YUCCA VALLEY, CALIF. — Progressive Real Estate Partners has arranged the sale of a multi-tenant retail building at 57990 29 Palms Highway in Yucca Valley. A Los Angeles County, Calif.-based private investor sold the asset to a Los Angeles County-based private investor for $1.9 million. Crazy Bargains, Luxury Nail Spa and No Limits Boutique are tenants at the 13,593-square-foot property. Lance Mordachini of Progressive Real Estate Partners represented the seller, while the buyer was self-represented in the transaction.

Property Type

CENTENNIAL, COLO. — Burgeon Properties Denver LLC has purchased an office building, located on 0.76 acres at 4901 E. Dry Creek Road in Centennial, from Non Paddle LLC for $1.7 million. Built in 1979, the 19,409-square-foot property features private offices, open work areas and suites with kitchens. The building was 80 percent occupied at the time of sale, providing a revenue stream while allowing space for the buyer’s operations. Paul Cattin of Platinum Commercial Real Estate represented the seller in the deal, while the buyer was unrepresented in the transaction.

MADISON, WIS. — CRG has broken ground on Chapter Mifflin, a six-story, 516-bed student housing community in Madison’s Mifflin District adjacent to the University of Wisconsin-Madison. CRG assembled a 1.5-acre site of 12 contiguous parcels along West Washington Avenue and West Mifflin Street for the project and rezoned them for higher-density residential. Chapter Mifflin will offer 162 fully furnished units. Completion is slated for the 2027-28 academic year, with preleasing expected to commence in summer 2026. Currently home to a mix of single-family residences and duplexes operating as student housing, the project site is a half mile from the Memorial Library and four blocks from the retail and entertainment offerings along the State Street corridor. Chapter Mifflin will offer a range of studio through five-bedroom units. Amenities will include a fitness center, study areas, outdoor courtyards, a fifth-floor terrace and secure parking garage. Lamar Johnson Collaborative, a subsidiary of CRG’s parent company Clayco, designed the project, which will feature a public pedestrian connection. Wisconsin-based CG Schmidt will serve as general contractor. CRG worked with Alder Mike Verveer; Madison’s Department of Planning, Community & Economic Development; Capitol Neighborhoods Inc.; and other local stakeholders on the project.

CLEVELAND — The NRP Group has completed The Collins, a 316-unit luxury apartment development on the Scranton Peninsula in Cleveland. The development transforms a long-underutilized waterfront site. Designed by BKV Group, the project spans more than 7 acres and comprises two five-story apartment buildings and three townhome buildings. Apartment units range from studios to three-bedroom layouts. Townhomes include private entry, rooftop balconies and two-car garages. Indoor amenities include a fitness center, resident clubhouse, conference room, private breakout pods and a pet spa. A fifth-floor lounge provides views of the Cuyahoga River and city skyline. Outdoor amenities include a resort-style pool, firepits, grilling stations and an event plaza. The development connects to the Towpath Trail, with free onsite bike rentals available for residents. Dollar Bank served as the construction lender. The Ohio Department of Development provided funds through its Brownfield Remediation and State Opportunity Zone Programs. The Ohio Water Development Authority provided gap financing as well. The City of Cleveland provided tax abatement and tax-increment financing. Monthly rents start around $1,505, according to the property’s website. Residents can earn two months of free rent by moving in prior to Nov. 1.

WATERLOO, IOWA — TVS Supply Chain Solutions has opened its new 225,113-square-foot, build-to-suit facility in Waterloo. Developed in partnership with ElmTree Funds and Ryan Cos. US Inc., the project features 6,800 square feet of office space, a driver’s lounge, 30 loading dock doors and two drive-in doors. TVS’s first Iowa facility is in Iowa City. Ryan is also building another 225,000-square-foot property for TVS in Davenport that is scheduled for completion in October. Ryan served as developer and builder of the Waterloo facility, and Ryan A+E Inc., Ryan’s design studio, served as the architect. ElmTree served as facility owner and financier.

NEW ALBANY, OHIO — Cushman & Wakefield has brokered the sale of a 170,000-square-foot office campus located at 8111 Smith’s Mill Road in New Albany near Columbus. EOG Resources Inc., one of the largest crude oil and natural gas exploration and production companies in the United States, was the buyer. The campus will house EOG Resources’ new Columbus division, adding support for the company’s Utica Shale asset development close to its operations in the region. The LEED Gold-certified building offers office, training and lab facilities along with modern amenities. Randy Stephens and W. Allan Meadors of Cushman & Wakefield represented EOG Resources in the transaction. The company plans to open the new office later this year.

PLAINFIELD, IND. — Chicago-based HSA Commercial Real Estate has inked a new 68,486-square-foot industrial lease with home furnishings retailer Ashley DSG at Gateway Industrial V in Plainfield near the Indianapolis International Airport. The deal returns the 262,758-square-foot building in HSA’s Gateway Business Park to full occupancy. Memphis, Tenn.-based Ashley DSG maintains 166 locations in the United States and Canada. The company will use its space at Gateway V to warehouse and distribute home furnishings. The lease is a relocation and expansion from the company’s existing location in the Indianapolis area. HSA oversaw tenant improvements, including racking and upgrades to the truck dock area. Developed on a speculative basis and delivered in 2019, Gateway V features a clear height of 32 feet, 30 truck docks, four drive-in doors, 185 parking stalls and 70 trailer positions. The warehouse is also home to auto glass distributor Mygrant Glass Co., Paris-based aerospace firm Safran Nacelles and transplant solutions provider LifeNet. Tom Niessink of Niessink Commercial Real Estate represented Ashley DSG in the lease. Terry Busch and Jared Scaringe of CBRE represented ownership.

CHICAGO — Related Midwest and CRG have broken ground on the Illinois Quantum & Microelectronics Park (IQMP), the first phase of Quantum Shore Chicago, a 440-acre, master-planned technology and innovation district along the Chicago lakefront. The project is located on the former U.S. Steel South Works site at 8080 S. DuSable Lake Shore Drive in the South Chicago neighborhood. The co-developers are receiving financing from funds managed by Blue Owl Capital on both the land acquisition and vertical development of facilities for IQMP’s anchor tenant, PsiQuantum, a Palo Alto, Calif.-based company with a mission “to build and deploy the world’s first useful quantum computers.” Quantum computing utilizes quantum mechanics to solve complex problems such as climate, energy and defense challenges faster than traditional computers. Created through a public-private partnership with State of Illinois and federal agencies, IQMP will occupy 128 acres on the southern end of the development site. In addition to PsiQuantum’s 80,700-square-foot office and research facility — the first of several buildings the firm will eventually occupy — the campus will include a cryoplant (a facility that uses extremely low temperatures to produce gases like liquid helium and nitrogen for high-tech applications) and equipment labs, as well as …

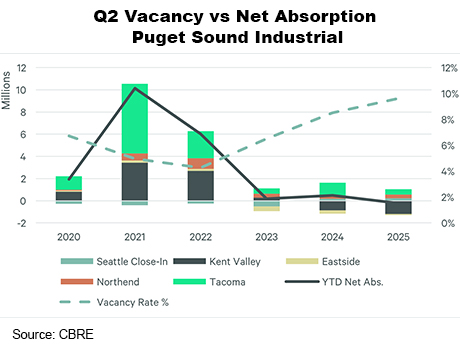

— By Andrew Hitchcock of CBRE — The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April. While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing. Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 …

HOUSTON — Hines Global Income Trust (HGIT) has acquired Montrose Collective, a 189,000-square-foot office and retail development located just outside of downtown Houston, for $137.5 million. Montrose Collective houses the offices of Live Nation and Pattern Energy, as well as a range of shopping and dining establishments. Montrose Collective was fully leased at the time of sale. John Mooz and Ashley Prasse-Freeman led the transaction for the new ownership on an internal basis. The seller was not disclosed.