 26 one- and two-bedroom units at 5633 Farmdale Ave. in North Hollywood. The interiors of the 727 units will include energy-efficient stainless steel kitchen appliances, in-unit washers/dryers and stone countertops. Community amenities across the portfolio include fitness centers, rooftop decks, electric vehicle charging stations, pools, spas, outdoor lounge areas and dog parks …

— Kyle Davis, Sales & Leasing Agent, Commercial Properties Inc., a CORFAC International Firm — A market cooldown is likely in 2023 as interest rates rise and the investor pool becomes more cautious to some degree. I believe many investors recall lessons from the Great Recession and are not as significantly overleveraged, which means the effects of this market correction may not be nearly as drastic. Phoenix’s retail market also has some bright spots. The area’s retail net absorption was positive at more than 1.5 million square feet, with vacancy rates down to 5.1 percent at the end of the fourth quarter of 2022. This is compared to the 1,071,783 square feet of absorption and 6.6 percent vacancy rate a year ago. Many look at factors like unemployment, interest rates, housing starts, etc., to speculate about the coming market. What will impact our industry most directly, however, is how the lending market reacts to these indicators. As with 2008 and 2020, creditors may look at the same data points as investors and lower their risk profiles significantly faster than investors are able to counteract. There will be many commercial property loans set for refinancing in the near or upcoming future, as commercial property …

WALTERBORO, S.C. — Pomega Energy Storage Technologies, a subsidiary of Kontrolmatik Technologies, has broken ground on its first U.S. lithium-ion battery manufacturing plant in South Carolina. The company will invest $300 million in upfront capital expenditures in the new facility in Walterboro, a suburb of Charleston in Colleton County. Pomega Energy Storage expects to begin production at the 500,000-square-foot facility in mid-2024, create about 575 new jobs and have an initial production capacity of 3 gigawatt-hours (GWh) — with plans to later increase capacity to 6 GWh with future development on the site. In addition to manufacturing the battery cells at the South Carolina plant, Pomega Energy Storage will also manufacture and assemble turnkey battery energy storage systems, including modules, cabinets and final containerized energy storage solutions. JLL led the site selection process for Pomega Energy Storage, which considered more than 200 locations before selecting the Colleton County site.

MIAMI — JLL has arranged a $193 million permanent loan for the refinancing of a nine-property industrial portfolio totaling 1.7 million square feet. The properties are located on infill sites in South Florida, Texas, North Carolina, Alabama and Maryland. Chris Drew, Melissa Rose and Christopher Gathman of JLL arranged the five-year, fixed-rate, non-recourse loan through TIAA Bank on behalf of the borrower, Adler Real Estate Partners. The assets were constructed between 1981 and 2001 and were leased to 145 separate tenants at the time of financing. The properties included: • Riverchase Center in Hoover, Ala. • 1001 Broken Sound Parkway in Boca Raton, Fla. • Prospect Park I & II in Fort Lauderdale, Fla. • Delray North Business Center in Delray Beach, Fla. • Rivers Business Park I & II in Columbia, Md. • South Point Business Park in Charlotte, N.C. • Parkwest I & II in Raleigh, N.C. • Addison Tech Center in Addison, Texas • Kramer 1-5 at Braker Center in Austin, Texas

Terra, Blanca Begin Leasing Offices at Mixed-Use Development in Miami’s Bay Harbor Islands District

by John Nelson

MIAMI — Locally based developer Terra and brokerage firm Blanca Commercial Real Estate have launched leasing at The Offices at THE WELL, the office component of THE WELL Bay Harbor Islands mixed-use project located at 1177 Kane Concourse in Miami. Tere Blanca, Danet Linares, Christina Jolley and Nicole Kaiser of Blanca Commercial Real Estate have begun leasing the building’s 98,420 square feet of office space, which is spread across four floors. In addition to offices, THE WELL Bay Harbor Islands will also feature 54 luxury residences and 11,000 square feet of wellness space operated by New York-based THE WELL that includes a fitness center, concierge services, indoor and outdoor classes and onsite sessions with a health coach. Other amenities include a 6,500-square-foot food-and-beverage outlet, elevated plaza, rooftop and a parking garage. Terra plans to break ground on the mixed-use development in the first quarter with completion anticipated for late 2024. The design team includes architect Arquitectonica and interior designer Meyer Davis.

CANTON, MISS. — Hodges Ward Elliott has brokered the sale of an 80-room Hampton Inn hotel located in Canton, about 30 miles north of Jackson, Miss. B.J. Patel, Clint Hodges and Michael Brandes of Hodges Ward Elliott represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed. Built in 2004 along I-55, the Hampton Inn Canton hotel features a business center, outdoor pool, fitness center, complimentary breakfast and connecting rooms.

Northmarq Arranges $3.3M Sale of Governor’s Walk Shopping Center in Peachtree City, Georgia

by John Nelson

PEACHTREE CITY, GA. — Northmarq has arranged the $3.3 million sale of Governor’s Walk, a 21,280-square-foot shopping center located at 1980 GA Highway 54 in Peachtree City. The property was fully leased at the time of sale to Car Wash, Donut Shop, Peachtree Pawn, Fresh Smoothie Café, Mary Nails, Curves, Carolina Hemp Co., Southern Crescent Spa, Peachtree Wax Studio, La Plaza R&R Inc., Flooring Store, Men’s World Barber, Rene’e Paige Salon and M&R Alterations. Jeff Enck of Northmarq represented the Florida-based seller in the transaction, as well as the California-based 1031 exchange buyer.

Belmont Village Senior Living Breaks Ground on 177-Unit Project in San Ramon, California

by Amy Works

SAN RAMON, CALIF. — Belmont Village Senior Living, in partnership with Sunset Development, has broken ground on Belmont Village San Ramon. Located at 6151 Bollinger Canyon Road within the Bishop Ranch neighborhood of San Ramon, the 175,320-square-foot community will feature a heated saltwater pool, putting green, farm-to-table gardening areas, al fresco dining, outdoor yoga lawn and group fitness space, and a dog park. Slated for completion by fall 2024, Belmont Village San Ramon will feature 177 studio, one- and two-bedroom residences for independent living, assisted living and memory care needs. The property will offer residents concierge and transportation services, valet parking, onsite physiotherapy, a fitness center, art studio, screening room, club lounge, full-service salon and spa, personal wine storage and multiple dining venues. Aron Will, Tim Root and Michael Cregan of CBRE National Senior Housing secured the non-recourse construction financing for the project on behalf of a joint venture between Belmont Village Senior Living and Harrison Street Real Estate Capital. The project team includes W.E. O’Neil Construction and HKIT Architecture.

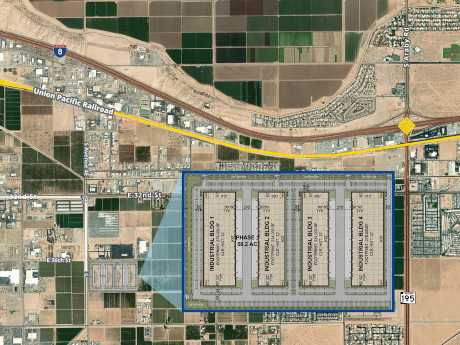

YUMA, ARIZ. — Panattoni Development has unveiled plans to develop a 1 million-square-foot industrial park at 36th Street and South Avenue 4E in Yuma. The initial phase of Panattoni’s Yuma Industrial Park is slated to include four buildings ranging from 234,000 square feet to 279,000 square feet each. The buildings will feature two grade-level doors, 49 rear-load, dock-high doors and 32-foot clear heights.