HACKENSACK, N.J. — The Kislak Co. Inc. has negotiated the $38.5 million sale of 22 Sussex, an 88-unit apartment building in the Northern New Jersey community of Hackensack. The property consists of 22 studios, 51 one-bedroom units and 15 two-bedroom units. Residences average 883 square feet and feature stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a fitness center, coworking lounge, rooftop deck and a gaming area. Andrew Scheinerman of Kislak represented the seller and developer, an entity doing business as 22 Sussex Street Urban Renewal LLC, in the transaction. Scheinerman also procured the buyer, Lusia Realty Corp.

Property Type

TUCSON, ARIZ. — CBRE has arranged a $30 million loan for the dual-branded Hampton Inn/Home2 Suites hotel in Tucson. Located at 141 S. Stone Ave., the 199-key property opened in late summer 2021. Adrienne Andrews and Will Denton of CBRE facilitated the refinancing for the owner, Fayth Hospitality. A national bank lender provided the seven-year, fixed-rate loan, which pays off the construction loan and provides a future funding upside.

CHESTER, PA. — Locally based brokerage firm Starkman Realty Group has arranged the $3.1 million sale of Buckman Meadows, a 42-unit affordable housing building in Chester, a southwestern suburb of Philadelphia. The property was originally constructed in 1917 to house shipbuilders during World War I and subsequently converted to a veterans’ hospital and then an affordable housing complex for veterans in 2015. New Jersey-based Tunic Group purchased Buckman Meadows from an undisclosed partnership. Jason Starkman of Starkman Realty Group represented both parties in the deal.

JLL Arranges Construction Financing for 54-Unit Mountain View Memory Care in California

by Amy Works

MOUNTAIN VIEW, CALIF. — JLL Capital Markets has arranged an undisclosed amount of construction financing for the redevelopment of Italian restaurant Frankie, Johnnie & Luigi Too! into Mountain View Memory Care, a Class A, 54-unit, 60-bed, private-pay memory care community in the Bay Area city of Mountain View. JLL worked on behalf of the borrower, the D’Ambrosio Family, and its operating partner, Calson Management, to secure the construction financing through a local bank. The community will also continue be home to the D’Ambrosio Family’s restaurant, Frankie, Johnnie & Luigi Too! once completed. The community is positioned on 0.85 acres in an affluent residential neighborhood in Silicon Valley. The site is near highways 85, 237 and 101 and will have two accessible bus stops on either end of the community, providing future residents with transportation to nearby retail, dining and entertainment amenities. Bercut Smith, Lillian Roos and Chad Morgan led the JLL Capital Markets debt advisory team representing the borrower.

NEW YORK CITY — Social media platform Praxis has signed a 7,462-square-foot office lease at 446 Broadway in Manhattan. The lease term is five years, and the space encompasses the entire third floor. Greg Herman of Cushman & Wakefield represented Praxis in the lease negotiations. David Malawer of Newmark represented the landlord, KPG Funds. The building is now fully leased.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

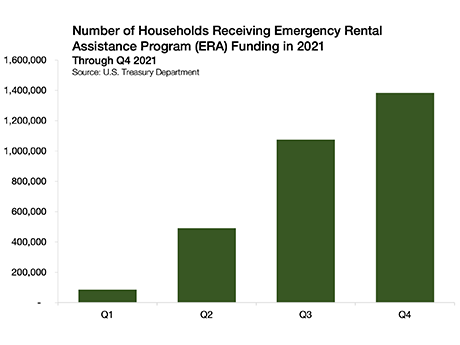

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

Lincoln Property, FCP Plan 450,000 SF Colorado Research Exchange Life Sciences Campus in Broomfield

by Jeff Shaw

BROOMFIELD, COLO. — Lincoln Property Co. (LPC) and FCP, both privately held real estate investment companies, have unveiled plans for the Colorado Research Exchange (CoRE), a 450,000-square-foot life sciences campus in Broomfield. Construction is scheduled to begin this fall for completion in early 2024. Located approximately midway between Denver and Boulder, CoRE will comprise four buildings, three of which will be four- to five-story tenant buildings ranging from approximately 110,000 to nearly 200,000 square feet. The fourth property, a shared amenity center for all tenants, will total 15,960 square feet and feature a fitness center, locker rooms, bike storage, tenant lounge with fireplace, outdoor terrace, conference/training facility and a food market. Each tenant building boasts views of the Front Range section of the Rocky Mountains, while green space connects each of the properties. Development cost estimates were not disclosed. The developers selected Broomfield due to its highly educated workforce and close proximity to two major metro areas. Current demand for life sciences space in this area has reached over 1.4 million square feet and continues to grow as companies focus on the market for its access to talent, capital and business-friendly environment, according to the developers. The partnership expects CoRE …

LAS VEGAS; SCOTTSDALE, ARIZ.; AND ALBUQUERQUE, N.M. — Kennedy Wilson has acquired three multifamily communities totaling 1,110 units in three separate off-market transactions for $418 million, excluding closing costs. The properties are Palms at Peccole Ranch in Las Vegas, La Privada in Scottsdale and San Miguel del Bosque in Albuquerque. The company invested $255 million of total equity in the three communities, which are expected to generate approximately $15 million of initial annual net operating income to Kennedy Wilson. Beginning immediately, Kennedy Wilson will implement a $19 million value-add asset management plan, including renovating more than 65 percent of existing units, refreshing common areas and enhancing amenities to further grow net operating income.

Majestic Realty, Sunroad Enterprises Start Construction of 1.1 MSF Spec Industrial Expansion in San Diego

by Amy Works

SAN DIEGO — Majestic Realty Co. and Sunroad Enterprises have started construction on the second half of their four-building Landmark at Otay development, located at the intersection of state routes 905 and 125 in San Diego. Construction is underway on 50 acres of the 67-acre master-planned development, including a 240,975-square-foot building at 1610 Landmark Road and a 235,085-square-foot building at 1910 Landmark Road. Both buildings will feature 36-foot ceiling clearance and 185-foot secure truck courtyards with individual trailer storage. Additionally, the buildings will offer ESFR fire systems, 51 trailer parking stalls, 40 dock-high doors and two ground-level doors with ramps, as well as Superflat warehouse floors and building-wide clerestory windows. Mark Lewkowitz, Chris Holder and Will Holder of Colliers San Diego are marketing and leasing Phase II of the project. Completion is slated for February 2023. The development team plans to break ground on Phase III, a two-building component including 150,000-square-foot and 115,000-square-foot buildings, this summer.

Halftery Development, Trinity Investors Receive $39.4M Construction Loan for Shopping Center in French Valley, California

by Amy Works

FRENCH VALLEY, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $39.4 million in construction financing for French Valley Marketplace, a grocery-anchored shopping center development in French Valley. The nonrecourse loan will provide funds to complete the horizontal and vertical construction of the project. A partnership between Texas-based Trinity Investors and Pasadena-based Halftery Development Co. are leading the fully entitled, 22-acre project. Current tenants include Grocery Outlet, Rite Aid, EoS Fitness, McDonald’s, AutoZone and 7-Eleven. Brandon Wilhite of MMCC and Sunny Sajnani and Todd McNeill of Institutional Property Advisors, a division of Marcus & Millichap, arranged the financing. The origination team is based out of MMCC’s Dallas office. Trez Capital operated as the lender for the transaction.