NAPERVILLE, ILL. — Physician Real Estate Capital Advisors (PRECAP) has arranged the sale of a 19,900-square-foot building in Naperville for $15.2 million. Constructed in 2008 and located at 1243 Rickert Drive, the property is home to Suburban Gastroenterology and Midwest Endoscopy Center. In 2020, the endoscopy center underwent a 6,800-square-foot expansion and renovation. Scott Niedergang of PRECAP represented the seller, a physician partnership, and procured the buyer, a privately held company specializing in healthcare real estate acquisitions.

Property Type

NEW BRIGHTON, MINN. — Clear Height Properties has acquired Rush Lake Business Park in New Brighton, a northern suburb of Minneapolis. The purchase price was undisclosed. The industrial property consists of two buildings totaling 79,028 square feet that are 87 percent leased. Harrison Wagenseil and Erik Coglianese of Transwestern represented the undisclosed seller. Transwestern will also handle leasing on behalf of Clear Height. The transaction marks the first acquisition in Minnesota for Oak Brook, Ill.-based Clear Height.

WASHINGTON, D.C. — Mesirow, a financial services firm based in Chicago, has provided the $275 million refinancing for the National Aeronautics and Space Administration (NASA) headquarters offices in Washington, D.C. Located at 300 E St. SW, the nine-story office building spans more than 600,000 square feet and was built in 1991, according to LoopNet Inc. The borrower is a partnership between Hana Alternative Asset Management and Ocean West Capital Partners. Proceeds from the financing provided the partnership with fixed-rate debt that is interest-only for the full term. The loan has a 2028 maturity date, which is coterminous with NASA’s lease. With the funds, the Hana and Ocean West partnership is recapitalizing its equity interest at the property, which is subject to the sixth-largest lease by the General Services Administration (GSA), the federal government’s independent agency that oversees certain operations like office and research space. (The GSA is the leaseholder for NASA.) Mesirow served as placement agent and administrative agent on the financing. Cushman & Wakefield arranged the financing on behalf of the borrower and negotiated terms between the borrower and Mesirow. Mesirow was founded in 1937 and offers credit tenant lease and structured debt products to borrowers. The company’s services …

At the mid-year mark, industrial occupancy in the greater Richmond area remains strong, closing with an overall occupancy rate of 98.5 percent in the categories being tracked (Class A, B, select C vacant and investor-owned product with a minimum of 40,000 square feet total RBA). Class A occupancy remained steady at 97 percent at the end of the second quarter. Class B occupancy also remained steady at 94 percent at the end of the first quarter. CoStar Group reports overall industrial occupancy at 96.8 percent for product of all sizes, including investor-owned facilities, but excluding flex space (minimum 50 percent office). There remains a shortage of space in the 25,000- to 50,000-square-foot range as most spec buildings being built are larger single-tenant buildings. Richmond’s strategic Mid-Atlantic location along Interstate 95 provides access to 55 percent of the nation’s consumers within two days’ delivery by truck, and in addition to being the northernmost right to work state on the Eastern seaboard, Virginia has once again been named as the No. 1 state for business by CNBC. Metro Richmond has a civilian labor force of almost 700,000 (1.03 million population) with unemployment rates at 3.7 percent as of June. With 12 Fortune …

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

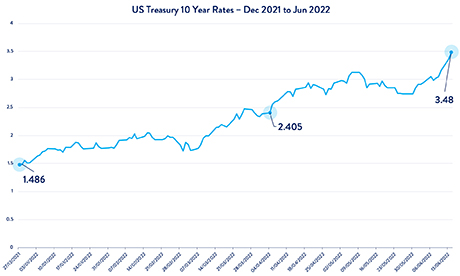

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

PLANO, TEXAS — Chicago-based investment firm Waterton has acquired Mission Gate, a 434-unit apartment community in Plano. Built on 24 acres in 1999, Mission Gate features one-, two- and three-bedroom units with an average size of 965 square feet across 13 buildings. Amenities include a pool, outdoor grilling stations, a playground and a dog park. Waterton plans to invest in capital improvements to unit interiors and common areas. The seller and sales price were not disclosed.

AUSTIN, TEXAS — Northmarq has arranged three bridge loans totaling $43.7 million for the acquisition of five multifamily properties in Austin. The properties include Mueller I and II, which feature a combined 110 units and are located in the Windsor Park area; Villas at Mueller, a 124-unit community; the 40-unit Spanish Trails Apartments; and the 51-unit Miller Square Apartments. Chase Johnson and Brian Fisher of Northmarq originated the financing on behalf of the borrower, Zion Capital. The direct lenders were not disclosed.

NORMAN, OKLA. — Hospitality development and management firm Lambert is nearing completion of the NOUN Hotel, a 92-room boutique hotel located near the University of Oklahoma’s campus in Norman. The grand opening is scheduled for Thursday, Sept. 22. The four-story hotel, which will include two suites, will offer multiple food and beverage establishments and 3,900 square feet of meeting and event space.

ARLINGTON, TEXAS — Bassett Furniture, a Virginia-based manufacturer and retailer, has signed a 38,582-square-foot industrial lease at 1019 Enterprise Place in Arlington. Mark Graybill of Lee & Associates represented the landlord, High Street Logistics Properties, in the lease negotiations. Reed Parker, also with Lee & Associates, represented the tenant.

LUBBOCK, TEXAS — Texas-based brokerage firm Independence Commercial Advisors has negotiated the sale of Poka Lambro Shopping Center, a 37,500-square-foot retail property in Lubbock. Built on 4.9 acres in 1983, the property includes outparcels that house a Wells Fargo ATM and a recently renovated Burger King. Richard Mireles of Independence Commercial Advisors represented the undisclosed seller and procured the buyer, Texas-based NetCo Investments Inc., in the transaction.