ROSWELL, GA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $10.3 million sale of Mansell Oaks, a 43,190-square-foot shopping center in the north Atlanta suburb of Roswell. Zach Taylor of IPA represented the seller, an entity doing business as PLC Mansell LLC, in the transaction. Peachtree Industrial Partners LLLP is the buyer. Mansell Oaks’ tenant roster includes LongHorn Steakhouse, Bird Watcher Supply and Animal Emergency Center of North Fulton. “Well-located, unanchored retail strips with reasonable rents have become nearly as sought after as grocery anchored centers, and the cap rates are reflecting this demand,” says Taylor.

Property Type

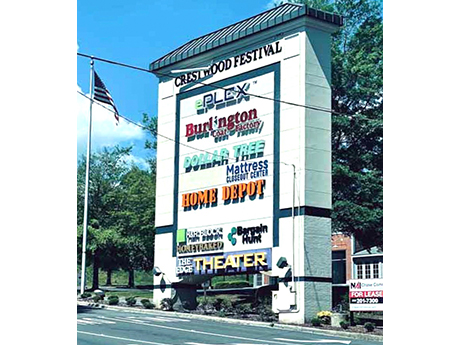

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

By Chase Clancy, vice president, Colliers The Austin industrial market is booming. According to Colliers’ research, Austin’s industrial market continues to grow at an amazing clip, spurred by rapid population growth, major manufacturing relocations and new e-commerce and inventory trends. Despite the longstanding shadows that larger markets like Houston and Dallas have cast on Austin’s growth, the market is reaching a fever pitch of rising rents, tightening vacancy, significant new deliveries and equally noteworthy preleasing activity. Based on Austin’s population size, Colliers’ research suggests that the market has the runway — both in terms of supply and demand — to nearly double in size over the next five years. With demand for space showing no sign of cooling at the local level, we project a prolonged period of record development and record absorption. To put that into context, Austin’s industrial market currently spans roughly 57 million square feet. We are tracking more than 40 million square feet of product in our development pipeline — more than 10.2 million square feet of which is currently under construction — with more on the horizon. Trailing 12-month absorption stands at approximately 3.4 million square feet as of the second quarter of 2022, but …

SAVANNAH, GA. — Atlanta-based Capital Development Partners has started construction of Central Port Logistics Center at Rockingham, a 5.4 million-square-foot speculative industrial development in the coastal Georgia city of Savannah. Central Port Logistics Center at Rockingham will consist of seven buildings, with Phase I of the project comprising a roughly 1.1 million-square-foot cross-dock warehouse. According to the development team, that building will be the largest warehouse ever constructed on a speculative basis in Savannah. Completion of Phase I is slated for 2023. Phase II of the project will feature a 982,000-square-foot, rail-served building, a construction timeline for which was not disclosed. Subsequent phases of the project will deliver both cross-dock and rear-load storage and distribution facilities. “Central Port Logistics Center at Rockingham is the last large-scale industrial infill site in Savannah with unmatched access to the port, excellent rail service and immediate connectivity to major highways,” says John Knox Porter Jr., CEO of Capital Development Partners. “These facilities will provide a significant location advantage for our customers.” Bill Sparks, executive vice president of CBRE’s Savannah office, which is marketing the development for lease, also said that the proximity and access to various pieces of major infrastructure would be a game-changer …

ATLANTA — After a quarter characterized by rising costs of living and mounting inflation, “recession” is the word on everybody’s lips. But Roger Tutterow, professor of economics at Kennesaw State University in Georgia, states that “it is not a foregone conclusion that we’re in a recession today or that we’ll get there in the next several months.” The official definition of a recession is not two consecutive quarters of negative growth in gross domestic product (GDP). “Most of the time it works out that way,” Tutterow said, “but the technical definition of a recession is a period of diminishing activity in production, trade, employment and income.” Tutterow noted that looking at these four components of economic activity and comparing them to today indicates a softening economy and an elevated risk of recession, but he does not believe that the economy is necessarily contracting. He puts the risk of a recession in the next 12 months as roughly one chance in three. Tutterow’s assessment of the current state of the economy and his near-term outlook came during a keynote address Tutterow delivered at the ninth annual InterFace Seniors Housing Southeast, a networking and information conference hosted by France Media’s InterFace Conference …

CEDAR PARK, TEXAS — Florida-based investment firm TerraCap Management has acquired Latitude at Presidio, a 337-unit apartment community located in the northern Austin suburb of Cedar Park. The property features one-, two- and three-bedroom units with an average size of 959 square feet. Amenities include a pool, game room, outdoor grilling and dining stations, fitness center, coffee bar and a dog park. Matt Pohl and Kevin Dufour of Walker & Dunlop represented the undisclosed seller in the transaction.

LANCASTER, TEXAS — Marcus & Millichap has brokered the sale of Pleasant Creek, a 159-unit apartment complex in Lancaster, a southern suburb of Dallas. The garden-style property houses 16 buildings with amenities such as a pool, fitness center, business center and onsite laundry facilities. Nick Fluellen and Chris Pearson of Marcus & Millichap represented the undisclosed seller and procured the buyer, Cove Capital Investments, in the transaction.

SAN ANTONIO — Atlanta-based developer RangeWater Real Estate has broken ground on Caliza at the Loop, a 154-unit build-to-rent residential community that will be situated on a 16.5-acre site in San Antonio. Homes will come in three-bedroom formats and will average 1,600 square feet in size. Amenities will include a pool, outdoor grilling areas, a fitness center, playground and a business center. The first move-ins are scheduled for May 2023. RangeWater will manage the property under its Storia brand.

BARTLESVILLE, OKLA. — Locally based brokerage firm Stan Johnson Co. has negotiated the $15.3 million sale of Silver Lake Village, an 87,750-square-foot shopping center in Bartlesville, located north of Tulsa. The center was fully leased at the time of sale to 12 tenants, with T.J. Maxx, Ross Dress for Less, Petco and Ulta Beauty serving as the anchors. Margaret Caldwell and Patrick Kelley of Stan Johnson Co. represented the seller, Tennessee-based GBT Realty Corp., in the transaction. The buyer was a Florida-based 1031 exchange investor that requested anonymity.

GRANBURY, TEXAS — Living Care Lifestyles, a Seattle-based seniors housing developer and manager, has sold Quail Park of Granbury, a 75-unit community located on the southwestern outskirts of Fort Worth. The property, which was 95 percent occupied at the time of sale, offers independent living, assisted living and memory care services. Charles Bissell and Dean Ferris of JLL represented Living Care Lifestyles in the transaction. Lloyd Jones Senior Living purchased the asset for an undisclosed price.