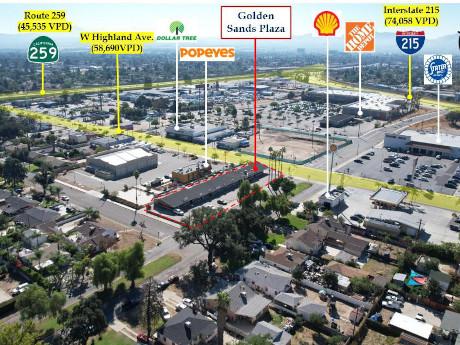

SAN BERNARDINO, CALIF. — Marcus & Millichap has brokered the sale of Golden Sands Plaza, a retail property located at 1090 W. Highland Ave. in San Bernardino. Built in 1962, the 10,057-square-foot property was 90.3 percent leased at the time of sale. A Northern California-based limited liability company sold the asset to another Northern California-based limited liability company for $1.1 million. Julia Evinger of Marcus & Millichap’s Indianapolis office represented the seller and secured the buyer in the deal. Adam Christofferson of Marcus & Millichap’s Los Angeles office served as broker of record for the transaction.

Property Type

PHOENIX — Ready Capital has closed on $13.3 million in financing for the acquisition, renovation and stabilization of a 105-unit apartment community in Phoenix’s Midtown submarket. Upon acquisition, the undisclosed borrower will implement a capital improvement plan consisting of interior and exterior upgrades. The nonrecourse, interest-only, floating-rate loan features a 36-month term, two extension options and a facility to provide future funding for capital expenditures.

SCHERTZ, TEXAS — Atlanta-based Core5 Industrial Partners has acquired 164 acres in Schertz, a northeastern suburb of San Antonio, for the development of a 1.8 million-square-foot project. Construction of Phase I, which will comprise two buildings totaling roughly 1 million square feet, is set to begin later this year. Carlos Marquez and Brett Lum of NAI Partners represented Core5 Industrial in its acquisition of the land and have also been retained to lease the development. Corbin Barker of Endura Advisory Group represented the land seller, an entity doing business as Boeck Farm Co. Ltd.

AUSTIN, TEXAS — Newmark has brokered the sale of 823 Congress, a 190,254-square-foot office building in downtown Austin. The recently renovated building was 71 percent leased at the time of sale. Chris Murphy, Robert Hill, Gary Carr and Chase Tagen of Newmark represented the seller, a fund backed by New York-based DRA Advisors, in the transaction. David Milestone, Brett Green and Josh Francis of Newmark arranged an undisclosed amount of acquisition financing on behalf of the buyer, Dallas-based Pillar Commercial. The sale included a six-story parking garage located at 900 Brazos St. The building was recently renovated to the tune of $15 million.

BEAUMONT, TEXAS — Marcus & Millichap has arranged the sale of Storage Depot, a 507-unit self-storage facility in Beaumont. The property spans 59,120 net rentable square feet. Dave Knobler, Brandon Karr and Danny Cunningham of Marcus & Millichap represented the undisclosed, Texas-based seller in the transaction. The trio also procured the buyer, El Paso-based Riverbend Development. The sales price was not disclosed.

HOUSTON —Dallas-based private equity firm Trive Capital, in partnership with Dallas-based Aspen Oak Capital Partners, has acquired Alta Med Main, a 338-unit apartment community located near Texas Medical Center in Houston. Built in 2020 by Wood Partners, the property features one- and two-bedroom units and amenities such as a pool, fitness center and coworking space and outdoor grilling areas.

FORT WORTH, TEXAS — Locally based residential developer ONM Living has sold Cottages at Bell Station, a 140-unit multifamily property in Fort Worth. The pet-friendly property offers one-, two- and three-bedroom units that were fully leased at the time of sale. Berkadia brokered the sale of the property. The buyer and sales price were not disclosed.

NEW YORK CITY — Los Angeles-based Parkview Financial has provided a $92 million construction loan for a 215,379-square-foot office building that will be located at 1498-1538 Coney Island Avenue in Brooklyn’s Midwood neighborhood. The project will include 51,000 square feet of retail space and a 267-space automated parking structure. Construction is underway and expected to be complete in October 2023. Between the office and retail components, the building is 30 percent preleased. Aaron Birnbaum and Elliott Kunstlinger of Meridian Capital Group arranged the loan through Parkview on behalf of the borrower, an affiliate of locally based developer Baruch Singer.

Electra America and BH Group Buy South Florida Mall for $100.4M, Plan Mixed-Use Redevelopment

by John Nelson

CUTLER BAY, FLA. — Electra America and BH Group have formed a joint venture to purchase Southland Mall, a 808,776-square-foot shopping mall in the Miami suburb of Cutler Bay. The buyers purchased the 80-acre site for $100.4 million with plans to reposition the mall and develop new Class A apartments on the campus. The joint venture is working closely with the Town of Cutler Bay on the redevelopment project. Located at 20505 S. Dixie Highway, Southland Mall was 80 percent leased at the time of sale to more than 100 tenants, including JC Penney, Macy’s, T.J. Maxx, LA Fitness, Regal Cinemas, Old Navy, Sephora, Kay Jewelers and Applebee’s. According to the buyers, Southland Mall is the only enclosed regional mall servicing southern Miami-Dade County through the Florida Keys. Michael Fay, John Crotty, David Duckworth and Brian de la Fé of Avison Young represented Electra America and BH Group in the land deal. The seller(s) was not disclosed. Southland Mall includes a former Sears department store and auto center that were not part of the transaction.

Bridge Industrial Obtains $153.5M Construction Loan for Metro Miami Logistics Project

by John Nelson

MIAMI GARDENS, FLA. — Bridge Industrial has obtained a $153.5 million construction loan to complete Phase II of Bridge Point Commerce Center, a 2.7 million-square-foot logistics park in Miami Gardens. Steve Roth of CBRE arranged the loan through CIBC Bank on behalf of Bridge Industrial. The second phase, which comprises two buildings totaling 1.6 million square feet, is expected to deliver in third-quarter 2023. Each building will span 794,230 square feet and feature 36-foot clear heights. There are build-to-suit and build-to-own opportunities available at the project, according to Bridge Industrial. Located on a 186-acre site at 4310 NW 215th St., Bridge Point Commerce Center features frontage on the Florida Turnpike and is equidistant between Miami International Airport and Fort Lauderdale International Airport. Phase I spans 1.1 million square feet across three buildings and is fully leased to tenants including City Furniture and HapCor.