NORTHAMPTON, PA. — New York City-based investment and development firm Rockefeller Group has sold a 453,600-square-foot warehouse located in the Lehigh Valley community of Northampton for $91 million. The site spans 36 acres and is located within the 1.8 million-square-foot Rockefeller Group Logistics Park. The cross-dock facility was completed in 2022 and features a clear height of 36 feet, four drive-in doors, 90 dock doors, 59 trailer stalls and 264 car parking spaces. John Plower, Ryan Cottone, Zach Maguire, Paul Torosian and Jeff Lockard of JLL represented Rockefeller Group in the transaction. The buyer was New York City-based Link Logistics.

Property Type

NEW YORK CITY — Locally based investment firm Ashkenazy Acquisition Corp. has received a $20.6 million loan for the refinancing of a 25,673-square-foot retail property located along Third Avenue on Manhattan’s Upper East Side. The property was fully leased at the time of the loan closing. Ronnie Levine and Ben Jacobs of Meridian Capital Group arranged the 10-year, fixed-rate acquisition loan through Bank of Montreal on behalf of ownership.

MADISON, N.J. — Locally based brokerage firm Hudson Atlantic Realty has negotiated the $14.7 million sale of Tudor House, a 26-unit apartment complex in the Northern New Jersey community of Madison. The sales price equates to roughly $565,000 per unit. The property was built in 2015, and units include private garages and individual washers and dryers. Adam Zweibel and Nicholas Favorito of Hudson Atlantic brokered the deal. The buyer and seller were not disclosed.

NEPTUNE, N.J. — Hobby Lobby has signed a 58,952-square-foot retail lease at Neptune Plaza Shopping Center in coastal New Jersey. The Oklahoma-based retailer will backfill a space previously occupied by HomeGoods and Marshalls. Kevin Pelio of Azarian Realty Co. represented the undisclosed landlord in the lease negotiations. Michael Testa of Jeffrey Realty represented Hobby Lobby, which plans to open in 2024. Neptune Plaza, which totals 215,000 square feet, is now 99.3 percent leased.

NEW YORK CITY — Boffi | DePadova, an Italian furniture provider, will open a 19,694-square-foot showroom at 99 Madison Avenue in Manhattan’s Nomad Design District. The space comprises the entire ground floor, mezzanine, second floor and lower level of the building. The opening is scheduled for spring 2024. Andrew Kahn, Fanny Fan and Adrienne Gallus of Cushman & Wakefield represented the landlord, Windsor Management, in the lease negotiations. The representative of the tenant was not disclosed.

DALLAS — KeyBank Real Estate Capital has provided NexPoint Residential Trust (NYSE: NXRT) with an $807.5 million Freddie Mac loan to refinance debt on 19 garden-style, market-rate multifamily properties across Texas, Florida, Nevada, Georgia, Arizona and North Carolina. NexPoint is a publicly traded real estate investment trust based in Dallas. Various properties in the portfolio are equipped with smart home technology, as well as a variety of individual and community amenities. Creekside at Matthews, for instance, is a 240-unit complex located in the Matthews suburb of Charlotte, North Carolina. The property offers one-, two- and three-bedroom floor plans with features such as slate or stainless steel appliances, washers and dryers, patios and garden-style bathtubs. Community amenities at Creekside include a playground, business center, clubhouse, courtyard, nature trail, a swimming pool and Wi-Fi in common areas. Meanwhile, Silverbrook Apartments in Grand Prairie, Texas, comprises 642 one-, two- and three-bedroom units and includes community amenities such as a business center, fitness center, dog park, volleyball court, tennis court, picnic area and three swimming pools. Individual units feature washers and dryers, ceiling fans, fireplaces and private patios. Christopher Black, Brendan O’Keefe and Christopher Neil of KeyBank’s Commercial Mortgage Group originated and structured the …

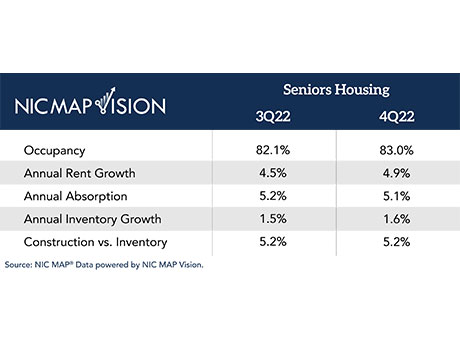

Seniors Housing Occupancy Rises 90 Basis Points in Sixth Consecutive Quarterly Increase

by Jeff Shaw

ANNAPOLIS, Md. — The national occupancy rate for private-pay seniors housing increased 90 basis points from 82.1 percent in the third quarter of 2022 to 83 percent in the fourth quarter of 2022, according to data from NIC MAP Vision. The occupancy rate has increased 520 basis points from a pandemic low of 77.8 percent in the second quarter of 2021. NIC MAP Vision is a product of the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit firm that tracks industry data gathered from 31 primary metropolitan markets. Private-pay seniors housing comprises independent living, assisted living and memory care. The seniors housing occupancy rate increased for the sixth consecutive quarter due to continued strong demand that outpaced inventory growth. Because new inventory has been added during the pandemic, however, the occupancy rate has not yet reached pre-pandemic levels, according to NIC. On the inventory side, about 3,300 units were added within the 31 NIC MAP Primary Markets during this quarter, while more than 8,600 units were absorbed on a net basis. This robust demand led to a new record high total number of occupied units: within the NIC MAP Primary Markets, the total number of occupied …

By Cathy Jones, Founder and CEO, Sun Commercial The 2022 Las Vegas retail market can be characterized by a generally positive outlook and some strong trends, even in the face of market uncertainty. A few of these core trends are quite interesting. Market research shows significant upward trends in asking rents, decreases in vacancy and certain key indicators driving this process. When broken down further, we find that these trends are emphasized in certain geographic areas more than others. The Southwest Las Vegas Valley submarket is seeing the greatest change in growth and development, followed closely by Henderson/Southeast. As an example, 93,592 square feet of retail space was constructed in the third quarter alone in the Southwest and Henderson; 91.2 percent of this space was pre-leased. The current amount of net absorption in the total market is 1.3 million square feet year to date. Half of this annual total occurred in the Southwest and Southeast submarkets. These two markets saw an explosion of growth driven largely by the housing boom. As new developments are constructed and homes sold, retail developments expand to meet that growing demand. There is more compartmentalization, however, than in the past with more community-oriented unanchored strip centers dominating the …

HOUSTON — Locally based investment and development firm Triten Real Estate Partners has purchased three industrial outdoor storage sites totaling 53.3 acres in Houston. The sites at 3004 Aldine Bender Road and 3434 Greens Road are both located on the city’s north side and total 35.3 acres and 6.8 acres, respectively. The third property, which is located at 15005 Crosby Freeway in northeast Houston, spans 11.2 acres. Triten acquired the properties, all of which house existing structures and have the capacity to support truck parking operations, in three separate, off-market transactions. The sellers and sales prices were not disclosed.

FORT WORTH, TEXAS — The Gettys Group Cos., a Chicago-based hotel design and development firm, has broken ground on the $45 million renovation of the 403-room Sheraton Fort Worth Downtown Hotel. The hotel originally opened in 1974 and also offers 25 suites. The capital improvement program will upgrade all the bedding, furniture and bathrooms of all guestrooms and expand the number of suites to 37. In addition, the project team will upgrade the entryway, lobby and amenity spaces, which include private and conference-style workspaces and 30,000 square feet of event space. Lastly, ownership will introduce a revamped lineup of food-and-beverage offerings. Completion is slated for the fall. Dallas-based HKS Architects designed the renovation, and an entity doing business as 1701 Commerce Acquisitions owns the property.