KENNESAW, GA. — Franklin Street has brokered the $13 million sale of Town Center Commons, a 72,168-square-foot shopping center located at 725 Ernest W. Barrett Parkway in Kennesaw, a northwest suburb of Atlanta. Nashville-based 615 Ventures purchased the retail center from Ardent Cos. Bryan Belk and John Tennant of Franklin Street represented the seller in the transaction. Town Center Commons is anchored by Public Lands, the first Southeast location of a new outdoors and sporting goods retail concept from Dick’s Sporting Goods. Other tenants include Five Below, which recently renewed its lease, as well as The Original Mattress Factory, Affordable Dentures & Implants, Town Center Nails, K-Town Vapor Lounge, Automation Personnel Services and Pinch of Spice. The center, which is shadow-anchored by Dick’s Sporting Goods and Costco, was 96 percent leased at the time of sale.

Property Type

Colliers Mortgage Provides Agency Acquisition Loan for French Quarter Apartments in Tampa

by John Nelson

TAMPA, FLA. — Colliers Mortgage has provided a Fannie Mae loan for the acquisition of French Quarter Apartments, a 57-unit multifamily community in Tampa. Built in 1968, the market-rate property features one- and two-bedroom units, as well as laundry facilities, a picnic area, barbecue grills, Spanish-speaking staff and a pool. Fritz Waldvogel of Colliers Mortgage’s Minneapolis office originated the seven-year loan on behalf of the undisclosed borrower.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the $33.6 million sale of a portfolio of six South Bronx multifamily buildings totaling 297 units. The portfolio consists of 14 studios, 67 one-bedroom apartments, 196 two-bedroom units, 19 three-bedroom residences and one office space. Victor Sozio, Shimon Shkury, Daniel Mahfar and Jason Gold of Ariel represented the undisclosed seller in the transaction. The buyer was a partnership between PH Realty Capital & Rockledge.

BOSTON — Locally based REIT American Tower (NYSE: AMT) has signed a 40,000-square-foot office lease renewal at 116 Huntington Avenue in Boston’s Back Bay neighborhood. The 15-story building spans 273,000 square feet and includes ground-floor retail and restaurant space. Michael Joyce and Lauria Brennan of Cushman & Wakefield represented the landlord, Columbia Property Trust (NYSE: CXP), in the lease negotiations. Kevin Kennedy and Tim Lahey of CBRE represented American Tower.

WALTHAM, MASS. — Marcus & Millichap has brokered the sale of a 16,637-square-foot office building located at 230 Second Ave. in Waltham, a western suburb of Boston. The sales price was $3.4 million. The property was fully leased to six tenants at the time of sale. Harrison Klein and Luigi Lessa of Marcus & Millichap represented the seller, an entity doing business as Eastport 230 LLC, in the transaction. The duo also procured the buyer, a private investor that acquired the asset via a 1031 exchange.

NEW YORK CITY — CBRE has negotiated a 14,375-square-foot office lease at 535 Madison Avenue in Midtown Manhattan. Steve Siegel, Craig Reicher, Tim Dempsey, Ramneek Rikhy and Marlee Tepliztky of CBRE represented the tenant, locally based law firm Fried Frank, in the lease negotiations. The tenant, which has committed to a 15-year term, plans to relocate from The Seagram Building to the 37-story tower in early 2024. Brian Gell and Laurence Briody, also with CBRE, represented the landlord, Park Tower Group.

Low Tide Properties, Continental Properties Receive $110M Refinancing for Met Tower Apartments in Downtown Seattle

by Amy Works

SEATTLE — Affiliates of Low Tide Properties and Continental Properties have obtained $110 million in financing for Met Tower, a multifamily property located at 1942 Westlake Ave. in Seattle. Citibank provided the loan, which Dave Karson, Alex Hernandez, Chris Moyer, Alex Lapidus and Meredith Donovan of Cushman & Wakefield Equity, Debt & Structured team arranged. Built in 2001, Met Tower features 366 apartments in a mix of studio, one- and two-bedroom floor plans along with 10,139 square feet of retail space and an attached, eight-level parking garage.

LAS VEGAS — Northmarq has arranged the sale of Sutton Place, a garden-style community located at 5400 W. Cheyenne Ave. in Las Vegas. West Lake Village, Calif.-based Sunstone Properties Trust acquired the asset from Salt Lake City-based Bridge Investment Group for $37 million, or $162,281 per unit. Built in 1986, Sutton Place features 228 apartments in a mix of one- and two-bedroom units ranging from 650 square feet to 927 square feet, a remodeled leasing office, fitness center, playground, soccer field, barbecue and picnic areas, and a laundry facility. At the time of sale, the property was 93 percent leased. The seller invested $2.8 million in capital improvements including deferred maintenance, exterior upgrades, paint and wood repair, asphalt, lighting, HVAC, landscaping, pool/deck furniture and new balcony railings throughout the property. Thomas Olivetti, Trevor Koskovich, Jesse Hudson and Ryan Boyle of Northmarq’s Las Vegas and Phoenix Investment Sales team handled the transaction.

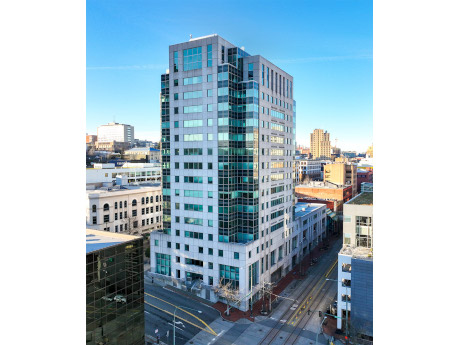

TACOMA, WASH. — Kirkland-based MJR Development has released plans to renovate the office building at 1145 Broadway in downtown Tacoma. Renamed as Tacoma Centre, the 15-story, 200,000-square-foot office building will include a café, bar, lounge areas, conference rooms and a fitness center with locker rooms. With the renovations, the tower will offer office space optimized for a culture of work/life balance and creative collaboration. Once complete, Tacoma Centre will offer a high-end lounge to accommodate casual team meetings, happy hours and corporate events and soirees. The remodeling will focus on common areas, and the building will remain open to tenants during construction. Interior designs will use natural materials, tall windows and expansive views. The renovation is slated for completion in summer 2023. MJR acquired the property, previously known as Tacoma Financial Center, in January 2022. Will Frame, Drew Frame and Ben Norbe of Kidder Mathews represented MJR in the sale and are now managing the leasing.

Sonnenblick-Eichner Negotiates Sale of Hotel Development Site in Dana Point, California

by Amy Works

DANA POINT, CALIF. — Sonnenblick-Eichner Co. has arranged the sale of the fee simple interest in the Cannon’s Hotel development site in Dana Point. The former home of Cannon’s Restaurant, the site is fully entitled and has received California Coastal Commission approval for a 100-room hotel. A private investor acquired the asset for an undisclosed price. Located on a bluff-top overlooking the Dana Point Harbor and Marina, the site is one block south of Pacific Coast Highway and approximately 2.5 miles west of Interstate 5. The Dana Point Harbor and Marina features more than 2,400 boat slips, several restaurants and various marine-oriented activities. The harbor and marina are undergoing a $338 million revitalization, including the addition of approximately 110,000 square feet of destination retail, restaurant, hotel and office space. Todd Bedingfield and David Sonnenblick handled the transaction.