YORKTOWN, VA. — Divaris Real Estate’s Investment Sales Group has brokered the sale of The Villages at Kiln Creek, a 45,255-square-foot shopping center located in Yorktown, about 13 miles north of Newport News, Va. Jason Oliver, Rachel Salasky and George Fox of Divaris represented the seller, Glazer Properties, in the transaction. Liberty Investment Partners acquired the property for $8.2 million. The center was fully leased at the time of sale to tenants including Riverside Health System, Guitar Center and McCormick Paint. George Fox and Caroline Zarpas of Divaris will handle leasing at the center on behalf of Liberty Investment Partners.

Property Type

HOUSTON — High Street Residential is nearing completion of Parkside Residences, a 43-story multifamily tower located at 808 Crawford St. in downtown Houston. Designed by Ziegler Cooper and built by Andres Construction, the property houses 309 units in studio, one-, two- and three-bedroom formats, as well as one- and two-story penthouses. Amenities include a pool, fitness center, coworking lounge, outdoor grilling and dining areas and a catering kitchen. Rents start at $2,130 per month for a studio apartment. Full completion is slated for April 2023.

LAKELAND, FLA. — Northmarq has arranged the sale of The Caroline, a recently completed apartment community comprising 228 units in Lakeland, roughly 40 miles east of Tampa. Luis Elorza, Justin Hofford and Kevin Mosher of Northmarq represented the buyer, Topaz Capital Group, which acquired the property for an undisclosed price. Located at 1906 Griffin Road, the community features units in one-, two- and three-bedroom layouts, with an average unit size of 1,161 square feet. Amenities include a clubhouse, pool, an outdoor kitchen and entertainment space, pet park, fitness center, playground and wetland boardwalk.

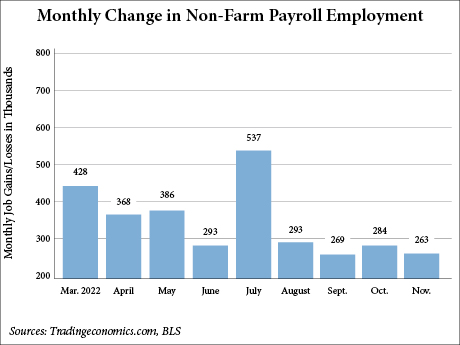

WASHINGTON, D.C. — The U.S. economy added 263,000 jobs in November, and the unemployment rate remained unchanged at 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). The employment gains beat Dow Jones economists’ expectations of 200,000 new jobs, reports CNBC. Meanwhile, average hourly wages jumped 0.6 percent for the month, according to the BLS, double the estimate of economists. Furthermore, the 5.1 percent annual growth in wages exceeded the expectation of 4.6 percent. CNBC also reports that the better-than-expected wage growth may put even greater pressure on the Federal Reserve to continue its path of rate hikes, which Fed officials have been signaling as likely ahead of the December Federal Open Markets Committee (FOMC) meeting. Many media outlets report that economists are expecting the central bank to boost the federal funds rate by 50 basis points before the end of the year, raising the target range to between 4.25 and 4.5 percent. However, some other media sources indicate that strong wage growth is another sign of inflation and could push the Fed to boost the rate by 75 basis points. Big gains in leisure and hospitality In November, the employment sector with the biggest surge was leisure and …

MESQUITE, TEXAS — Arizona-based Coleman Powersports has signed a 379,620-square-foot industrial lease at Mesquite Airport Logistics Center, located on the eastern outskirts of Dallas. The tenant will occupy the entirety of Building 1, which was part of Phase I at the 2.3 million-square-foot development. Construction of the two-building second phase is underway and expected to be complete next year. Matt Dornak and Ryan Wolcott of Stream Realty Partners represented the landlord, Dalfen Industrial, in the lease negotiations.

SAN ANTONIO — Marcus & Millichap has brokered the sale of Noah’s Ark Self Storage, a 477-unit facility located in the Stone Oak neighborhood of San Antonio. The facility was built on 1.2 acres in 2013 and spans 57,219 net rentable square feet. Dave Knobler and Charles LeClaire of Marcus & Millichap represented the seller, a locally based limited liability company, in the transaction. The duo also procured the buyer, a publicly traded REIT. Both parties requested anonymity.

HOUSTON — Los Angeles-based investment firm CIM Group has sold Ashton on West, a 246-unit apartment community located in the Montrose neighborhood of Houston. The garden-style property offers one- and two-bedroom units and amenities such as a pool, clubhouse, fitness center, outdoor grilling and dining stations and a dog park. The buyer and sales price were not disclosed. CIM Group originally acquired the asset in 2013.

HOUSTON — Locally based brokerage firm Finial Group has negotiated a 26,320-square-foot industrial lease at 6422 Calle Lozano Drive in northwest Houston. Built in 1984 and renovated in 2021, the facility sits on two acres and includes 2,000 square feet of office space. Chase Tucker and William Alcorn of Finial Group represented the undisclosed landlord in the transaction. The name and representative of the tenant were not released.

DETROIT — Bedrock has acquired the Roberts Riverwalk Hotel located at 1000 River Place in Detroit’s East Riverfront neighborhood. The purchase price was undisclosed. The seller was Michael Roberts, a St. Louis-based business mogul, according to Crain’s Detroit Business. The 108-room hotel features 5,500 square feet of banquet and event space as well as 126 parking spaces. Bedrock says this acquisition aligns with its mission to further position the riverfront as an ideal site for sustainable urban development. In the East Riverfront area, Bedrock has previously purchased the former UAW-GM Center for Human Resources and a portfolio of properties previously owned by the Stroh family. Bedrock plans to make additional updates regarding the riverfront in 2023. Bedrock, the real estate arm of Rocket Mortgage founder Dan Gilbert, maintains a portfolio of more than 19 million square feet of office, retail and residential space.

ELKHART, IND. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of an 801,218-square-foot industrial facility in Elkhart for an undisclosed price. Completed in October, the build-to-suit is home to a recreational vehicle tenant. The property, which includes a showroom and office as well as warehouse and distribution space, features a clear height of 30 feet, 56 dock-high doors, a 194-foot truck court and seven drive-in overhead doors. Peter Bauman and Tivon Moffitt of IPA represented the seller and procured the buyer, neither of which were disclosed.