CHICAGO — Kiser Group has arranged the sale of an 18-unit multifamily property at 7224 N. Rockwell St. in Chicago’s Rogers Park neighborhood for $2.7 million. The property has been partially renovated and houses four dorm units for the Hebrew Theological College. The building comprises a mix of one-, two- and three-bedroom units. Danny Logarakis of Kiser brokered the sale. The buyer, a local investor, also recently purchased another building nearby with 40 units.

Property Type

WASHINGTON, D.C. — Redbrick LMD has received a $142.5 million construction loan for the development of The Douglass, a 750-unit residential project in Washington, D.C.’s Bridge District. Brian Gould of Chatham Financial arranged the loan through Citizens Bank on behalf of Redbrick. The Douglass will feature 40,000 square feet of retail space, and about 80 of the apartments will be reserved as affordable housing. The Douglass will be the first building constructed in the Bridge District, which comprises eight acres. Upon completion, the 2.5 million-square-foot project will be developed as a mixed-use neighborhood with a focus on sustainability and wellness. The Douglass is designed to target net zero carbon from operations and to meet or exceed International Future Living Institute (IFLI) and LEED Platinum standards.

NASHVILLE, TENN. — Dairy Farmers of America (DFA), represented by Tarek El Gammal and Vincent Lefler of Newmark, has sold a 3.2-acre parcel in Nashville. Bosa Development acquired the land for $66 million. Located at 1401 Church St., the site is part of the Midtown submarket and will be developed as a mixed-use property. John Shaunfield, Kyle Jett and Chris Murphy of Newmark’s Dallas office also provided transactional support. Details about the construction timeline or project design were not disclosed.

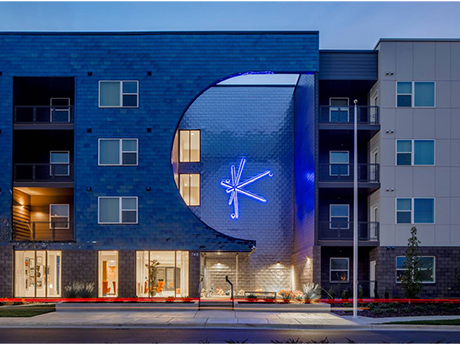

HUNTSVILLE, ALA. — Doster Construction Co., in partnership with Chicago-based developer Heartland Real Estate Partners, has completed the development of Constellation, an apartment community located in downtown Huntsville. Designed by Chicago-based Built Form Architects, Constellation features 219 luxury units in studio, one-, two- and three-bedroom layouts. Construction on the development, which is now open for leasing, began in late 2020. Rental rates at Constellation range from $1,117 to $3,709 per month, according to Apartments.com.

PENSACOLA, FLA. — JLL has arranged the sale of Pensacola Square, a 142,767-square-foot shopping center located in Pensacola. Brad Peterson and Whitaker Leonhardt of JLL represented the seller, an affiliate of Atlanta-based RCG Ventures LLC. Pensacola Square, which was 95 percent leased at the time of sale, is anchored by Big Lots and shadow-anchored by Hobby Lobby. Tenants at the property include American Freight Outlet, Beall’s Outlet and Petland. A private Florida-based family office acquired the shopping center for an undisclosed price.

VIRGINIA BEACH, VA. — Matthews Real Estate Investment Services has brokered the sale of a 13,225-square-foot store located at 1701 Independence Blvd. in Virginia Beach. The single-tenant property was leased to CVS/pharmacy at the time of sale Preston Schwartz and Chad Kurz of Matthews represented the private seller in the transaction. Jason Maier of Stan Johnson Co. represented the undisclosed buyer, which acquired the property for $10.6 million. CVS/pharmacy has a little over 12 years remaining on the lease.

PHOENIX — Dallas-based developer Howard Hughes Corp. (NYSE: HHC) has broken ground on Teravalis, a 37,000-acre master-planned community that will be located in the West Valley area of Phoenix. Preliminary plans for the development call for 100,000 single-family homes and 55 million square feet of commercial space. Previously known as Douglas Ranch, the project marks the largest master-planned community in the state, according to the development team. Teravalis — the name of which means “land of the valley” — will be developed with an emphasis on public space and the natural environment. Ecological sustainability will also be a focal point of the construction process. “Teravalis is an eco-friendly, sustainable community that sets the bar high for other cities to model,” says Eric Orsborn, mayor of Buckeye, a city located roughly 35 miles west of Phoenix. Arizona Gov. Doug Ducey also credits the development with “answering the call” of increased housing demand. “Since 2015, Arizona has welcomed over 584,000 new residents, and we don’t expect that momentum to stop anytime soon,” says Ducey. “This increases the demand for housing opportunities, and Howard Hughes is providing quality housing options for current and future Arizonans.” The development team also notes that the location …

SCOTTSDALE, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of SeventyOne15 McDowell, an apartment property in Scottsdale. The asset traded for $150 million, or $547,445 per unit. The buyer and seller were not disclosed. Completed in 2022, SeventyOne15 McDowell features 274 apartments, a swimming pool and spa, private cabanas, a rooftop lounge with fire pits, two-story fitness center, direct-access parking garage, rooftop deck, electric charging stations and 24-hour parcel package concierge. Alliance Residential developed the property. Steve Gebing and Cliff David of IPA represented the seller and procured the buyer in the transaction.

LOS ANGELES — South Bay Partners has completed construction of The Variel of Woodland Hills, a luxury independent living, assisted living and memory care community in the Woodland Hills neighborhood of Los Angeles. The property features 215 independent living units, 94 assisted living units and 27 memory care units. Momentum Senior Living is the operator. VTBS Architects designed the buildings, while Rodrigo Vargas Design handled the interiors. W.E. O’Neil Construction was the general contractor. The site is located near Warner Tennis Center, grocery stores and Kaiser Permanente Woodland Hills Medical Center, a 264-bed hospital. The project was originally announced in 2018, and construction began just before the COVID-19 pandemic hit in early 2020.

R.D. Olson Construction Breaks Ground on $38M Springhill Suites by Marriott in Chula Vista, California

by Amy Works

CHULA VISTA, CALIF. — R.D. Olson Construction has commenced construction on Springhill Suites by Marriott in Chula Vista, a five-story hotel slated for completion by December 2023. Located at 870 Showroom Place, the $38 million, 127,628-square-foot hotel will feature 179 guest rooms, a lounge, bar, buffet, meeting room, rim flow pool, hot tub, cabanas, fire pits, activity area, pavilion, event lawn, barbecues and fitness center. Project partners include Lee & Sakahara as architect and Design Studio as interior designer.