ATLANTA — Delays in the arrival of building materials — everything from windows and roof trusses to microchips for electrical panels — is one of the biggest hurdles slowing down new seniors housing developments, according to Kristin Kutac Ward, CEO of Solvere Living. Ward’s comments came during the ninth annual InterFace Seniors Housing conference. The event, which took place Aug. 17 at the Westin Buckhead in Atlanta, was hosted by France Media’s InterFace Conference Group and Seniors Housing Business and drew 324 attendees. Joining Ward on the development panel was Tod Petty, vice chairman with Lloyd Jones Senior Living; Matthew Griffin, senior vice president, eastern states, with Griffin Living; and Jim Vogel, president of Solvida Development Group. Rick Shamberg, managing director of Scarp Ridge Capital, served as the moderator. Despite the challenges in today’s building environment, there is pent-up demand and plenty of excitement regarding new seniors housing projects, said Ward. As baby boomers age, there will be a need for seniors housing care for about 50 million more people in the U.S., according to Shamberg. There’s ample opportunity for developers to fill that void in housing. According to Petty, the need for seniors housing units will be most pronounced …

Property Type

BRIDGEPORT, CONN. — Flaherty & Collins Properties (F&C), in partnership with RCI Group and the City of Bridgeport, has unveiled plans for a $200 million waterfront apartment community at Steelepointe Harbor, a mixed-use development along Long Island Sound. Plans call for 420 units and 10,000 square feet of retail space. Amenities will include a pool, outdoor kitchens, gathering spaces, secure parking and a dedicated dog park and pet spa. A water taxi will provide residents with service to nearby beach areas. A fitness center will offer fitness classes, a spin studio, sauna and jacuzzi. Residents will also have access to a pickleball court. Bridgeport is located 50 miles northwest of New York City. Steelepointe Harbor is accessible along the I-95 corridor and a short walk to the Bridgeport Transportation Center, which features access to the train station and the Bridgeport & Port Jefferson Ferry to Long Island. The Hartford Healthcare Amphitheatre live event venue, which opened in 2021, is less than a mile away. Previous development phases of Steelepointe Harbor included a Bass Pro Shops, Chipotle and Starbucks in late 2015, followed by the addition of Bridgeport Harbor Marina. The 220-slip marina is approaching full occupancy in its third year. …

By Rob Welker, president and partner, Hoefer Welker; and Steven Janeway, principal and commercial practice leader, Hoefer Welker As one of the biggest states, Texas regularly sees some of the largest demand in real estate development in the country. In recent years, North Texas specifically has experienced a rapid short-term increase in population, leading to a significant development boom and driving up urban and workforce construction volume, rental rates and sale values. Mixed-use developments have led the charge in commercial growth throughout the Dallas-Fort Worth (DFW) metroplex. Higher overall interest in a live-work-play lifestyle has contributed to the development of a larger number of spaces that provide corporate, retail and residential capabilities. Gone are the days when corporate campuses and multifamily complexes were predominantly in the suburbs; tenants and employers have increasingly searched for living experiences in urban environments where they can combine the three biggest facets of their lives within a single destination. This provides the convenience that tenants crave and the access to concentrated populations that retailers and office users need to be successful. The Coastal Exodus As personal and business income tax rates, regulatory hurdles and costs of living abound in coastal markets, corporations have begun relocating …

Multifamily Market Experiences Increased Demand Despite Rising Rents and Interest Rates, Berkadia Poll Shows

by Jeff Shaw

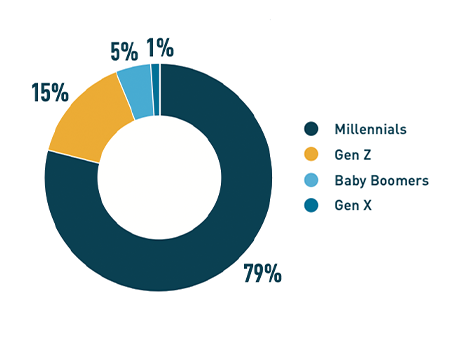

NEW YORK CITY — Berkadia’s newly released 2022 Mid-Year Powerhouse Poll reveals that the multifamily market continues to experience increased demand among investors and renters despite rising rents and interest rates. The survey respondents included 123 Berkadia investment sales agents and mortgage bankers across 65 offices, 80 percent of whom reported that they expect multifamily rental demand to continue to outpace supply for the remainder of 2022. The survey was conducted in July. Nearly 80 percent of Berkadia mortgage bankers and investment agents responded that millennials, persons born roughly between 1981 and 1996, are likely to be the generation that will make up the highest percentage of multifamily renters in the next one to two years. An even greater percentage of Berkadia professionals in the Western region (88 percent) report that the majority of their current renters are millennials. The survey results also revealed that baby boomers tend to rent single-family rental/build-for-rent (SFR/BFR) housing most commonly, while Gen Z typically rent workforce housing. Seventy-two percent of advisors reported that, besides cost, location is most important to renters today. While movement away from metropolitan areas continues — a trend made popular during the COVID-19 pandemic as renters sought more space — 59 percent of …

EULESS, TEXAS — JLL has negotiated the sale of Urban District 183, a 366,771-square-foot industrial development located in the central metroplex city of Euless. The newly built development comprises three buildings that were constructed on a speculative basis at the former site of Coopers Golf Park. Dustin Volz, Stephen Bailey, Dom Espinosa, Wells Waller, Robby Westerfield and Megan Babovec of JLL represented the seller, Urban Logistics Realty, in the transaction. The buyer was not disclosed, but The Dallas Morning News reports that an affiliate of Morgan Stanley Real Estate Advisors purchased the asset for an undisclosed price.

DENTON, TEXAS — Resia, a Miami-based developer formerly known as AHS Residential, has received an undisclosed amount of construction financing for a 322-unit multifamily project in the North Texas city of Denton. The unnamed project will consist of two seven-story buildings with one-, two- and three-bedroom units, as well as a pool, fitness center, clubhouse and a business center. Construction is expected to be complete in the second quarter of 2023. Regions Bank provided the financing.

HOUSTON — Atlanta-based investment management firm Invesco has signed a 180,218-square-foot office lease extension at Greenway Plaza, a 52-acre development located in between Houston’s Uptown and downtown districts. The tenant has re-committed to Eleven Greenway Plaza for a term in excess of 10 years. Amanda Nebel represented the landlord, Parkway, in the lease negotiations on an internal basis. John Shlesinger of CBRE represented Invesco. The 31-story, 745,871-square-foot building is now 87 percent leased.

HOUSTON — Locally based development and management firm Moody Rambin has broken ground on Town Centre Two, a 167,141-square-foot office building in Houston. Moody Rambin is developing the project, which is part of a two-building initiative that will be situated within the 41-acre Town and Country Village development on the city’s west side, in partnership with American National Insurance Co. Kirksey Architecture designed the eight-story building, with DBR Engineering and Hoar Construction respectively serving as the civil engineer and general contractor. Frost Bank provided construction financing. Completion is slated for the third quarter of 2023.

GOSHEN, IND. — Evergreen Real Estate Group has topped out construction of Green Oaks of Goshen. The four-story, 120-unit assisted living community for low-income seniors is located at 282 Johnston St. in Goshen, a city in northern Indiana. Evergreen Construction Co., a division of Evergreen Real Estate Group, is the general contractor. Completion is slated for early 2023. The $30 million project is being built on a vacant three-acre lot near an existing Salvation Army building. Gardant Management Solutions will manage the property. Green Oaks of Goshen will offer 49 studios and 71 one-bedroom units, all of which will be reserved for seniors age 62 and older with incomes at or below 80 percent of the area median income. Amenities will include a community room, media room, computer room, fitness center, salon, library, community garden and outdoor area. The Indiana Housing and Community Development Authority authorized 4 percent low-income housing tax credits (LIHTC) in support of the project. The City of Goshen issued tax-exempt bonds that were sold by PiperSandler, providing debt financing. Affordable Housing Partners invested in the project, providing LIHTC equity.

NEW PHILADELPHIA, OHIO — The Cooper Commercial Investment Group has negotiated the $5.6 million sale of Monroe Centre in New Philadelphia, about 85 miles south of Cleveland. The 78,743-square-foot complex is home to office, medical and General Services Administration (GSA) tenants. The New Philadelphia VA Clinic, which recently renewed its lease for five years, anchors the property. Additional tenants include the Social Security Administration, Ohio BMV, OhioMeansJobs and Fresenius Medical Care. Bob Havasi and Dan Cooper of Cooper Group represented the seller, an Ohio-based private investment group. An Ohio-based private investor was the buyer. The property sold at about 96 percent of the list price.