RIVERSIDE, CALIF. — PSRS has arranged the $3.5 million cash-out refinancing of Riverside Apartments, a multifamily property located in Riverside. David Sarnoff of PSRS secured the 10-year, fixed-rate loan with a flexible prepayment structure. The name of the borrower was not released. Built in 1990, the wood-frame property features 32 garden-style apartments.

Property Type

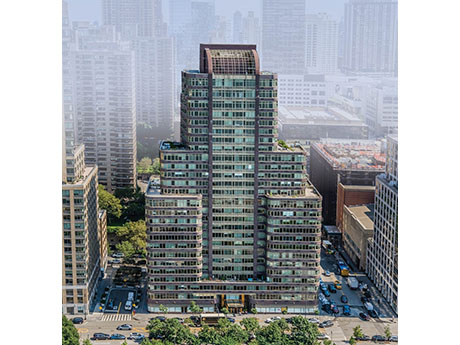

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

After several years in the top 10, Nashville was named the No. 1 “market to watch” in overall commercial real estate prospects, according to Urban Land Institute and PwC’s 2022 Emerging Trends in Real Estate report. Nashville surpassed its supernova competitors (markets with a population between 1 million and 2 million people) such as Raleigh-Durham, Phoenix, Austin and Charlotte. The report credits Nashville’s robust and sustained job and population growth, above-average levels of economic diversity and investment/development opportunities. In short, Nashville’s economy fared relatively well during the pandemic-induced recession, and its industrial market never slowed down. Nashville has been a top location for relocating and expanding industrial-using companies, as its location is unmatched for distribution. Fifty percent of the nation’s population lives within 650 miles of Middle Tennessee, with 24 states falling within that radius. This translates to a one- or two-day truck delivery time to more than 75 percent of all U.S. markets. Additionally, it is one of only six U.S. cities with three major intersecting interstate highways. Nashville’s economy is extremely resilient due to its diversified economy. However, Nashville is not immune to national trends that have affected multiple industrial markets. The cost of construction continues to increase, …

DALLAS — A joint venture between Acram Group, an investment firm formerly known as JMC Holdings, and New York City-based alternative investment group Oak Hill Advisors has purchased Spectrum Center, a 614,000-square-foot office complex in North Dallas, for $114.3 million. The sales price equates to roughly $185 per square foot. Spectrum Center consists of two 12-story buildings. According to LoopNet Inc., the property offers amenities such as a fitness center, courtyard and an onsite restaurant, while users also have access to services such as banking, dry cleaning and daycare. Todd Savage of JLL represented the seller, Granite Properties, in the transaction. Jim Curtin and Ryan Pollack, also with JLL, represented the joint venture. Miami-based Rialto Capital provided an undisclosed amount of acquisition financing for the deal.

HOUSTON — JLL has arranged the sale of Champions Village, a 383,346-square-foot retail power center situated on 31.5 acres in northwest Houston. Retailers at the property include grocer Randalls, Barnes & Noble, T.J. Maxx, Tuesday Morning, Kirklands, Jenny Craig, Supercuts, Bath & Body Works, Body & Brain Yoga and Berkeley Eye Center. Restaurant users include La Madeleine, Don Ramons Mexican Restaurant, Cassandra’s Louisiana Kitchen and MOD Pizza. Chris Gerard, Ryan West, Sherri Rollins and Ethan Goldberg of JLL represented the seller, New Market Properties LLC, a subsidiary of Atlanta-based REIT Preferred Apartment Communities Inc., in the transaction. New Jersey-based First National Realty Partners acquired the asset for an undisclosed price.

SAN MARCOS, TEXAS — Austin-based Palladius Capital Management has purchased The Heights, a 672-bed student housing community serving students at Texas State University in San Marcos, located south of the state capital. The property is located about three miles from campus, comprises 240 units and offers amenities such as a pool, fitness center, clubhouse and study lounges. The seller and sales price were not disclosed. The new ownership plans to implement a value-add program focused on unit interiors, building exteriors and amenity spaces.

DALLAS — Dallas-based CBRE has brokered the $91 million sale of an eight-building medical office portfolio across four states in the Southeast and Texas. A joint venture between Chicago-based Remedy Medical Properties and Boca Raton, Fla.-based Kanye Anderson Real Estate purchased the properties. Lee Asher, Chris Bodnar, Jordan Selbiger, Ryan Lindsley, Cole Reethof, Sabrina Solomiany and Zach Holderman of CBRE represented the seller, Los Angeles-based Spruce Healthcare, in the transaction. The 177,000-square-foot portfolio includes five properties in Florida and one each in Texas, North Carolina and Tennessee. The portfolio was fully leased at the time of sale with 11 years of weighted average lease terms remaining. Two-thirds of the overall tenancy features orthopedics, oncology and imaging practices. Other specialties include ophthalmology and dermatology, both of which include ambulatory surgery centers.

GEORGETOWN, TEXAS — Titan Development has broken ground on Building 5 at NorthPark 35 Industrial Park, a project that will add 297,057 square feet of industrial space to the local supply. The building will serve as the new headquarters for the Greater Austin Merchant’s Cooperative Association, a trade organization for convenience stores and gas stations. Completion is slated for the fourth quarter. NorthPark35 is funded by Titan’s Development Real Estate Fund II, which focuses on industrial and multifamily projects in Texas, New Mexico, Colorado and California.

ATLANTA — New York-based Eastern Union has secured an $83.3 million bridge loan for The Halsten at Vinings Mountain, a 440-unit multifamily property in Atlanta. Michael Muller of Eastern Union arranged the non-recourse, two-year loan, which has three 12-month extension options. The loan was underwritten with interest-only payments for a period of up to three years. The borrower was not disclosed. Formerly known as Stone Ridge at Vinings, The Halsten offers studio, one-, two- and three-bedroom floorplans. Completed in 1973, the property spans 452,385 square feet. The new owner plans to upgrade the property’s exteriors and modernize and renovate the interiors. Unit features include walk-in closets, patios and balconies and washer and dryer hookups. Community amenities include a business center, clubhouse, playground, tennis court, grill, picnic area, fitness center, laundry facilities and a pet play area. Located at 3000 Cumberland Club Drive, the property is situated two miles from The Battery Atlanta and 15.7 miles from downtown Atlanta.

WEST PALM BEACH, FLA. — Greystone has provided a $17.5 million HUD-insured loan for the redevelopment of Christian Manor Apartments, a 200-unit affordable seniors housing community located in West Palm Beach. Jon Morales of Greystone arranged the loan on behalf of the borrower, Phase Housing Corp. Inc. Located in Palm Beach County, Christian Manor includes four, three-story buildings that offer studio and one-bedroom units. Originally built in 1972, the property will provide affordable housing for low-income, which is classified as below 60 percent of area median income, and “extremely low-income” seniors (below 28 percent AMI) over 62 years of age. The project team worked with HUD and the West Palm Beach Housing Authority to obtain project-based rental assistance for over half of the residents who, although eligible, were previously not receiving this support. The expected construction cost for the redevelopment of the property is $38.7 million. Along with the funding from Greystone, the project also received 4 percent Low-Income Tax Credit (LIHTC) equity, and secondary debt consisting of a Florida State Apartment Incentive Loan and Florida Extremely Low-Income funds. The non-recourse loan carries a 40-year term at a low, fixed interest rate. Paul Ponte of Phase Housing Corp. Inc., Jason …