JERSEY CITY, N.J. — Walker & Dunlop has arranged an $85.4 million bridge loan for the refinancing of City Line East and City Line West, two adjacent apartment complexes totaling 342 units in Jersey City. Both properties are located within the University Place mixed-use development and feature studio, one- and two-bedroom units and Class A amenities. John Banas, Kris Wood, Christopher Philipps, John Wilson, Rhett Saltiel and Erik DiGirolamo of Walker & Dunlop arranged the two-year, fixed-rate loan through an undisclosed debt fund on behalf of the New Jersey-based borrower.

Property Type

NEW YORK CITY — Cushman & Wakefield has brokered the $40 million sale of a 63-unit multifamily property located at 223 Fourth Ave. in Brooklyn’s Park Slope neighborhood. The newly constructed, 13-story building houses 18 studios, 34 one-bedroom units, nine two-bedroom apartments and two duplexes. Residences are furnished with quartz countertops, stainless steel appliances, dishwashers and in-unit washers and dryers. Amenities include a lounge with coworking space, rooftop terrace, media room and bike storage space. HUBB NYC acquired the property from Greystone Development. Dan O’Brien, Adam Spies, Adam Doneger and Avery Silverstein of Cushman & Wakefield brokered the deal.

QUAKERTOWN, PA. — New Jersey-based Cronheim Mortgage has arranged $9 million in permanent financing for a 210,000-square-foot shopping center in Quakertown, located north of Philadelphia in Bucks County. Anchored by grocer Giant, the unnamed center also houses tenants such as Rite Aid, Buffalo Wild Wings, H&R Block and Panera Bread. Allison Villamagna and Andrew Stewart of Cronheim Mortgage arranged the financing on behalf of the borrower, a subsidiary of New York City-based ADCO Group. An undisclosed life insurance company provided the loan.

POMONA, CALIF. — Stos Partners has completed the disposition of a Class A industrial distribution facility in Pomona to Denver-based EverWest Advisors for $45.9 million. Jeffrey Cole, Jeffrey Chiate, Bryce Aberg, Brad Brandenburg, Mike Adey and Zachary Harman of Cushman & Wakefield’s National Industrial Advisory Group represented the buyer in the transaction. Stos Partners was self-represented in the deal. Originally built in the 1950s and renovated in the 1970s, the 182,275-square-foot distribution facility features 7,200 square feet of office space, 18 dock-high and 12 grade-level doors, 19- to 21-foot clear heights, a fenced yard and rail service. A leading provider of packaging and protective products fully occupies the property. The property is situated on 8.5 acres at 159 N. San Antonio Ave.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $6.8 million sale of a five-story building in Brooklyn’s Borough Park neighborhood that comprises four four-bedroom apartments and 6,611 square feet of retail space. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of Rosewood Realty represented both private investors involved in the deal, which traded at a cap rate of 4.9 percent. The building was originally constructed in 1930.

Echo Real Estate, LGE Break Ground on 676,176 SF Echo Park Industrial Project in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Echo Real Estate Capital and LGE Design Build, as design-build contractor, have broken ground on Echo Park 303, a two-building industrial facility situated on nearly 40 acres in Glendale. Located near the intersection of Northern Parkway and Reems Road, Echo Park 303 will feature a 455,936-square-foot facility, a 220,240-square-foot building, 743 parking spaces and gated yards for nearly 250 trailer spaces. The buildings will feature two stories of storefront window systems to allow for natural lighting in the lobbies and offices situated on the corners of the buildings. Completion of the 676,176-square-foot park is slated for third-quarter 2023.

TOTOWA, N.J. — Total Wine & More has opened a 32,000-square-foot store at Totowa Square, a 258,000-square-foot retail power center in Northern New Jersey. The retailer is backfilling a space formerly occupied by Babies ‘R’ Us. Brian Katz and Amy Staats of Katz & Associates represented the landlord in the lease negotiations. Brian Schuster of Ripco Real Estate represented the tenant.

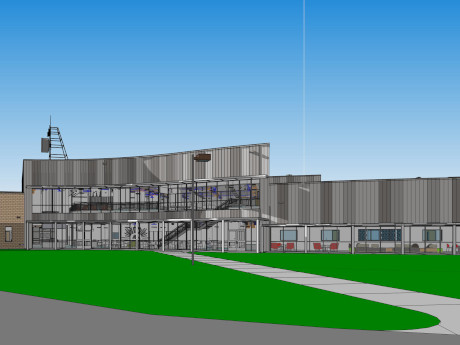

McCarthy Building Cos. Starts Construction of $17.5M Student Experience Center at Arizona Western College in Yuma

by Amy Works

YUMA, ARIZ. — McCarthy Building Cos. has broken ground for development of the $17.5 million Student Experience Center at Arizona Western College in Yuma. Serving more than 11,000 students, the two-story, 45,000-square-foot center will be situated on 3.5 acres. Slated to open in fall 2023, the center will feature a lecture hall, multiple instructional modalities, shared common areas, conference rooms, maker space, an eatery, game areas and a multimedia center and esports arena. The multimedia center will house the KAWC radio station and broadcast television studio with an emphasis on modern technology. Students and the public will be able to observe behind-the-scenes production through glass walls and TV monitors. The Student Experience Center will also offer a space for honors students to study and collaborate on group projects; a food pantry and clothing program for disadvantaged students; and 13,000 square feet of administrative space on the second floor. EMC2 is serving as the design architect on the project. The project team also includes Haxton Masonry, Delta Diversified Enterprises, Yuma Valley Contractors, Pacific Steel Inc. and Progressive Roofing.

Crystal Investment Property Negotiates Sale of 30-Room Packwood Lodge in Washington State

by Amy Works

PACKWOOD, WASH. — Crystal Investment Property (CIP) has arranged the sale of Packwood Lodge, a select-service hotel located at 13807 US-12 in Packwood. Terms of the transaction were not released. The 30-guest room Packwood Lodge includes extensive capital improvements, 21 updated guest rooms or suites and nine detached cabins. The property features a lobby with a breakfast area, office, laundry room, owner’s quarters and a hotel-adjacent leased restaurant. Rooms and suites include flatscreen TVs, mini fridges, microwaves, coffee makers and high-speed wireless internet. The cabins, completed in 2019, feature kitchenettes, dining areas, jacuzzi tubs and outdoor decks. Joseph Kennedy of CIP, along with the CIP team, represented the buyer and seller in the transaction.

Northcap Commercial Brokers $8.6M Sale of Stax Studios Apartment Complex in Downtown Las Vegas

by Amy Works

LAS VEGAS — Northcap Commercial has arranged the sale of Stax Studios, a studio apartment community in downtown Las Vegas. Clark Studio Investar LLLP sold the asset to an undisclosed buyer for $8.6 million, or $196,591 per unit. Built in 1963 and fully renovated in 2019, the property offers 44 studio units. Stax Studios is located at 501 S. 10th St. Devin Lee, Robin Willett and Jerad Roberts of Northcap Commercial represented the seller in the deal.