DENVER — Institutional investors advised by J.P. Morgan Global Alternatives have sold Airport Central Portfolio, a two-building industrial property near Denver International Airport in Denver. Boston-based TA Realty acquired the asset for an undisclosed price. Jeremy Ballenger, Tyler Carner, Jim Bolt and Jessica Ostermick of CBRE National Partners in Denver represented the seller in the deal. Situated on 15 acres at 11777 E. 55th Ave. and 11475 E. 53rd Ave., the 340,960-square-foot asset includes two multi-tenant distribution buildings. The buildings are 93 percent leased to seven diversified tenants. Current unit sizes range from 19,000 square feet to 86,200 square feet with the ability to divide and combine units in the future as tenant demand dictates. The buildings feature clear heights ranging from 24 feet to 26 feet with dock-high and drive-in loading, ESFR/wet sprinklers and rail service by Union Pacific.

Property Type

Serfer Land Ventures Sells 48-Acre SiteOne Landscape Supply Industrial Campus in Windsor, Colorado

by Amy Works

WINDSOR, COLO. — Serfer Land Ventures has completed the disposition of a 48-acre industrial campus located at 6166 Weld County Road 74/Harmony Road in Windsor. IA Windsor LLC bought the asset for $9.8 million. SiteOne Landscape Supply fully occupies the site. In 2019, SiteOne constructed a 12,821-square-foot showroom and 14,922-square-foot warehouse on the site. Jared Goodman, Aki Palmer, Cole VanMeveren, Tyler Murray and Nate Heckel of Cushman & Wakefield represented the buyer and seller in the deal.

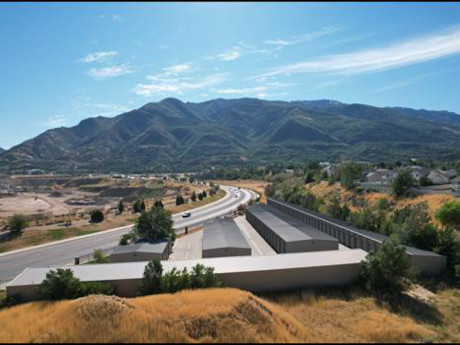

OGDEN, UTAH — Marcus & Millichap has brokered the sale of South Weber Storage, a self-storage facility in Ogden. Terms of the transaction were not released. Jordan Farrer and Adam Schlosser of Marcus & Millichap’s LeClaire-Schlosser Group represented the seller, a local partnership, and procured the undisclosed buyer. Totaling 26,060 square feet, South Weber Storage consists of five single-story buildings offering a total of 136 non-climate-controlled drive-up units. The facility features brick front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and asphalt driveways.

EAST BRUNSWICK, N.J. — New Jersey-based developer Garden Communities is underway on construction of Legacy Place, a 520-unit multifamily project located in the Northern New Jersey community of East Brunswick. The development will comprise one-, two- and three-bedroom units across two buildings with garage parking and 18,000 square feet of retail space, all on a 25-acre site. Amenities will include a pool, outdoor grilling and dining areas, a coworking lounge, fitness center, dog park and walking trails. Garden Communities plans to begin leasing Legacy Place in mid-2023.

BRISTOL, CONN. — Newmark has arranged the $79.2 million sale of Bristol Logistics Center, a 1.1 million-square-foot industrial property in Connecticut. The rail-served site spans 179 acres and formerly housed a General Motors manufacturing plant. Treetop Development acquired the property from an entity doing business as Bristol Center LLC. Jeff Fishman, Cory Gubner and Alex Haendler of Newmark brokered the deal. At the time of sale, Bristol Logistics Center was 93 percent leased to three tenants: Firestone, Clark Dietrich and Arett Sales.

NEW YORK CITY — A partnership between locally based firm Quinlan Development Group and global investment group GTIS Partners will develop a 197-unit multifamily project in the Gowanus neighborhood of Brooklyn. The 17-story building will house parking and retail space and have an affordable housing component. Units will come in one- and two-bedroom formats, and amenities will include a fitness center, gaming lounge, coworking spaces and a rooftop terrace. Christopher Peck, Peter Rotchford, Nicco Lupo, Jeff Julien, Rob Hinckley, Jillian Mariutti, Phil Cadorette and Joy Ryoo of JLL arranged construction financing through Los Angeles-based CIT on behalf of the partnership.

COATESVILLE, PA. — KeyBank has provided a $12.2 million construction loan for The Willows at Valley Run, a 60-unit affordable housing project in Coatesville, located west of Philadelphia in Chester County. The property will offer one-, two- and three-bedroom units across a trio of three-story buildings. The amenity package will consist of a fitness center, meeting room, basketball court, clubhouse, playground and a common kitchen. Eric Steinberg of KeyBank structured the financing on behalf of the developer, Ingerman Group. KeyBank also provided tax credit equity through its partnership with Enterprise Community Partners Inc. A tentative completion date was not disclosed.

Triangle Equities Begins Construction of $500M Mixed-Use Development in East Orange, New Jersey

by John Nelson

EAST ORANGE, N.J. — Real estate development firm Triangle Equities, along with investment partners Goldman Sachs, Basis Investment Group and co-developer Incline Capital, recently broke ground on The Crossings at Brick Church Station in East Orange, a suburb of Newark in Essex County. The $500 million mixed-use redevelopment project will be one of the largest real estate developments ever constructed in the city, according to East Orange Mayor Ted Green. Upon completion, The Crossings will comprise approximately 200,000 square feet of commercial and restaurant space, including a new ShopRite grocery store. The development will also include 820 mixed-income rental units, a 1,200-space parking garage and a public promenade and plaza. Located on 533 Main St., the transit-oriented project will be situated near NJ Transit’s Brick Church Train Station, which the City of East Orange is revamping. The Crossings will replace the former Brick Church Plaza and include a nine-story building, a five-story building and a seven-story parking garage. March Associates Construction, based out of Wayne, N.J., will serve as the construction manager and general contractor for the project. The Crossings will be built in two phases and is scheduled for completion in the fourth quarter of 2024. Over 85 percent …

By Jason Baker of Baker Katz It’s amazing how quickly things can change. Just a few short months ago, the commercial real estate outlook was generally positive. Both in Texas and nationally, retail sales were proving to be fairly resilient to the rising inflation and economic turbulence that have characterized most of 2022. Despite low consumer confidence, strong fundamentals and a retail sector riding the high of a post-pandemic boom provided plenty of reasons for optimism. That has all changed in the last 60 to 90 days. Prevailing positivity has recently given way to concern, and sentiment from within the industry has clearly shifted. High interest rates have made it virtually impossible to develop any type of commercial project, and persistent supply chain constraints and ongoing hikes in costs of construction materials have further exacerbated this challenge. With interest rate increases come higher cap rates, which complicates sellers’ efforts to move their assets while values are this fluid. To put the impact of rising rates into perspective, interest payments on commercial real estate have in some cases increased five-fold in just the last few months. The impact of this activity on retail real estate during the all-important holiday shopping season …

Content PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastPavlov MediaSoutheastStudent HousingTexasWestern

The Evolution of Internet Setups: How Student Housing Internet Preferences Are Influencing Traditional Multifamily

Multifamily properties have witnessed a rapid expansion in Internet needs, a trend presaged by burgeoning Internet demands in student housing. Multifamily residents have increased their connection demands and are becoming increasingly sophisticated in their requirements for high-quality Internet. What can the lessons of student housing connectivity teach us about traditional multifamily trends, especially when it comes to bulk Internet? Bulk Internet approaches allow for more sophistication in multifamily properties, as demonstrated by student housing best practices. Student housing pioneered built-in networks to keep mobile devices from competing for Wi-Fi bandwidth, minimize downtime and use fiber connections to ensure speed and reliability. This style of network is becoming the gold standard for constant, heavy-duty Internet use in multi-dwelling units (MDUs). High-level connectivity is becoming an absolute necessity for multifamily properties, drawing in residents and improving their Internet-driven lifestyles. And as never-before-seen demand for bandwidth is graduating from dorm rooms to traditional apartments, well-planned multifamily Internet connections can help operators adapt gracefully. COVID’s Role in Internet Use Expansion COVID lockdowns accelerated already growing Internet requirements, which pushed Internet quality to the forefront as connectivity became increasingly important. “COVID put the spotlight on properties to make sure they had great infrastructure. The demand …