PHOENIX — ViaWest Group and its institutional capital partner have received $35.5 million in construction financing for the ground-up construction of Converge Logistics Center, a three-building speculative logistics center located at 15175 S. 50th St. in Phoenix. Situated on 28.6 acres, Converge Logistics Center will feature approximately 500,000 square feet of Class A rentable industrial space. The individual buildings will range from 140,000 square feet to 210,000 square feet and may be leased to a single tenant or are divisible to 23,500 square feet for multi-tenant use. The buildings will feature 32-foot clear heights, a combination of dock-high and grade-level doors and office suites at the front. Construction on all three buildings began in January, with completion slated for fourth-quarter 2022. The borrowers control the lot through a ground lease with Kyrene Elementary School District. Mike Walker and Brad Zampa of CBRE Capital Markets’ Debt & Structured Finance group arranged the nonrecourse, floating-rate loan, which has a three-year term with two extension options. A regional bank headquartered in the southern United States provided the capital.

Property Type

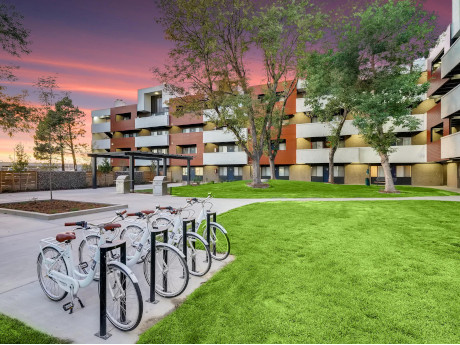

AURORA, COLO. — Northmarq has arranged the sale of Highline Lofts Apartments, a multifamily property located at 456 S. Ironton St. in Aurora. Lowe Property Group sold the property to Summit Communities for $29.1 million, or $260,000 per unit. Built in 1972, Highline Lofts Apartments features 112 units in a mix of one-, two- and three-bedroom floor plans, ranging from 740 square feet to 1,395 square feet. Alex Possick, Rich Ritter and Seth Gallman of Northmarq’s Colorado Multifamily Investment Sales team represented the seller in the deal.

Pacific Partners Residential Buys Former Transportation Terminal in Boise for Multifamily Redevelopment Project

by Amy Works

BOISE, IDAHO — Pacific Partners Residential has acquired a 0.84-acre site in downtown Boise for an undisclosed price. The buyer plans to redevelop the property, which is located at 1212 W. Bannock St. and formerly used as a transportation terminal for the Greyhound Bus Co., into a residential community. Curtis Cluff of Cushman & Wakefield and Matt Haumann of CBRE co-represented the buyer, while Jay Story of Story Commercial Real Estate represented the seller in the deal.

MIAMI — Affiliates of Harbor Group International (HGI) have acquired ParkLine Miami, an 816-unit luxury apartment community in downtown Miami. The purchase price was not disclosed, but news outlets reported last fall that the asking price was $500 million. The seller, Florida East Coast Industries (FECI), completed construction of the property in 2020. The development is perched directly above MiamiCentral, a transportation hub spanning six city blocks that connects to four major transit lines. “The ParkLine Miami investment represents a unique opportunity to acquire a world-class asset in a desirable, high-growth location with accessibility to major employment drivers and direct elevator access to all major regional and local transportation modes,” says Richard Litton, president of HGI. ParkLine Miami consists of two apartment towers rising 44 and 47 stories. Connecting the two towers is a two-acre amenity deck set 150 feet above street level. Offerings include pools, outdoor and indoor fitness centers, pet parks, a quarter-mile running track and a business center with coworking spaces. HGI, a privately owned international real estate investment and management firm based in Norfolk, Va., now owns 1,105 units across five properties in Miami-Dade County. Cammeby’s International Group partnered with HGI on the transaction. Cammeby’s, which …

FORT MYERS, FLA. — JBM Institutional Multifamily Advisors has brokered the $265 million sale of three multifamily properties in Fort Myers totaling 775 units. The three properties include Las Palmas, Drift at The Forum and Estero Oaks. Built in 2021 by The NRP Group, Las Palmas is a 300-unit, Class A apartment property with townhome-style units and attached two-car garages. Unit features include espresso flat-panel cabinets, vinyl flooring and kitchen islands with maple white quartz countertops. Community amenities include home office space, a fitness center, two resort-style saltwater pools and a volleyball court. PassiveInvesting.com purchased the property. Developed in 2021 by the Garrett Cos., the Drift at The Forum is a 195-unit apartment community that offers one-, two- and three-bedroom floorplans with in-unit washers and dryers and an elevator. Community amenities include a resort-style pool with shaded cabanas, a 1,500-square-foot fitness center, theater room, arcade and putting green. Situated at 3419 Forum Blvd., the property is located adjacent to The Forum shopping center, a Target-anchored power center. Miami-based Momentum Real Estate Partners purchased the property. Estero Oaks, a 280-unit apartment community, was completed in 2017. Unit features include granite countertops, walk-in closets, island kitchens and an in-unit washers and dryers. …

LAFAYETTE, LA. — New York-based Kushner Realty Acquisition LLC has purchased two multifamily properties in Lafayette for a combined $93.5 million. New Orleans-based Key Real Estate sold the communities, Robley Place and Ansley Walk, for $52.5 million and $41 million, respectively. Albert Elmore and Brian Savage of Colliers represented both the buyer and the seller in the transaction. The adjacent properties both offer one-, two- and three-bedroom floorplans. Built in 2016, Robley Place features 248 units with stainless steel appliances, wood-style flooring and walk-in closets. Community amenities include a courtyard, grill, fitness center, pet washing station, spa, pool, playground and a business center. Built in 2008, Ansley Walk has 242 units with walk-in closets, balconies and patios and master bathrooms with double vanities. Community amenities include laundry facilities, pet play area, car wash area, pet washing station, package service and Wi-Fi at the pool and clubhouse.

MARIETTA, GA. — CBRE has secured $38 million in acquisition financing for Crestmont Apartments, a 228-unit, garden-style apartment community in Marietta. Robert Kadoori and C.J. Kelly of CBRE arranged the loan on behalf of the borrower, TerraCap Management. The floating-rate loan has an initial term of four years, can extend up to one additional year and features future funding to finance the sponsor’s business plan. Built in 1986, Crestmont offers one- and two-bedroom unit floorplans. Unit features include nine-foot ceilings, stainless steel appliances, walk-in closets and washers and dryers in select units. Community amenities include a swimming pool with a sundeck, playground, picnic area with grilling stations, clubhouse, pet spa and a dog park. Located at 500 Williams Drive, the property is close to Interstates 75 and 575 and Atlanta’s Cumberland/Galleria office submarket, which includes 20 million square feet of office space. The property is also 5.3 miles from Kennesaw State University, 10.7 miles from Battery Atlanta and 2.9 miles from Town Center at Cobb.

AUSTIN, TEXAS — A partnership between two developers, New York-based Tishman Speyer and Minneapolis-based Ryan Cos., has broken ground on 321 West, a 58-story mixed-use tower in downtown Austin. The site is bounded by Sixth and Guadalupe streets near the Republic Square transit center. The 569,000-square-foot building will house 1,000 square feet of ground-floor retail space, 140,000 square feet of office space, 369 apartments and 440 parking spaces. Handel Architects and Austin-based Page are designing the project, with INC Architecture & Design handling interior design. Completion is slated for late 2024. Ryan Cos. announced the project in late 2019.

CHARLOTTE, N.C. — Taconic Capital Advisors has sold Three Resource Square, a 125,728-square-foot, Class A office building in Charlotte. Praelium Commercial Real Estate purchased the property for $21 million. Patrick Gildea, Matt Smith, Grayson Hawkins, Joe Franco and Stephanie Spivey of CBRE represented the seller in the transaction. Harris Ralston and C.J. Kelly of CBRE arranged an undisclosed amount of debt financing through Prime Finance on behalf of the buyer. Built in 1999, Three Resource Square was 85 percent leased at the time of sale. The property will be anchored by Republic Services, a solid waste management company, through 2026. The property’s other tenant is Resolvion, a financial services firm. The office property offers a six per 1,000-square-foot parking ratio and a fitness center. Located at 10815 David Taylor Drive, the property is situated close to Charlotte Douglas International Airport, the University of North Carolina at Charlotte and Interstate 85. Additionally, the property is situated within one mile from Centene’s 1 million-square-foot East Coast headquarters campus.

SAN ANTONIO — StorageMart, a Missouri-based owner-operator, has purchased a former Life Storage facility in San Antonio that spans 99,833 net rentable square feet across 877 units. The new ownership plans to implement a value-add program that will include the installation of an upgraded security system. StorageMart, which currently operates four self-storage facilities in the San Antonio area, will also turn management of the property over to its in-house team. The seller and sales price were not disclosed.