SAN ANTONIO — EōS Fitness will open a 48,248-square-foot gym in northwest San Antonio. The Dallas-based operator will backfill a space formerly leased to Conn’s HomePlus at The Village at Summit shopping center. Rise Commercial Partners represented the tenant in the lease negotiations. CBRE represented the landlord, an entity doing business as Summit Income Partners LP. The opening is set for 2027.

Property Type

THE WOODLANDS, TEXAS — Metro Philadelphia-based CenterSquare Investment Management has purchased Commons at Harper’s Preserve, a 21,777-square-foot retail strip center located north of Houston in The Woodlands. The center was 91 percent leased at the time of sale to tenants such as Five Guys, Jeremiah’s Italian Ice, Little Caesar’s, Dunkin’ and Next Level Urgent Care. The seller and sales price were not disclosed.

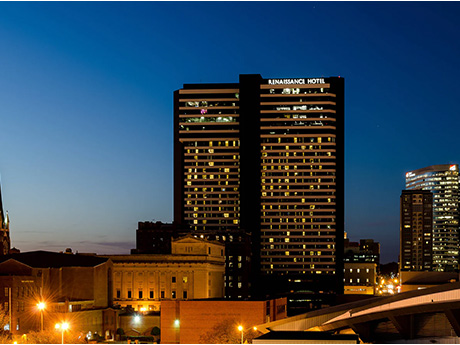

Ashford Hospitality Trust Obtains $218.1M Loan to Refinance Renaissance Hotel in Nashville

by John Nelson

NASHVILLE, TENN. — Ashford Hospitality Trust Inc. has obtained a $218.1 million loan to refinance Renaissance Hotel, a 673-room hotel located at 611 Commerce St. in Nashville. Built in 1987, the hotel features meeting and event space, a club lounge, Little Fib Bar, a 24-hour market and a third-floor bar and restaurant in a glass atrium called Bridge Bar, according to the hotel website. The two-year, non-recourse loan refinanced the existing $267.2 million mortgage. The undisclosed lender underwrote the loan with three one-year extension options and a floating interest rate of SOFR + 2.26 percent, which is 172 basis points lower than the interest rate on the previous loan. In conjunction with the debt refinancing, Ashford Hospitality increased the preferred equity investment on the hotel by $53 million.

TAMPA, FLA. — Rockpoint and Newbond Holdings have acquired Westin Tampa Waterside, a waterfront hotel in downtown Tampa. The seller and sales price were not disclosed. The 309-room property is situated on a 1.5-acre site and is the only hotel on the city’s Harbour Island. Westin Tampa is within walking distance of the Tampa Convention Center, Water Street District, Sparkman Wharf and the University of Tampa. Amenities include a fitness studio, heated outdoor pool, multiple dining and bar options and meeting and social event space. Rockpoint and Newbond Holdings plan to renovate Westin Tampa’s guest rooms, lobby and meeting space.

RICHARDSON, TEXAS — Lee & Associates has negotiated a 16,875-square-foot industrial lease in the northeastern Dallas suburb of Richardson. According to LoopNet Inc., the building at 301-323 Hilltop Ave. was constructed in 1965. Brett Lewis and George Tanghongs of Lee & Associates represented the landlord, Link Industrial Properties, in the lease negotiations. Trevor Atkins of CBRE represented the tenant, Starwood Distributors.

JERSEY CITY, N.J. — Walker & Dunlop has arranged a $220 million bridge loan for the refinancing of 626 Newark, a 576-unit apartment building in Jersey City. The newly built, 27-story building is located in the city’s Jersey Square neighborhood and includes 27,662 square feet of commercial space. According to Apartments.com, units come in studio, one- and two-bedroom floor plans, and amenities include a fitness center, arcade, bowling alley, music studio and a golf simulator. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Dustin Stolly, Sean Reimer, Jordan Casella, Christopher de Raet and Edward Leboyer of Walker & Dunlop arranged the loan through TYKO Capital on behalf of the borrower, Namdar Group. SCALE Lending provided the original $160 million construction loan for the property in early 2024.

BRADENTON, FLA. — An affiliate of Miami-based CORE Investment Management has acquired Cortez Plaza, a 260,000-square-foot shopping center in Bradenton. The seller and sales price were not disclosed, but the Business Observer reported that an affiliate of Richmond-based Hackney Real Estate Partners sold the property for $39.4 million. Cortez Plaza’s tenant roster includes LA Fitness, Sprouts Farmers Market and Burlington, along with newly developed outparcels occupied by Chick-fil-A and Starbucks Coffee.

Walker & Dunlop Arranges Sale of 576-Bed Student Housing Community Near Appalachian State University

by John Nelson

BOONE, N.C. — Walker & Dunlop has arranged the sale of Mountaineer Village, a 576-bed student housing community located near the Appalachian State University campus in Boone. Chris Epp, Matthew Chase, Craig Miller, Holden Penn, Ben Sarna, Sarah Foronda and Naomi Bludworth of Walker & Dunlop represented the seller, a joint venture between Coastal Ridge Real Estate and Heitman, in the disposition. The buyer and terms of the transaction were not released. Mountaineer Village offers three-bedroom units with bed-to-bath parity. Shared amenities include a study lounge, fitness center, resort-style pool, business center, basketball court, barbecue area, game room, sand volleyball court, pickleball courts and a fire pit.

CHARLESTON, S.C. — Locally based Middle Street Partners and Chicago-based Singerman Real Estate plan to develop Atlantic St. Thomas, a new 71-unit build-to-rent (BTR) residential community in Charleston. The townhome property will be located at 2815 Clements Ferry Road on Charleston’s Daniel Island. Atlantic St. Thomas will have an amenity package that includes a resort-style pool, clubhouse, fitness center, working space and a lounge. The property will include two- and three-bedroom, three-story townhomes ranging in size from 1,565 to 2,500 square feet. Units will include single and two-car garages, rooftop terraces and dens in select three-bedroom townhomes. The co-developers will welcome residents at Atlantic St. Thomas, which represents Middle Street’s first BTR community, in spring 2027. The project team includes general contractor Middle Street Construction, civil engineer Sitecast, land planner Cissell Design Studio, landscape architect Studioforme and architect Terminus Design Group.

PHILADELPHIA — Crow Holdings Development will build a 103,500-square-foot speculative industrial project at 2748 Grant Ave. in northeast Philadelphia. The single-story warehouse and distribution building will feature 32-foot ceiling heights, 32 dock positions, two drive-in doors and parking for 65 vehicles. M+H Architects is designing the project, and BH Cos. is providing engineering services. Oline Construction is the general contractor. JLL brokered the land deal, the seller in which was James D. Morrissey Inc. Construction, and has also been retained as the leasing agent. Completion is slated for mid-2026.