ST. LOUIS — Draper and Kramer Inc. has begun pre-leasing Moda at The Hill, a 225-unit apartment development in The Hill neighborhood of St. Louis. Residents can begin moving in this summer. The four-story building offers units that range in size from 600 to 1,200 square feet. Monthly rents start at $1,270. Amenities include a fitness center, game room, coworking spaces, grilling stations, fire pits, pool and hot tub. Moda at The Hill is part of a larger 11-acre master plan led by Draper and Kramer that includes single-family homes by McBride Homes and a community park.

Property Type

JANESVILLE, WIS. — Northmarq has arranged a $28.1 million loan for the refinancing of Village Green Apartments in Janesville, about 40 miles south of Madison. The 406-unit multifamily property is located at 3121 Village Court. Mark Ebersold of Northmarq arranged the 10-year loan, which features two years of interest-only payments and a 30-year amortization schedule. A CMBS lender provided the fixed-rate loan. The borrower was undisclosed.

MAPLEWOOD, MINN. — Arizona Partners has acquired Birch Run Station in the Minneapolis suburb of Maplewood. The purchase price was undisclosed. The 279,343-square-foot shopping center is home to tenants such as Burlington, Jo-Ann and Dollar Tree. CBRE represented the seller, Voya Investment Management.

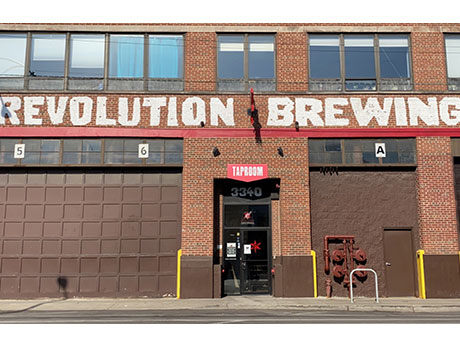

CHICAGO — Revolution Brewing, the largest independently owned brewery in Illinois, has purchased a 128,422-square-foot industrial property located on North Kedzie Avenue in Chicago. The purchase price was undisclosed. The building features clear heights ranging from 18 to 24 feet, 14 docks and one drive-in door. Mike Senner and Alex Kritt of Colliers represented the seller, a private investment group.

NEW YORK CITY — JLL has brokered the sale of The Vitagraph, a 302-unit apartment community located in the Midwood neighborhood of Brooklyn. Constructed in 2019, the eight-story building features one-, two- and three-bedroom apartments with high-end finishes, in-unit washers and dryers and private terraces. Amenities include an indoor and outdoor kids’ play area, courtyard, 24-hour doorman service, business center, fitness center and a rooftop patio. Jeffrey Julien, Steven Rutman, Ethan Stanton, Rob Hinckley, Brendan Maddigan and Stephen Palmese of JLL represented the seller, New York City-based developer Northlink Capital, in the transaction. The buyer was a partnership between The Dermot Co., Principal Real Estate Investors and Dutch pension fund PGGM.

PITTSBURGH — Law firm Dickie, McCamey & Chilcote PC has signed a 79,719-square-foot office lease at Four Gateway Center, a 1.5 million-square-foot office building in downtown Pittsburgh. The firm will relocate from its longtime space at PPG Place to occupy five floors at Four Gateway Center, which features a newly built conference facility and fitness center, in spring 2025. Dan Adamski, Nick Francic and Reid Mauro of JLL represented the tenant in its site selection and lease negotiations. The representative of the landlord, Hertz Investment Group, was not disclosed.

NEW YORK CITY — Avison Young has negotiated a 41,937-square-foot office sublease at 195 Broadway in downtown Manhattan. Lattice, a consulting firm focused on improving company cultures, will sublease the space at the 11-story building from Namely, a provider of human resources software. Brooks Hauf, Peter Johnson and Leah Zafra of Avison Young, along with Bryan Emanuel and John Diepenbrock of Raise Commercial Real Estate, represented the sublessee in the negotiations. Steve Rotter, Brett Harvey, Justin Haber and Kyle Riker of JLL represented the sublessor.

Laguna Point Properties Receives $328.8M in Acquisition Financing for Five-Property Multifamily Portfolio in Downtown Los Angeles

by Amy Works

LOS ANGELES — JLL Capital Markets has arranged $328.8 million in acquisition financing for a five-property apartment portfolio in downtown Los Angeles. The borrower is Laguna Point Properties. Totaling 1,037-units, the portfolio includes four historic pre-war buildings and a 1959-vintage building converted from an office asset. The properties are the 184-unit Lofts, 214-unit Main, 198-unit Manhattan, 178-unit Spring and 263-unit Tower, all of which underwent conversions to multifamily assets between 2007 and 2010. Charles Halladay, Jamie Kline and Charlie Vorscheck of JLL Capital Markets Debt Advisory team secured the three-year, floating-rate acquisition loan, which offers two 12-month extension options, through MF1 Capital. The seller was not disclosed.

Avanath Acquires St. John’s Manor Affordable Seniors Housing Community in Costa Mesa, California

by Amy Works

COSTA MESA, CALIF. — Avanath Capital Management LLC has acquired St. John’s Manor, a 36-unit affordable seniors housing community in the Orange County city of Costa Mesa, for $11.8 million. Built in 1984 and renovated in 2007, St John’s Manor is currently 100 percent occupied. This acquisition comes on the heels of Avanath’s acquisition of The Overlook at Anaheim Hills, a 261-unit seniors housing community in Anaheim, and The Grove Senior, an 85-unit seniors housing community in Garden Grove. “We entered the Orange County market earlier this year, and plan to continue to be extremely bullish in the region,” says John Williams, president and CIO at Avanath. “Seniors housing is an asset class that remains particularly of interest to us as it has been one of the best performing asset types within our portfolio throughout the pandemic.” Avanath currently owns more than 13,000 units across the United States, 2,550 units of which are age-restricted senior apartments. “There is an increasing need for affordable housing for seniors, especially in high-priced areas of Orange County,” says Williams. “Baby boomers, a large percentage of whom are expected to reach retirement age by 2030, will be looking to downsize and seek quality options that are …

YUMA, ARIZ. — Arlington, Va.-based FD Stonewater has acquired Alside Distribution Center in Yuma from Phoenix-based Merit Properties for an undisclosed price. Located at 7550 E. 30th St., Alside Distribution Center features 222,554 square feet of manufacturing and distribution space with 25-foot clear heights, 22 dock-high doors and trailer storage. Alside, a division of Associated Materials, has occupied the single-tenant building since it was originally developed in 2005. The 21.1-arce site, which provides additional expansion opportunities, is under a ground lease owned by the tenant, with 74 years remaining. The tenant is a manufacturer and distributor of vinyl windows, siding and doors. Barry Gabel, Chris Marchildon and Dan Calihan of CBRE represented the seller in the deal.