DOWNERS GROVE, ILL. — Lifespace Communities has broken ground on an expansion project at Oak Trace, a nonprofit continuing care retirement community in the Chicago suburb of Downers Grove. The expansion is Phase II of a $112 million reinvestment project at the community. The first phase, which converted some units to assisted living to complete the continuum of care, was completed in 2019. Phase II will add 145 independent living apartments, bringing the total from 232 to 377. Completion is scheduled for 2023. In addition to increasing the number of available independent living apartments, new construction will include a clubhouse featuring a fitness center, pool, salon, casual dining venue, café seating, multipurpose room, living room and new lobby. Existing common areas will also be renovated. Once the second phase of construction is completed, the health center will be connected to the existing independent living building via the new clubhouse. In addition to the independent living units, the senior living community currently features 66 assisted living apartments, 28 memory support suites and 104 skilled nursing suites.

Property Type

MASON, OHIO — Senior Living Investment Brokerage (SLIB) has arranged the sale of Cedar Village, a seniors housing community in Mason, Ohio, approximately 22 miles northeast of downtown Cincinnati. Cedar Village features 105 independent living/assisted living units and 162 skilled nursing beds. The seller was a nonprofit owner based in Indiana divesting of its only community in Ohio. The buyer was a regional owner with other properties nearby. The price was not disclosed. Ryan Saul of SLIB handled the transaction.

NEPTUNE CITY, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the $6.5 million sale of Steiner Ocean Apartments, a 36-unit multifamily property in Neptune City, located near the Jersey Shore. The garden-style property comprises three two-story buildings. Daniel Lanni of Kislak represented the buyer and seller, both of which requested anonymity, in the transaction.

BIRMINGHAM, MICH. — Bernard Financial Group (BFG) has arranged $6.5 million in permanent financing for a 23,500-square-foot, Class A office building in Birmingham, a northern suburb of Detroit. Joshua Bernard of BFG arranged the loan on behalf of the borrower, Chester Street Partners LLC. American United Life Insurance Co. provided the loan, the terms of which were undisclosed.

FLINT, MICH. — The Jonna Group of Colliers has brokered the sale of a 6,885-square-foot commercial building in Flint for an undisclosed price. The property, built in 2019, is located at 5009 Miller Road. Tenants at the fully leased building include U.S. Army & Navy Career Center, Jersey Mike’s and Smoothie King. Simon Jonna of Colliers represented the seller, a Michigan-based private developer. The buyer was not disclosed.

HOWELL, MICH. — Metro Infusion Center has leased the remaining 1,458 square feet at Shops at Westbury in Howell, about 30 miles north of Ann Arbor. Michael Murphy and Bill McLeod of Gerdom Realty & Investment represented the undisclosed landlord. Todd Schultz of Schultz Real Estate represented the tenant. Metro Infusion Center, a provider of infusion therapies for complex chronic conditions, now operates 15 locations across the state of Michigan.

Like many of the markets within the Sun Belt, Birmingham’s economy remained relatively resilient through the emergence of the COVID-19 pandemic. Despite its share of small business and restaurant closures, leasing activity is back to par, and owners continue to see steadily rising rental rates — up 3.1 percent over the last 12 months — as tenant demand continues to be robust. Retail absorption over the last 12 months is a healthy 400,000 square feet compared to -510,000 square feet a year ago, which is a phenomenal 909,000-square-foot change just 18 months out from the emergence of the Coronavirus and effective shutdown of the U.S. economy. As Americans return to whatever the new normal is deemed to be and retail conditions continue to rebound, Birmingham is poised and ready to stake its claim in the South’s hierarchy of bourgeoning retail markets. Over the course of retail’s revival during the last 12 to 15 months, development has picked up throughout the Birmingham MSA, fueled primarily by build-to-suit projects for established chains in rapidly expanding suburban markets like Hoover. Stadium Trace Village, a master-planned, mixed-use development at Interstate 459 and Ala. Highway 150, has been one of the most recent projects to …

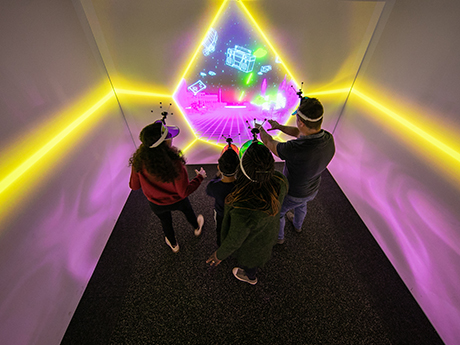

LOS ANGELES — After a two-year slog through COVID-19, consumer demand for shopping, dining and entertainment experiences has become a cresting tidal wave ready to descend upon the shore. The term “pent-up” is frequently used to describe this mentality, but industry professionals know that cliché doesn’t really do justice to the degree of concentrated demand for just about any form of dining out, barhopping, gaming and fraternizing. To this end, the National Retail Federation (NRF) projects that total retail sales across both digital and brick-and-mortar forums will grow between 6 to 8 percent year over year in 2022. And yet, to invoke another nautical metaphor, this scenario is not necessarily a rising-tide-lifts-all-boats phenomenon — at least not in the long run. The reality for developers and operators of shopping, dining and entertainment properties is that in order to win customer loyalty in the long haul and infuse a center with true cross-shopping potential and destinational status, they have to create a legitimately unique draw. This notion, while not necessarily revelatory and Earth-shattering in the current brick-and-mortar retail market, has only been more deeply ingrained by the events of the last 24 months. At the seventh-annual Entertainment Experience Evolution conference that …

NEW YORK CITY — Affiliates of private equity giant Blackstone (NYSE: BX) have agreed to acquire PS Business Parks (NYSE: PSB), a Glendale, Calif.-based commercial owner-operator primarily focused on industrial assets, for $7.6 billion. The deal is scheduled to close in the third quarter. Under the terms of the agreement, New York City-based Blackstone will purchase all outstanding shares of PSB’s common stock for $187.50 per share, which represents a premium of approximately 15 percent over the weighted average share price over the last 60 days. Blackstone plans to take the company private as part of the acquisition. Public Storage (NYSE: PSA), which is also based in Glendale, currently owns about 26 percent of PSB’s common stock, and the self-storage REIT’s executives and shareholders have voted in favor of the sale to Blackstone. The transaction will also include the acquisition of Public Storage’s limited partner equity interests in PSB’s operating partnership at the same per-share price of $187.50. As of March 30, 2022, PSB owned and operated 96 commercial properties across the country, primarily in California, South Florida, Texas and Northern Virginia. Those assets span approximately 27 million square feet and are occupied by nearly 5,000 tenants. Though mainly comprised …

KINGSTOWNE, VA. — Avison Young has brokered the sale of a retail portfolio totaling 410,398 square feet in Kingstowne, located in Fairfax County approximately 13 miles southwest of Washington, D.C. Federal Realty Investment Trust (NYSE: FRT) purchased the portfolio for $200 million. The deal will close in two parts, with the first half already completed and the second half scheduled to close in July. Dean Sands and Chip Ryan of Avison Young represented the seller, The Halle Cos. The portfolio is 97 percent leased to 61 tenants, including supermarkets Safeway and Giant. According to local news outlets, the properties also feature tenants such as T.J. Maxx, Ross, HomeGoods, &pizza and Cava. The retail portfolio includes a significant portion of Kingstowne Towne Center, a live-work-play power center in Virginia. The Halle Cos. developed Kingstowne Towne Center in the mid-1980s, converting 1,200 acres into a master-planned community. With large expanses of green space and a centralized town center, Kingstowne is considered one of Northern Virginia’s best places to live and work, according to Avison Young. “Kingstowne Towne Center, with its attractive demographics and significant barriers to entry, is reflective of our Northern Virginia growth strategy, and further demonstrates our corporate commitment to …