HOUSTON — A joint venture between Chicago-based Brennan Investment Group and Los Angeles-based PCCP LLC has purchased a 1.3 million-square-foot industrial park in northwest Houston in a short-term sale-leaseback. The development, which will soon be vacant, comprises 16 buildings that range in size from 11,000 to 450,000 square feet on a 126-acre site. Constructed between 1999 and 2018, the buildings feature HVAC-equipped warehouses, bridge cranes, heavy power capacities, industrial outdoor storage space and above-standard clear heights. Brennan and PCCP acquired the property from subsea oil and gas equipment manufacturer Innovex. John Ferruzzo of KBC Advisors brokered the deal.

Property Type

BRYAN, TEXAS — Dwight Mortgage Trust, the affiliate REIT of New York City-based Dwight Capital, has funded the $35 million recapitalization of Camber Villas, a 490-bed student housing community in the Central Texas city of Bryan. The property is located across the street from Blinn College and consists of 22 three-story buildings housing one-, two, three- and four-bedroom units. Amenities include a business center, pool, dog park, coffee bar, fitness centers, sand volleyball courts and an outdoor basketball court. The transaction was originated by David Scheer and Jack Baron of Dwight Capital and arranged by Culby Culbertson of Culbertson Holdings.

SAN ANTONIO — Newmark has arranged the sale of River House, a 261-unit apartment complex in San Antonio’s Riverwalk district. The midrise building was completed in 2015 and offers studio, one-, two- and three-bedroom units that range in size from 527 to 1,465 square feet. Amenities include a pool, fitness center, dog park, community kitchen and package lockers. Matt Michelson and Patton Jones of Newmark represented the seller, locally based investment firm Hixon Properties, in the transaction. The buyer and sales price were not disclosed. River House was 95 percent occupied at the time of sale.

HOUSTON — Colliers has negotiated a 48,000-square-foot lease in the Jersey Village area of northwest Houston. According to LoopNet Inc. the building at 7420 Security Way was built in 2006 and totals 191,594 square feet. Barrett Gibson and David McMahon of Colliers represented the tenant Hospitality Solutions Inc., which also recently subleased 26,847 square feet of space in North Houston to an unnamed user, in the lease negotiations. The name and representative of the landlord were not disclosed.

Selig Sells 45 Acres at LaGrange Mixed-Use Campus for Georgia’s First Professional Cricket Stadium

by John Nelson

LAGRANGE, GA. — Selig Enterprises has sold 45 acres at Sola, the Atlanta-based company’s 180-acre mixed-use campus in LaGrange. The buyer, the founders of DAS Cricket Academy and NJ Blackcaps in New Jersey, plan to develop Georgia’s first professional cricket stadium on the site. The LaGrange Cricket Stadium will be the first privately owned cricket stadium in the United States and the fourth cricket stadium in the country. The open-air stadium will break ground this fall and is slated to be completed in the first quarter of 2027. The project will have 10,500 seats, expandable to 25,000, and be designed to International Cricket Council regulations. The stadium will also have a FIFA-regulated soccer field and host various events. Additionally, a hotel with a sports-focused food-and-beverage program is planned on the 45-acre site, complementing the Marriott hotel currently under construction within Sola that Noble Investment Group is developing, as well as the Great Wolf Lodge resort that is situated on the northern end of the Sola campus. Selig plans to add offices, apartments, single-family homes and 150,000 square feet of retail at the Sola development in the near future.

Shriners Children’s Signs Multi-Floor Lease at Science Square Labs in Midtown Atlanta

by John Nelson

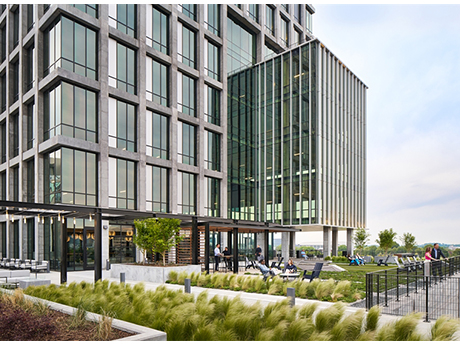

ATLANTA — Shriners Children’s, a global pediatric healthcare system, has signed a multi-floor lease for research-and-development space at Science Square Labs, a 368,213-square-foot laboratory and office tower in Midtown Atlanta. The project, owned and developed by Trammell Crow Co., is part of Georgia Tech’s 18-acre Science Square innovation district. Shriners Children’s Research Institute will feature next-generation laboratories, modern collaborative workspaces and advanced technology infrastructure. The move is expected to bring more than 470 jobs to Atlanta. With Shriners Children’s new lease, Science Square Labs is now 83 percent leased to tenants including Duracell, Georgia Tech & Emory BioMedical Engineering faculty labs, the Georgia Department of Agriculture, Portal Innovations and Osmose. Eric Ross, Jessica Doyle and Graham Little of CBRE represented Trammell Crow Co. in the lease negotiations.

MIAMI — Blanca Commercial Real Estate (Blanca CRE) has arranged a 78,315-square-foot office lease at Waterford Business District in Miami. ADP, a global HR and payroll solutions provider, will relocate its current Miami office at 10200 Sunset Drive to the Waterford campus at 65th Avenue and 7th Street, adjacent to Miami International Airport. Juan Ruiz, Andres del Corral, Jack Davidson, Tere Blanca and Jessy Aguila of Blanca CRE represented the undisclosed landlord in the lease negotiations. Other recent leases executed at the 250-acre Waterford campus include Carnival Corp., Assurant and Verizon, among other major firms.

LTC Properties Completes $40M Acquisition of Two Seniors Housing Communities in Kentucky

by John Nelson

WESTLAKE VILLAGE, CALIF. — LTC Properties has completed the acquisition of two seniors housing communities located in Kentucky. An undisclosed seller sold the properties for $40 million. Opened in 2023, the properties together total 158 units and feature assisted living and memory care residences. Charter Senior Living manages the communities, the locations of which were not disclosed. California-based LTC plans to execute an additional $195 million in seniors housing operating portfolio acquisitions by mid-October and an additional $90 million by the end of the year.

Disney Investment Group Negotiates Sale of 157,818 SF Shopping Center in Lake Charles, Louisiana

by John Nelson

LAKE CHARLES, LA. — Disney Investment Group (DIG) has negotiated the sale of Southgate, a 157,818-square-foot shopping center located in Lake Charles. The center has been anchored by a 37,442-square-foot Market Basket grocery store for nearly 40 years. Additional tenants at the property, which was 90.8 percent leased at the time of sale, include Dollar Tree, Office Depot, Books-A-Million and Oak Street Health. David Disney and Adam Crockett of DIG represented the seller and procured the buyer in the transaction. The sales price was not released.

NEW YORK CITY — Tremont Realty Capital, a division of Boston-based investment firm RMR Group, has provided a $34.5 million loan for the refinancing of a mixed-use building on Manhattan’s Upper West Side. The 23,300-square-foot building at 2875 Broadway houses retail and healthcare uses. Tremont funded the floating-rate loan, which has a two-year initial term with three one-year extension options, through its affiliate, Seven Hills Realty Trust (NASDAQ: SEVN). Meridian Capital Group arranged the debt on behalf of the sponsor, a partnership between TPG Angelo Gordon and Premier Equities.