NASHVILLE, TENN. — Avison Young has negotiated the $4.5 million sale of a 7,203-square-foot boutique office building located at 107 Kenner Ave. in Nashville. Mike Jacobs, Lisa Maki and Jordan Powell of Avison Young represented the seller, Jim Jacobs of SilverPine Investments and Chapman Capital, in the transaction. Crews Johnson of Cushman & Wakefield represented the buyer, an accounting firm that will occupy the office building. The two-story property features two conferences rooms, three work rooms, collaborative spaces, a break room, reception area and 23 parking spaces. The freestanding property was built in 1979, according to LoopNet Inc.

Property Type

FORT WAYNE, IND. — Mid-America Real Estate Corp. has arranged the sale of Covington Plaza, a 182,051-square-foot shopping center in Fort Wayne. Anchor tenants include The Fresh Market, Office Depot, Planet Fitness and The Woodhouse Day Spa. Other tenants include Pet Supplies Plus, Tequila Mexican Cantina, Cap n’ Cork, Christopher James Menswear and Catablu Grille. Ben Wineman, Joe Girardi, Rick Drogosz and Eric Geskermann of Mid-America represented the seller, Broad Reach Retail Partners. Charleston, S.C.-based Ziff Real Estate Partners was the buyer.

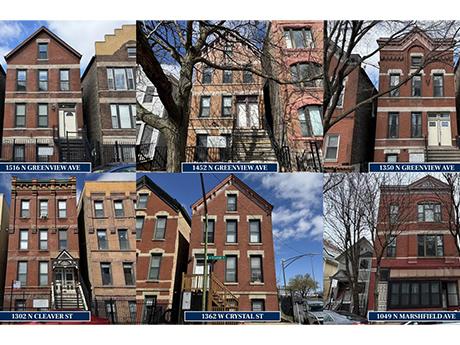

CHICAGO — Marcus & Millichap has brokered the $7.9 million sale of a six-property, 38-unit multifamily portfolio in Chicago’s Noble Square neighborhood. The assets are located at 1516 N. Greenview Ave., 1452 N. Greenview Ave., 1350 N. Greenview Ave., 1302 N. Cleaver St., 1362 W. Crystal St. and 1049 N. Marshfield Ave. The properties feature a mix of one-, two- and three-bedroom units, many of which have been recently renovated. The portfolio also includes 10 income-producing garage spaces. Tyler Preissing and James Ziegler of Marcus & Millichap represented the seller, a private investor, and procured the buyer, a local investment group.

SOUTH ELGIN, ILL. — Lee & Associates of Illinois has negotiated the $6.5 million sale of 84.4 acres of residential land at 325 Umbdenstock Road in South Elgin. John Cassidy, Jay Farnam and Ken Franzese of Lee & Associates represented the seller, Spohr Family Trust. The buyer, Lennar/CalAtlantic Group LLC, was self-represented. The site was previously marketed for an industrial use for more than a decade, according to Farnam. Lee & Associates secured a residential home builder to purchase the site and worked with the village on a land entitlement and approval process.

Marcus & Millichap Brokers $2.7M Sale of New Restaurant in Metro Atlanta Leased to Whataburger

by John Nelson

ACWORTH, GA. — Marcus & Millichap has brokered the $2.7 million sale of a newly built restaurant located at 3558 Cobb Parkway NW in Acworth, a northwest suburb of Atlanta. Whataburger occupies the freestanding restaurant, which features a double drive-thru, on a new 15-year corporate ground lease. Don McMinn and Andrew Koriwchak of Marcus & Millichap represented the seller, an unnamed developer based in Georgia, in the transaction. Mark Ruble, Chris Lind and Zack House of Marcus & Millichap procured the unnamed buyer. The 3,318-square-foot Whataburger restaurant was delivered in April and is adjacent to a Walmart Super Center and Super Target.

NAPERVILLE, ILL. — Greenstone Partners has arranged the $6.1 million sale of 1952 McDowell Road, a 55,000-square-foot medical and office building in the Chicago suburb of Naperville. The anchor tenant is Advanced Behavioral Health Services, which occupies the entire third floor and recently extended its lease through 2029. The asset was 86 percent leased at the time of sale. Jason St. John and AJ Patel of Greenstone represented the seller, a Naperville-based office operator. An outside broker represented the buyer, a local investor.

PLYMOUTH TOWNSHIP, MICH. — Bernard Financial Group (BFG) has secured a $1.5 million loan for the refinancing of a 53,314-square-foot office property in Plymouth Township. Adam Ferguson of BFG arranged the loan on behalf of the borrower, Plymouth Commerce Center LP. A life insurance company provided the loan.

HARTFORD, CONN. — Locally based brokerage firm Chozick Realty has negotiated the $10.5 million sale of a portfolio of three medical office properties totaling 94,400 square feet in Connecticut. The portfolio comprises the two-building, 66,000-square-foot Twin Ponds Office Centre in Tolland; Windham Professional Park, a two-building, 16,400-square-foot complex in Windham; and Ledgebrook North, a 12,000-square-foot, three-building property in Mansfield. Tom Boyle of Chozick represented the undisclosed seller in the deal.

NEW YORK CITY — WeWork has signed a 55,000-square-foot office lease at 245 Fifth Avenue, a 24-story, 316,495-square-foot building in Midtown Manhattan. The space spans four floors, and the lease term is 10 years. Aaron Ellison and Travis Milone of Newmark, along with internal agents Peter Greenspan and Melissa Visoky, represented WeWork in the lease negotiations. Scott Klau, Erik Harris, Zach Weil, Cole Gendels and Ben Klau, also with Newmark, represented the landlord, The Moinian Group.

NEW YORK CITY — Cushman & Wakefield has secured a 25,000-square-foot industrial lease near JFK International Airport in Queens. The tenant, pastry producer Pidy Gourmet Inc., will occupy space at Inwood Logistics Center, a 10-building development. Rico Murtha, Helen Paul, Sonny Singh, Thomas Deluca, David Frattaroli, John Giannuzzi and Joseph Hentze Jr. represented the landlord, a partnership led by Onyx Equities, in the lease negotiations. The tenant representative was not disclosed.