HOUSTON — JLL has arranged $29.5 million in acquisition financing for a portfolio of eight light industrial buildings totaling 275,602 square feet in Houston. Known as the Houston Prime Shallow Bay Portfolio, the buildings feature clear heights up to 25 feet, 76- to 126-foot truck court depths and “abundant” dock and drive-in doors. Melissa Rose, Jack Britton, Josh Barker, Jovi Rodriguez and James Lovell of JLL arranged the loan through an undisclosed bank as part of a larger, $107.8 million financing package that includes industrial portfolios in Charlotte and Denver. The borrower was Miami-based Adler Real Estate Partners.

Property Type

CBL, Vision Hospitality Open Element by Westin Hotel at Mayfaire Town Center in Wilmington, North Carolina

by John Nelson

WILMINGTON, N.C. — CBL Properties, in a 49/51 joint venture with Vision Hospitality, has opened a new Element by Westin hotel at Mayfaire Town Center, a 610,000-square-foot, open-air shopping mall in Wilmington. Both CBL and Vision are headquartered in Chattanooga, Tenn. The 139-room hotel is situated on International Drive and includes a lobby bar, 24/7 fitness center and complimentary bicycle rentals. Since 2024, CBL has executed retail leases exceeding 100,000 square feet at Mayfaire, including deals with Dave & Busters, Altar’d State Kids, Rowan, Free People, FP Movement, Warby Parker, Claire’s, Vochos Urban Mexican Kitchen, Potbelly Sandwich Shop and Dry Bar. Additionally, existing tenants like lululemon athletica, Rack Room Shoes and Reed’s Jewelers have remodeled and expanded their stores at Mayfaire. CBL purchased the mall in 2015.

Logistics Property Co. Breaks Ground on Second Phase of 1 MSF Industrial Park in Gainesville, Georgia

by John Nelson

GAINESVILLE, GA. — Logistics Property Co. has broken ground on Phase II of Gainesville 85 Business Center, a 1 million-square-foot, four-building industrial park in Gainesville. Phase II will comprise two buildings, 1800 and 1850 Fulenwider, that span 326,040 square feet. The project is situated along I-985 in Atlanta’s Northeast 85 industrial submarket and offers access to U.S. Route 129, I-85 and the upcoming Northeast Georgia Inland Port that will connect to the Port of Savannah via rail. Building 1800 will total 126,360 square feet with 32-foot clear heights and Building 1850 will span 199,680 square feet with 36-foot clear heights. The design-build team includes general contractor FCL Builders, architect POH+W Architects and civil and structural engineer Haines Gipson & Associates. Todd Barton, Joanna Blaesing, Mark Hawks and Matt Higgins of CBRE are marketing Gainesville 85 Business Center on behalf of the developer. The park is Logistics Property’s third development in the metro Atlanta area, joining Covington Commerce Center and Oakwood 985 Business Park. The developer plans to deliver Phase II of Gainesville 85 in second-quarter 2026.

WARNER ROBINS, GA. — BJ’s Wholesale Club plans to open a new grocery store and BJ’s Gas station at 6201 Watson Blvd. in Warner Robins, nearly 100 miles south of Atlanta via I-75. The Telegraph reports that the 21-acre site will house the 104,170-square-foot grocery store and 582 parking spaces, as well as a 2,204-square-foot gas station with eight pumps that opened in late August. The new BJ’s Wholesale Club store is set to open on Friday, Sept. 12. The property represents the first BJ’s Wholesale Club store in middle Georgia and its seventh in the state, according to The Telegraph.

GREENVILLE, S.C. — Denholtz has acquired a 103,897-square-foot flex industrial park located at 1 Marcus Drive in Greenville. The four-building, multi-tenant property features 16.7-foot clear heights, a sprinkler system, 21 dock doors, seven drive-in doors and more than 350 onsite surface parking spaces. Rhett Craig, Blaine Hart, Matt Smith, Charles Gouch, Shelby Dodson, Patrick Gildea and Robert Hardaway of CBRE represented Denholtz in the transaction with RealOp Investments. The sales price was not disclosed. 1 Marcus Drive is the second acquisition in South Carolina for Denholtz.

HOUSTON — California-based investment firm BKM Capital Partners has purchased a portfolio of two adjacent industrial properties totaling 242,555 square feet across eight buildings in southwest Houston. Southwest Business Park totals 131,000 square feet across three buildings, and Stonecrest Business Center totals 111,555 square feet across five buildings. Combined, the properties offer 39 suites with a current occupancy rate of about 70 percent. BKM Capital, which plans to implement capital improvements, purchased the portfolio for $29.5 million from Fort Worth-based investment firm Fort Capital.

Stratus Development Completes 60-Bed Student Housing Property Near University of South Carolina

by John Nelson

COLUMBIA, S.C. — Stratus Development Group has completed Pickens Corner, a 60-bed student housing community situated a few blocks from the University of South Carolina (USC). The Georgia-based developer has also fully leased the development, which comprises three-bedroom townhomes that each have 3.5 bathrooms and upscale finishes including granite countertops, recessed lighting and stainless steel appliances. Pickens Corner is located in Columbia’s Rosewood neighborhood near the city’s Five Points area and Williams-Brice Stadium, home football arena of the USC Gamecocks.

WESTLAKE, TEXAS — Pluralsight Inc. has signed a 26,000-square-foot office lease in Westlake, a northern suburb of Fort Worth. The global workforce development company has relocated from Utah to the fourth floor of the 120,543-square-foot Building 6 at Terraces at Solana, a 1.1 million-square-foot complex. A partnership between two Chicago-based firms, Glenstar and Singerman Real Estate, owns Terraces at Solana.

ARLINGTON, TEXAS — Holt Lunsford Commercial has negotiated a 5,731-square-foot office lease in Arlington. The space is located within the 123,000-square-foot building at 700 Highlander Blvd. Vic Meyer and Kareem Amer of Holt Lunsford represented the landlord in the lease negotiations. Ryan Matthews of JLL represented the tenant, Island Imaging Investments.

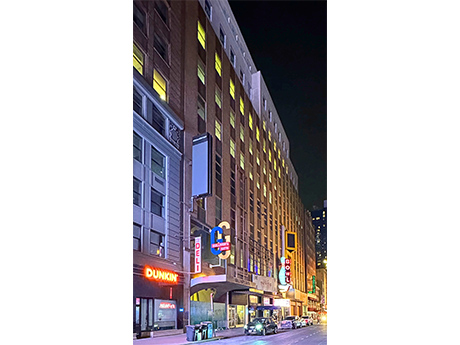

NEW YORK CITY — CBRE has negotiated the $28 million sale of the 245,419-square-foot retail space within the former New York Times building at 229 W. 43rd St. and 216-226 W. 44th St. in Midtown Manhattan. Kushner bought the space in 2015 for $296 million. The space spans the first four floors and two lower levels and was 34.5 percent leased at the time of sale to tenants such as entertainment concept Lucky Strike and restaurants Tacos No. 1 and Ra Sushi. Jay Miller and A.J. Felberbaum of BayBridge Real Estate Capital represented the buyer, a Delaware-based entity doing business as Forum at Time Square LLC, in the transaction. Jack Stillwagon and Doug Middleton of CBRE represented the seller, a trust working on behalf of CMBS bondholders that took title of the property last year via a foreclosure proceeding against Kushner.