OMAHA, NEB. — Marcus & Millichap has arranged the sale of a 65,413-square-foot retail property net leased to Family Fare Supermarket in Omaha for $4.6 million. The building is located at 5110 S. 108th St. Family Fare operates more than 80 locations across seven states. Brennan Clegg, Chris Lind and Mark Ruble of Marcus & Millichap represented the seller, a limited liability company. Buyer information was not provided.

Property Type

WOOD DALE, ILL. — Venture One Real Estate has acquired a 59,150-square-foot industrial building in the Chicago suburb of Wood Dale for an undisclosed price. Constructed in 1974, the property at 955 Lively Blvd. features three docks, three drive-in doors, parking for 60 cars, 5,180 square feet of office space and a clear height of 18 feet. Jay Farnam of Lee & Associates represented the undisclosed seller in the sale-leaseback transaction. Venture One utilized its acquisition fund, VK Industrial VI LP, which is a partnership between Venture One and Kovitz Investment Group.

CHICAGO — SVN Chicago Commercial has negotiated a new lease for the former Beacon Tavern restaurant space in Chicago. Lady May, a Garrett Hospitality Group concept, will occupy the space beginning late this year. Lady May is an eatery and cocktail parlor that serves southern coastal fare. Leslie Karr and Lorile Herlihy of SVN Chicago Commercial negotiated the 10-year lease. The 6,700-square-foot property will also include an outpost of Sushi|Bar.

NEW YORK CITY — U.S. audit, tax and advisory firm KPMG has unveiled plans to relocate its headquarters to Two Manhattan West, a new office building under construction in Midtown Manhattan’s West Side neighborhood. The 58-story tower is part of Brookfield Properties’ 7 million-square-foot Manhattan West mixed-use development. KPMG’s new space at Two Manhattan West is slated for completion in late 2025. The firm will relocate its roughly 5,500 New York-based employees and lease approximately 450,000 square feet. The new lease signing represents a more than 40 percent decrease in KPMG’s existing New York office space, according to The Wall Street Journal. The newspaper reports that KPMG is pursuing a hybrid work strategy where employees are expected to gather at company or client offices on some days. The firm is following suit of a number of companies that have downsized office footprints in exchange for nicer space following the pandemic. KPMG currently occupies space at 345 Park Ave., its headquarters, as well as 560 Lexington Ave. and 1350 Sixth Ave. The firm has been based in New York City since its inception in 1897. “As we celebrate our 125th anniversary and think about our firm’s future, this is an incredible …

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

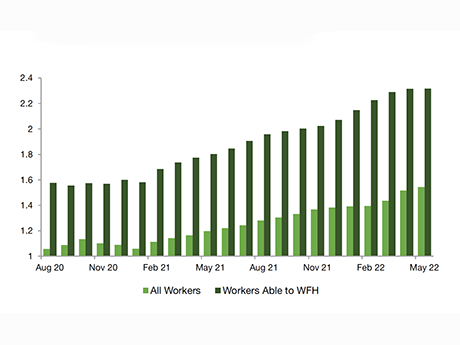

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

Greenwater Investments Sells Villas Los Limones Apartment Property in Phoenix for $58.2M

by Amy Works

PHOENIX — Greenwater Investments has completed the disposition of Villas Los Limones, an apartment community in Phoenix. Rincon Partners acquired the asset for $58.2 million, or $260,000 per unit. Situated on nine acres, Villas Los Limones features 224 apartments spread across 18 buildings. The average apartment size is 678 square feet. Community amenities include a pool, clubhouse and laundry facilities. Cliff David, Steve Gebing, Hamid Panahi and Clint Wadlund of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

SCOTTSDALE, ARIZ. — Revel Communities has completed construction of Revel Scottsdale and Revel Legacy, both independent living communities in Scottsdale. Then properties are the 12th and 13th independent living communities the brand has opened since launching in 2018, and its first two in Arizona. Revel Scottsdale offers 157 units near the bustling shops and dining of Old Town Scottsdale, with rents starting at $3,695 per month. Revel Legacy offers 169 units among the mountain views of North Scottsdale with rents starting at $3,795 per month.

CBRE Arranges Sale of Three-Property Multifamily Portfolio in Azusa, California for $33.6M

by Amy Works

AZUSA, CALIF. — CBRE has brokered the sale of a three-property apartment portfolio in Azusa. Azusa Riviera Holdings LLC, Azusa Rainbow Holdings LLC and 1345 San Gabriel Holdings LLC sold the portfolio to Azusa 116 Assets LLC for $33.6 million. Eric Chen and Joyce Goldstein of CBRE represented the seller and buyer in the transaction. The three properties are: The Riviera Apartments, a 36-unit property at 1381 N. San Gabriel Canyon Road Palm View Apartments, a 36-unit community at 1311 N. Azusa Ave. The Azusan Apartments, a 44-unit asset at 1345 N. San Gabriel Ave. Each property has a mix of one- and two-bedroom units averaging more than 800 square feet per apartment. The properties include a community pools, laundry facilities, private patios/balconies, air conditioning and covered parking.