ATLANTA — Chicago-based Sterling Bay and Charlotte-based Asana Partners have broken ground on 1050 Brickworks, a 14-story office building located at West Marietta Street and Brady Avenue in Atlanta’s West Midtown district. The co-developers are building the 225,000-square-foot property on a speculative basis. The duo recently secured an undisclosed amount of construction financing from Bank OZK. The design-build team includes architect HKS and general contractor Gilbane. The local Stream Realty Partners team of Bryan Heller, Peter McGuone and Parker Welton are leasing the property on behalf of Sterling Bay and Asana. 1050 Brickworks will feature a fitness center, private tenant balconies, open-air conference spaces and lounges and 14,000 square feet of retail space. The property will also feature creative office space with floor plates averaging 33,000 square feet. Upon completion, which is set for early 2024, 1050 Brickworks will anchor Asana’s adjacent Brickworks campus that currently features 166,000 square feet of shops and restaurants.

Property Type

THE WOODLANDS, TEXAS — General contractor Strike Construction has signed a 43,230-square-foot office lease at Wildwood Corporate Centre in The Woodlands, about 30 miles north of Houston. The two-building, 330,000-square-foot complex was built in phases between 2014 and 2016 and offers a fitness center and conference facilities. Steve Rocher and Jason Presley of CBRE represented the landlord, an entity doing business as GeoSouthern Budde Road LLC, in the lease negotiations. Jon Silberman of Partners represented the tenant. Wildwood Corporate Centre is now fully leased.

Lerner Enterprises Purchases Parc at Gatlin Commons Apartments in Port St. Lucie, Florida for $65M

by John Nelson

PORT ST. LUCIE, FLA. — Lerner Enterprises, a Rockville, Md.-based multifamily developer and manager owned by Washington Nationals’ principal owner Mark Lerner, has purchased Parc at Gatlin Commons, a 200-unit apartment community in Port St. Lucie. Miami-based JSB Capital sold the property to Lerner for $65 million. Aaron Jungreis of Rosewood Realty represented the buyer and seller in the transaction. Built in 2020, Parc at Gatlin Commons features a pool, fitness center, pet play area and a basketball court. The community is located on a 14.4-acre site at 1900 Aledo Lane in Port St. Lucie’s Newport Isles neighborhood. Rental rates range from $1,800 to $2,970, according to Rosewood Realty.

Estate Cos. Completes Multifamily Conversion of Former Ramada Inn Hotel in Metro Miami

by John Nelson

HIALEAH, FLA. — The Estate Cos. has completed the conversion of a former Ramada Inn hotel located at 1950 W. 49th St. in Hialeah, a suburb of Miami. The redevelopment, known as Alture Westland, is a four-story garden-style community housing 251 apartments and 5,522 square feet of retail space. The Estate Cos. acquired the shuttered hotel and the five-acre site for $15.3 million in August 2020 and broke ground on the adaptive reuse project in April 2021. Alture Westland, which represents Estate’s first Alture-branded property, features studios and one-bedroom apartments, as well as a pool with a sundeck, fitness center and a clubhouse. The community is currently 85 percent leased, with rental rates starting at $1,636, according to the property website. Additionally, Panera plans to open a new 2,036-square-foot outparcel restaurant on the site with a drive-thru fronting West 49th Street.

North American Properties, Galley Group to Open Food Hall at Newport on the Levee in Kentucky

by John Nelson

NEWPORT, KY. — Cincinnati-based North American Properties (NAP) has partnered with Galley Group, a Pittsburgh-based food hall operator, to open a new food hall and bar at Newport on the Levee, a mixed-use destination along the Ohio River in Newport. The 7,900-square-foot venue, dubbed The Galley on the Levee, will feature four restaurants and a signature bar that will be able to accommodate 200 patrons. Designed by Reztark Design Studio, the food hall will open onto Bridgeview Box Park, an open-air shipping container park that opened in 2020 as part of NAP’s redevelopment of Newport on the Levee, which originally opened in 2001. The Galley on the Levee is set to open in summer 2023 and will mark Galley Group’s entry into the Kentucky market. In addition to the food hall, several other restaurants are currently under construction at the mixed-use development, including Shiners on the Levee, 16 Lots Brewing Co. and Amador. Shiners will soft-open during Thanksgiving week and host grand opening festivities in early December, while 16 Lots and Amador are slated to open next spring, according to NAP.

HURST, TEXAS — Bradford Commercial Real Estate Services has negotiated a 12,000-square-foot industrial flex lease at 10728 S. Pipeline Road in Hurst. According to LoopNet Inc., the property was built on 1.3 acres in 1964. Jason Finch and Michael Spain of Bradford represented the landlord, an entity doing business as Euless Industrial LLC, in the lease negotiations. The representative of the tenant, Mid-Cities Classics Inc., a provider of automotive repair and restoration services, was not disclosed.

KITTERY, MAINE — Private equity real estate firm Jones Street Investment Partners has received a $70 million construction loan for the development of Seacoast Residences, a 282-unit multifamily project in Kittery, located in the southern coastal part of Maine. The five-building community will offer amenities such as a pool, fitness center, dog park and nature trails. KeyBank provided the loan, and Colliers arranged a $7.9 million preferred equity investment with an undisclosed partner. Construction is slated for an early 2024 completion.

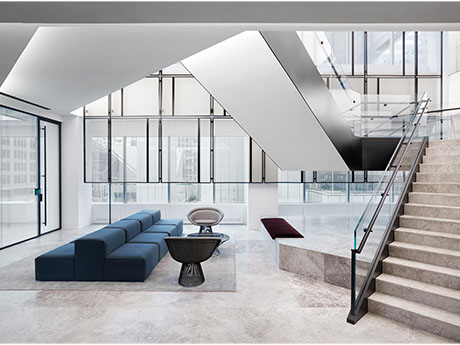

NEW YORK CITY — Global law firm Shearman & Sterling has completed the renovation of its 340,000-square-foot office headquarters space at 599 Lexington Avenue in Midtown Manhattan. The redesigned workspace houses apportioned offices, improved boardroom acoustics, new artwork and various health and wellness features. Perkins & Will served as the architect of the project, which was conceived in advance of the pandemic and took approximately two years to complete. L&K Partners served as the construction manager, and MEP provided engineering services.

PHILADELPHIA — Developer LCOR has topped out The Ryland, a 267-unit apartment building in Philadelphia’s Society Hill neighborhood. The property will offer a mix of studio, one- and two-bedroom units, as well as two- and three-bedroom penthouses. The amenity package will comprise an outdoor pool, fitness center, multiple lounges, a rooftop deck, a children’s play area and concierge services. Hunter Roberts Construction Group is the general contractor for the project, which is scheduled for a fourth-quarter 2023 completion.

TREXLERTOWN, PA. — Home Depot (NYSE: HD) will open a 136,000-square-foot store at Macungie Crossing, a 182,000-square-foot shopping center that is under construction in the Lehigh Valley community of Trexlertown. New York City-based RD Management is developing the project, construction of which is underway and expected to be complete next summer. The Atlanta-based home improvement retailer now operates about 70 stores in Pennsylvania.