SAN JOSE, CALIF. — A joint venture between Sack Capital Partners and Belveron Partners has acquired Fountain Park, an apartment community in San Jose. Terms of the transaction were not released. Located at 1026 S. De Anza Blvd., Fountain Park offers 164 studio, one- and two-bedroom units. Community amenities include a clubhouse, barbecue area, resort-style swimming pool with spa hot tub, sauna, covered parking with electric vehicle charging and a dog park. The new owners have a long-term commitment to convert a portion of the apartments into affordable housing. Sack will provide property management services for the asset.

Property Type

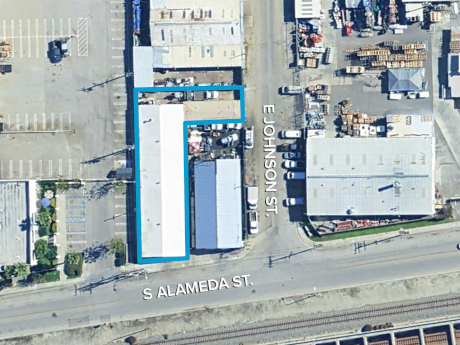

COMPTON, CALIF. — FallTech has purchased an industrial building located at 1414 S. Alameda St. in Compton from Accurate Glass & Mirror Corp. for $1.5 million. Situated on a 9,269-square-foot site, the 6,432-square-foot property features one ground-level door and a clear height of 14 feet. FallTech, which makes fall protection, will use the property to expand its operations. Scott Anderson of The Klabin Co. represented the seller, while Matt Stringfellow of The Klabin Co. represented the buyer in the transaction.

BENSALEM, PA. — Hanley Investment Group Real Estate Advisors has arranged the $12.5 million sale of Bensalem Crossings, a 67,215-square-foot shopping center located roughly 19 miles north of Philadelphia. Bensalem Crossings was fully leased at the time of sale, with ShopRite and CVS occupying 93 percent of the space. Kevin Fryman, Bill Asher and Jeff Lefko of Hanley, in association with ParaSell Inc., represented the seller, Adler Realty Investments Inc., in the transaction. The team also procured the buyer, an undisclosed, Southern California-based private investor.

CUMMING, GA. — Seven new tenants have signed leases to join Coal Mountain Shops, a 19,805-square-foot shopping center undergoing redevelopment in the Coal Mountain neighborhood of Cumming. Sam Krueger and Kaitlyn Schoerner of Franklin Street handled leasing efforts on behalf of the landlord, FrostPoint Capital, which purchased the center last May. Phase I of the redevelopment is now fully leased, with the new tenants including PNC Bank, Wingstop, barre3, Kumon, Smoothie King, The Bagel Hole and Shape Nails. Details of Phase II of the redevelopment project were not disclosed.

PEEKSKILL, N.Y. — MAG Capital Partners has purchased a two-building, 104,220-square-foot industrial facility in Peekskill, about 50 miles north of Manhattan, in a sale-leaseback. The site spans approximately 6 acres along the Hudson River and houses the headquarters operations of White Plains Linen, which in 2019 expanded its services to include e-commerce fulfillment of similar products. STREAM Capital Partners’ Daniel Macks, Jonathan Wolfe and Joe DiGennaro represented the seller in the transaction.

MANCHESTER, N.H. — Colliers has brokered the $3.4 million sale of a portfolio of three multifamily buildings totaling 21 apartments in Manchester, located near the Massachusetts-New Hampshire border. The portfolio offers one-, two- and three-bedroom units, as well as one commercial space, and was fully occupied at the time of sale. Andrew Robbins of Colliers represented the seller, Select Capital LLC, in the transaction and procured the buyer, White Barn Real Estate LLC.

FOREST PARK, ILL. — Eastham Capital has sold Central Park Apartments in Park Forest, a southern suburb of Chicago, for $23.2 million. Eastham acquired the 220-unit property for the portfolio of Eastham Capital Fund V LP in partnership with Bender Cos. in September 2019. At the time, Central Park Apartments marked the second collaboration between Eastham and Bender. To date, the companies have co-invested in 10 properties. Over the six-year hold period, ownership completed exterior renovations to Central Park Apartments, including parking lot resurfacing, sidewalk repairs and patio concrete upgrades. The property averaged more than 97 percent occupancy during the ownership period. The community at 11 Fir St. features a mix of one-bedroom units as well as two- and three-bedroom townhomes ranging from 724 to 1,326 square feet.

MOUNT VERNON, ILL. — Contegra Construction has completed a 100,000-square-foot manufacturing facility for PVC-maker Manner Polymers in Mount Vernon. The solar-powered facility is located on a 30-acre site at 401 Fountain Place Drive near I-57 and I-64. McKinney, Texas-based Manner Polymers installed and integrated its advanced manufacturing equipment and systems for producing flexible PVC compounds. Once fully operational, the plant is expected to increase the company’s production capacity by 100 million pounds. Powered by a roof-mounted solar array and a 15-acre solar field, the project is anticipated to create more than 60 new jobs. The facility features 11 dock doors, three drive-in doors and 5,000 square feet of office space. Contegra led the design-build team that included architect Gray Design Group and structural engineer Alper Audi. The design-build subcontractor team included Jarrell Mechanical, Haier Plumbing, Bi-State Fire Protection and Clinton Electric.

GREENWOOD, IND. — Marcus & Millichap has arranged the $3.8 million sale of an auto repair center occupied by Caliber Collision in Greenwood. The property totals 33,511 square feet and is located at 155 Melody Ave. Caliber Collision occupies the asset under a double-net lease with more than three years remaining on the lease. Mitch Grant, Nicholas Kanich and Josh Caruana of Marcus & Millichap represented the Indiana-based seller. Dominic Sulo, Ryan Engle and Andrean Angelov of Marcus & Millichap procured the Illinois-based buyer.

ALTOONA, IOWA — Planet Fitness has opened a 15,496-square-foot location at the Outlets of Des Moines in Altoona. Founded in 1992 in Dover, N.H., Planet Fitness is one of the largest franchisors and operators of fitness centers in the world. As of June 30, there were 2,762 clubs worldwide. Outlets of Des Moines is an open-air lifestyle center home to stores such as Coach Outlet, Polo Ralph Lauren, Kate Spade Outlet, Ann Taylor Factory Store and Nike Factory Store.