SUMMERVILLE, S.C. — WRS Inc. Real Estate Investments has acquired three fully tenanted industrial/flex buildings totaling 55,643 square feet in Summerville. Patrick Marr of WRS Inc. represented the firm internally. The seller and sales price were not disclosed. The industrial/flex buildings include the following: 114-A&B Trigard Lane (20,803 square feet); 215-A&B Varnfield Drive (25,000 square feet); and 220 Varnfield Drive (9,840 square feet). The properties are located about 25 miles from Charleston and 18 miles from Charleston International Airport.

Property Type

NEW YORK CITY — New York City-based developer HAP Investments is nearing completion of a 112-unit multifamily project located at 225 W. 28th St. in Manhattan’s Chelsea neighborhood. The 20-story building’s one- and two-bedroom units and three penthouses feature custom white oak cabinetry and marble countertops, and amenities include a pool, fitness center with a sauna and steam room, children’s play area and a rooftop deck with grilling areas. HAP Investments has received a temporary certificate of occupancy (TCO), allowing the first move-ins to commence, and expects to receive a permanent certificate this fall. More than 60 percent of the units were preleased at the time of the TCO issuance.

HINESVILLE AND BRUNSWICK, GA. — Marcus & Millichap has arranged the sale of two shopping centers in South Georgia for the combined sales price of $7.7 million. The two properties include Veterans Square in Hinesville and Canal Crossing in Brunswick. Constructed in 2018, Veterans Square is located on West Oglethorpe Highway. The property was fully leased at the time of sale to three tenants: Krispy Kreme, Mad Vapes and McAlister’s Deli. Built in 2018, Canal Crossing is located adjacent to the Sam’s Club in Brunswick. The center was fully leased at the time of sale to four tenants: Five Guys, Tropical Smoothie, Great Clips and Fuse Frozen Yogurt. Harrison Creason, Andrew Margulies and Benjamin Kapinos of Marcus & Millichap represented the seller, a limited liability company. John Leonard, Marcus & Millichap’s broker of record in Georgia, assisted in closing this transaction. The buyer was not disclosed.

WILMINGTON, MASS. — Boston-based mortgage banking firm EagleBridge Capital has arranged $38 million in debt and joint venture equity financing for a 210,945-square-foot office and lab complex in the northern Boston suburb of Wilmington. Located at 181 and 187 Ballardvale St., the two buildings sit on a combined 15.4 acres and each span approximately 105,000 square feet. Ted Sidel and Brian Walsh arranged the financing, specific terms of which were not disclosed, on behalf of an unnamed borrower.

HOLMDEL, N.J. — CentralReach, a provider of electronic medical record software, will open a 25,000-square-foot office at Bell Works, an office and retail campus owned by Somerset Development in the Northern New Jersey community of Holmdel. The company will relocate from its current office in Matawan late this summer. CentralReach employs about 400 people who work remotely on a full-time basis and views the new office as a “collaboration-focused space” that represents “the office of the future.” CentralReach is designing the space in collaboration with G3 Architects and NPZ Style & Décor.

BOURBONNAIS, ILL. — Maverick Commercial Mortgage Inc. has arranged $63.2 million in permanent financing for Tri-Star Estates, a mobile home park in Bourbonnais, about 50 miles south of Chicago. The property, which consists of 853 pad sites across 157 acres, was developed in three phases beginning in 1965. The current owner acquired Tri-Star in April 2012 when 380 homes were occupied. Today, 810 homes are occupied. Amenities include a basketball court, three playgrounds and a 7,500-square-foot clubhouse with a pool and fitness center. PGIM Real Estate provided the Freddie Mac loan. The 10-year, fixed-rate loan features five years of interest-only payments followed by a 30-year amortization schedule. Proceeds from the loan paid off the existing lender, provided cash to the borrower and paid for closing costs.

FENTON, MO. — U.S. Capital Development has selected IMPACT Strategies to build two new speculative industrial buildings at Fenton Logistics Park in Fenton, a southwest suburb of St. Louis. Building 6A will span 125,000 square feet, while Building 6B will total 160,000 square feet. Completion of both buildings is slated for the fourth quarter of this year. IMPACT is also handling site development for earthwork, utilities, parking lots and landscaping. Fenton Logistics Park is the redevelopment of a former Chrysler plant that will span more than 2.5 million square feet upon full buildout.

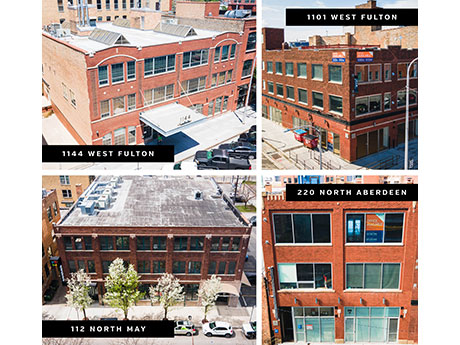

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

CRESTWOOD, ILL. — Entre Commercial Realty has arranged the sale of a 20,273-square-foot industrial building in Crestwood, a southwest suburb of Chicago. The sales price was undisclosed. The property features five drive-in doors and an outdoor storage yard. The building is fully leased to two tenants. Jeff Locascio and Chris Wilbur of Entre represented the seller, TFZ Enterprises. Matthew Lee of Darwin Realty/CORFAC International represented the buyer, Commercial Business Properties LLC.

SEVILLE, OHIO — Sheetz Inc., a gasoline station, convenience store and coffee shop chain owned by the Sheetz family, has purchased a vacant lot at 350 Center St. in Seville, about 40 miles south of Cleveland. The nearly 12-acre site sold for $1.2 million and will be custom-built for Sheetz. Jerry Fiume and Aaron Davis of SVN Summit Commercial Real Estate Advisors brokered the sale. The seller was undisclosed.