PUEBLO, COLO. — Capstone has arranged the sale of a multifamily complex located at 1411-1434 Anita St. in Pueblo. The assets traded for $3.2 million. The names of the seller and buyer were not released. The 24-unit portfolio consists of six duplexes and three quadraplexes. The duplexes were built in 1994 and feature two-bedroom/one-bath units, while the quadraplexes were built in 1993 and feature 1,050-square-foot three-bedroom/two-bath units. Lee Wagner of Capstone represented the seller and buyer in the deal. Ari Schriger of WCW Commercial arranged financing for the value-add acquisition.

Property Type

MARLTON, N.J. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of The View at Marlton, a 91,000-square-foot shopping center in Southern New Jersey. The sales price was $36.5 million. LA Fitness anchors the center, which was originally built in 2017 and was 98 percent leased at the time of sale. Other tenants include Truist Financial Corp., Restore Cryotherapy and Smoothie King. Brad Nathanson of IPA represented the seller, a partnership between Philadelphia-based firms Abrams Realty & Development and Lazgor Co., in the transaction. Nathanson also procured the buyer, Paramount Realty Services, which acquired the asset via a 1031 exchange.

CAMBRIDGE, MASS. — Locally based firm Nauset Construction is underway on the renovation of a 90,000-square-foot data center that is located across the Charles River from Boston in Cambridge. The project represents the third phase of capital improvements at the property at 300 Bent St. Upgrades will include the demolition and excavation of the existing lobby, the revamping of mechanical and utility systems and the addition of another 8,000 square feet of tenant space. Khalsa Design is the project architect. Construction is anticipated to be complete this fall. CEM Realty Trust owns the property.

PENNSYLVANIA — Evans Senior Investments (ESI) has arranged the $39 million sale of a portfolio of three seniors housing properties in Pennsylvania. The properties, the specific names and locations of which were not disclosed, total 395 skilled nursing beds and 32 units of private-pay seniors housing. The portfolio was approximately 64 percent occupied at the time of sale. The buyer was a regional owner-operator, and the seller was not disclosed.

NEW YORK CITY — JLL has negotiated a 45,000-square-foot, 20-year office lease at 2100 Bartow Ave. in The Bronx. The 180,000-square-foot building was constructed in 1988. Al Gutierrez and Ian Ceppos of JLL represented the landlord, Prestige Properties, in the lease negotiations. Mark Boisi and Stephen Bellwood of Cushman & Wakefield, along with Neil Lipinski of Lipinski Real Estate represented the tenant, United Federation of Teachers. The tenant plans to take occupancy of its new space this fall.

PARAMUS, N.J. — The Hospital for Special Surgery (HSS) has signed a 40,062-square-foot healthcare lease at Nexus 17, a two-building complex located in the Northern New Jersey community of Paramus. Brian Given, Bryn Cinque and James Bailey of Colliers represented HSS in the lease negotiations. David DeMatteis, Benjamin Brenner and Mark Zaziski of Cushman & Wakefield represented the landlord, The Birch Group. The building is now 96 percent leased.

WOONSOCKET, R.I., AND CHICAGO — CVS Health (NYSE: CVS) has agreed to acquire Oak Street Health (NYSE: OSH) in an all-cash transaction at $39 per share, representing a total purchase price of roughly $10.6 billion. The price represents a premium of approximately 11.9 percent over Oak Street’s opening price per share this morning. Chicago-based Oak Street Health is a network of primary care centers for adults on Medicare. The company employs approximately 600 primary care providers and maintains 169 medical centers across 21 states. By 2026, Oak Street Health plans to grow to more than 300 centers. Oak Street Health’s technology solution, Canopy, is fully integrated with its operations and utilized when determining the appropriate type and level of care for each patient. That care will be enhanced by CVS Health’s community, home and digital offerings, according to the companies. Bringing CVS Health and Oak Street Health together can significantly benefit patients’ long-term health by reducing care costs and improving outcomes, particularly for those in underserved communities, according to a news release. Oak Street Health centers are located where healthcare services are needed most; more than 50 percent of Oak Street Health’s patients have a housing, food or isolation risk …

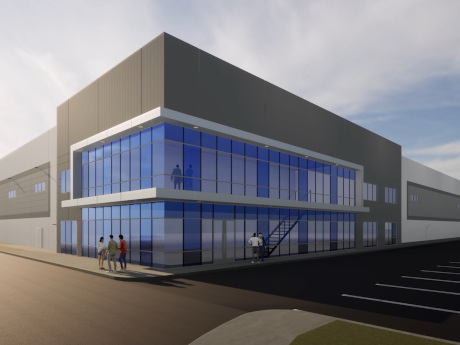

SAN DIEGO — A joint venture between San Diego-based Elevation Land Co. and a real estate fund advised by Crow Holdings Capital has unveiled plans to develop Otay Business Park, a 1.8 million-square-foot industrial, distribution and warehouse property in the Otay Mesa submarket of San Diego. Current construction plans for Otay Business Park include the development of eight speculative or build-to-suit buildings that can accommodate users ranging from 45,000 square feet to 500,000 square feet. The buildings will feature 32-foot to 36-foot clear heights, 325 dock-high loading positions, 175 trailer stalls and 16 grade-level loading doors. Slated for completion in the second half of 2024, Phase I will consist of 1 million square feet of space spread across five buildings. Phase II will consist of 770,000 square feet across the buildings, with completion scheduled for 12 months after Phase I is delivered. All buildings are planned for speculative development but can be delivered on a build-to-suit basis for occupants. The developers acquired a total of 263 acres of land where the project is being developed during the second quarter of 2022 for $165 million. The land purchased included the 119 acres that Otay Business Park will occupy, along with several …

LOS ANGELES — Sony Pictures Entertainment has signed a long-term, multi-floor lease to occupy 225,239 square feet of office space at Wilshire Courtyard, a two-building, Class A office campus on Los Angeles’ Miracle Mile. The company is relocating select divisions from Culver City to the new offices at 5750 Wilshire Blvd. Josh Bernstein, Peter Collins, Scott Menkus and Alexa Delahooke of Cushman & Wakefield represented the landlord, Onni Group, while Josh Gorin and Mike Catalano of Savills represented Sony in the lease negotiations. Neal Linthicum of Onni managed the transaction on the company’s behalf. Wilshire Courtyard comprises two six-story office buildings, located at 5700 and 5750 Wilshire Blvd., totaling 1 million square feet. The buildings were originally developed in the late 1980s and underwent significant interior and exterior renovations in 2015. The asset features 125 tiered outdoor balconies for indoor/outdoor work, an onsite Equinox Fitness, renovated common areas and plazas, and a park with jogging trails. Additionally, Onni is adding an amenity center to the property with a golf simulator, multi-screen entertainment center, tenant lounge and conference facility.

Progressive Real Estate Partners Brokers $11.9M Sale of Retail Property in Norco, California

by Amy Works

NORCO, CALIF. — Progressive Real Estate Partners has arranged the sale of a gas station, car wash and multi-tenant retail space at 996 Mountain Ave. in Norco. A Los Angeles private investor sold the asset to a Los Angeles-based private investor that operates gas station properties for $11.9 million in an all-cash transaction. Built in 2000 and fully remodeled in 2020, the property features 18 Chevron fueling positions, a self-service express car wash with a 150-foot tunnel, a 22,000-square-foot ExtraMile convenience store and two retail spaces that Valvoline and a window tinting company occupy. Victor Buendia of Progressive Real Estate represented the seller, while Grace Sue of Meiguo Realty represented the buyer in the deal.