LIVONIA, MICH. — Marcus & Millichap has brokered the $2.9 million sale of Century Plaza in Livonia, just west of Detroit. The 19,584-square-foot retail center is located at 37300 Five Mile Road. Davita Dialysis anchors the fully leased property. Craig Fuller, Erin Patton and Scott Wiles of Marcus & Millichap represented the seller, a REIT. The team also procured the all-cash buyer.

Property Type

BRIGHTON, MICH. — Spencer’s and European Wax Center have signed leases to open new locations at Green Oak Village Place in Brighton, a western suburb of Detroit. Both retailers are slated to open by this fall. Spencer’s, which sells edgy T-shirts, jewelry and accessories, will occupy 2,528 square feet. The European Wax Center location will span 1,710 square feet. Green Oak Village Place is home to more than 50 retailers and restaurants. REDICO and Lormax Stern developed the 500,000-square-foot property.

PARAMUS, N.J. — Unibail-Rodamco-Westfield (URW), a shopping center owner-operator based in France, has unveiled plans to redevelop Westfield Garden State Plaza, a 2.1 million-square-foot regional mall in the Northern New Jersey community of Paramus. According to Forbes, Westfield Garden State Plaza remains one of the best-performing regional malls in the country. But about 10 years ago, URW began planning a long-term redevelopment to distinguish the property from and compete with American Dream, Triple Five Group’s entertainment-heavy mega-mall that is located within the Meadowlands sports complex in nearby East Rutherford. To that end, URW executive vice president Geoff Mason says that the redevelopment is about transitioning the mall into a mixed-use destination where living, working and leisure all come together. The first phase of the redevelopment will center on the construction of 550 luxury apartments that will be integrated with the existing shopping and dining establishments via open green space. Phase I will also introduce a “main street’ outdoor district featuring restaurants and everyday convenience- and services-oriented retailers. Ownership also plans to upgrade the existing infrastructure that connects to public transit services. Construction is scheduled to begin in 2024, with the first residential units becoming available for occupancy in 2026. The …

Amazon recently reconfigured and consolidated its network of warehouses, and many other retailers followed suit. The result? The outlook for industrial real estate, particularly retail warehouses, is now more difficult to interpret. Many retail clients are repositioning their supply chains to help avoid slowdowns and a potential International Warehouse Logistics Association (IWLA) union strike on the West Coast. This change has merged with a corporate need to find additional options for shipping and transport (especially as prices for transportation and industrial rents rise). The demand for industrial space has increased rapidly in less “congested” areas. As economic uncertainty continues, there is a shift towards tertiary markets for industrial real estate. This change provides significant opportunities for industrial investors, says Steve Pastor, VP of global supply chain, and ports/rail logistics/consultant at NAI James E. Hanson, who serves as NAI Global Industrial Council Chair. Investors and developers may be able to take advantage of a pause in a highly competitive field, in tertiary markets that have been traditionally less expensive than major and core markets. Amazon’s Impact News of Amazon’s plans to scale back its acquisition of industrial space (and to sublease its existing property to other retailers) has given some users opportunities …

AUSTIN AND BEE CAVE, TEXAS — JLL has negotiated the sale of three self-storage facilities totaling approximately 1,600 units that are located in the Austin area. Two of the properties are located within the city limits at 8200 S. I-35 Service Road and 8327 S. Congress Ave., and the third is located in the western suburb of Bee Cave. The properties traded as part of a portfolio sale that totaled 6,550 units across 11 facilities, with the other eight assets being located in California and Oregon. Brian Somoza, Steve Mellon, Matthew Wheeler, Adam Roossien and Jake Kinnear of JLL represented the seller, Pegasus Group, in the portfolio sale to California-based SecureSpace Self Storage.

AUSTIN, TEXAS — Newmark has arranged the sale of Barton Creek Villas, a 250-unit multifamily property in West Austin. Built in 1998, the property features one-, two- and three-bedroom floor plans with an average size of 1,049 square feet. Amenities include a pool, fitness center, clubhouse with a coffee bar, outdoor grilling stations, a dog park and walking trails. The Connor Group sold Barton Creek Villas, which was 99 percent occupied at the time of sale, to a fund backed by Goldman Sachs Asset Management for an undisclosed price. Patton Jones and Andrew Dickson of Newmark brokered the deal.

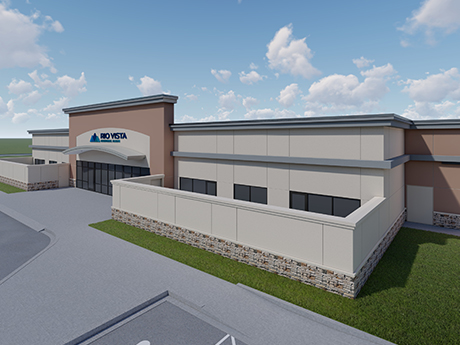

EL PASO, TEXAS — General contractor Adolfson & Peterson has topped out a 52,000-square-foot healthcare project in El Paso that is an expansion of the Rio Vista Behavioral Hospital. The project will add 40 beds, outdoor recreation spaces, an outpatient center and 14,000 square feet of parking space to the existing facilities. Full completion is slated for spring 2023. Tennessee-based Acadia Healthcare Co. Inc. owns Rio Vista Behavioral Hospital.

DALLAS — Northwood Retail has signed leases with four new tenants at Hillside Village, the Dallas-based owner’s outdoor shopping and dining plaza in the city’s Lakewood neighborhood. Phoenix-based grocer Sprouts Farmers Market and spa and salon concept Alchemy 43 will open this fall. Sugared + Bronze, which offers hair removal and tanning services, will open this winter, and California-based veterinary clinic Modern Animal will follow in 2023.

SOUTH TEXAS — VIUM Capital has provided a $17.1 million bridge-to-HUD loan for the refinancing of an undisclosed skilled nursing facility in South Texas. The financing also provides equity-out proceeds and covers transaction costs. The loan features a 60 percent loan-to-value ratio and partial recourse that disappears upon submission to HUD. The borrower leased the property in 2017, exercised its purchase option in 2018 and continued to improve operating performance during the COVID-19 pandemic. The name and location of the facility were not disclosed.

NEW YORK CITY — Meridian Capital Group has arranged a $147 million loan for the refinancing of three New York City self-storage facilities. The names and unit counts of the facilities, all of which were built in 2017, were not disclosed. Drew Anderman and Ben Nevid of Meridian Capital arranged the loan through Slate Asset Management on behalf of the borrower, Saratoga Springs-based Prime Group.